Correction: What happened and is it over?

Much has been written about the stock market correction in February. Meeting the traditional definition, peak to trough, markets fell more than 10% (the market peaked January 26th to bottom February 8th). Since the lows, it bounced back substantially.

What drove the correction?

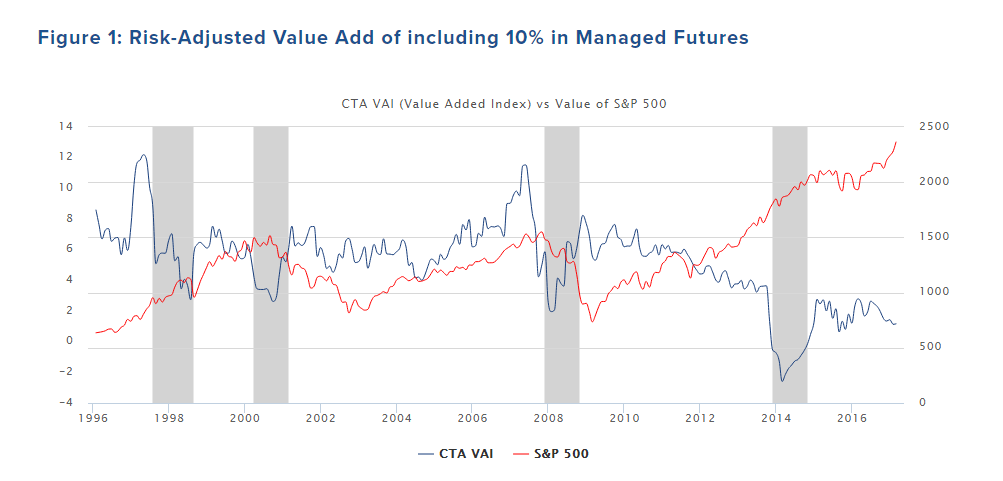

We have heard the blame laid on “computers”: algorithmic/program trading, CTAs, quants, stop-loss selling – the list goes on.

But as we tabled over the last few months, inflation concerns have been building for some time as central banks voiced concerns and took action with rate increases while alluding to more. At Auspice we experience inflation concern as demand for commodity products that increased in late 2017 and early 2018 actually rising in the first week of February - despite the stock market sell-off.

Additionally, there has been a growing discussion regarding the over-valuation of stocks yet the market kept moving higher while other assets are at historically low levels. Commodities are in this camp. Correspondingly the VIX was at all time lows. The trade that kept on giving until it bit back as volatility expanded quickly.

Further discussions of “FOMO” was used to describe the market action. The “fear of missing out” is simply putting a new media acronym for “herd behavior”. Scary if the only reason for a market to be going up is FOMO. But more importantly, if the market is driven by “FOMO”, then it should be no surprise that it is fragile enough to quickly and sharply correct.

What is the trend? The long term trend in equity has indeed been up - for over 9 years. However, the trend is at question if we retest the lows. We started exiting long trends in equity in January (as well as covering the VIX short) and further exited all equity exposure in early days of February. While we don’t have a crystal ball to market direction, what we do know is the low volatility regime for the markets and economy is likely over for now.

To keep in mind: There hadn’t been a correction in over 2 years which is one of the longer periods without a correction in 80 years. Remember, corrections are normal, they are frequent (36 times in the 38 years since 1980) and likely to happen more often after having been so infrequent for so long.

Given a return to more normal volatility, and a heightened concern for further “corrections”, we believe this is not over. Stay tuned for more volatility regardless of ultimate direction.

Disclaimer

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results is not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

COMPARABLE INDICES

Auspice Managed Futures Excess Return Index (AMFERI): The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The strategy focuses on Momentum and Term Structure strategies and uses a quantitative methodology to track either long or short positions in a diversified portfolio of exchange traded futures, which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available in total return (collateralized) and excess (non-collateralized) return versions.

Returns for Auspice Managed Futures Excess Return Index (AMFERI) represent returns calculated and published by the NYSE. The index does not have commissions, management/incentive fees, or operating expenses.

The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Price Return data is used (not including dividends).

60-40 Portfolio: 60% investment in SPY (S&P 500), 40% investment in IEF (intermediate-term US Treasuries), rebalanced monthly.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.