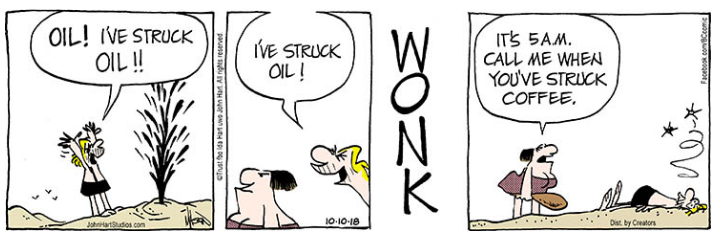

Striking Oil

Too much of a good thing creates a problem. The overabundance of any commodity puts downward pressure on the price. Striking oil creates a unique dilemma: getting it to market is often part of the challenge as prices often react immediately to changes in perceived supply and demand regardless of the delivery terms and constraints.

Since October 1st, WTI oil has plunged 30% (Canadian Crude even more), that “Striking Oil” may seem like an odd topic to discuss. But if you think about it, this is an important issue. Oil like any commodity that needs to be extracted, transported and stored, goes through periods of price swings. Too much of it and prices fall. Not enough and prices rise. For a producer company or producing nation, it can be like chasing your tail.

However, just like a producer, investors need to take price swings in stride and consider the long term. Short term deviations are challenging to judge but may present opportunities in the context of long term trends and fundamental demand. For oil, we believe global demand is strong and growing. Moreover, the easy oil, produced conventionally, is becoming more and more scarce making technology and nations that embrace this, the ones to watch. Growing supply in Canada and the U.S. is upon us. At times there is a mismatch between the supply and the ability to get it to market. Canada has done a poor job managing this. Arguably, it has the largest recoverable oil reserves in the world yet lacks the infrastructure (pipelines, shipping) to transport it to global markets.

In a bear market you have two choices, go short falling prices, or sit back and wait for an entry point. If you are interested in being short to generate non-correlated returns, we specialize in this and can help you out. On the other hand, if you are looking for an entry point, the market has already sold off and thus your risk is further correction. Given the long-term demand, and recently announced Alberta production cuts, we think it won’t last for too long.

The fact remains – Canada has the cheapest oil on the planet.

For those interested in the opportunities in oil, specifically deeply discounted Canadian oil, we recommend checking out our website under the Canadian Crude Index, the CCX ETF, and related Research section postings.

For more about the Auspice philosophy and the potential portfolio benefits, please give us a call.

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results is not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.