News and Media

Commentaries and Performance Archive

The January 2023 and preceding Commentaries and Fact Sheets published on this web page were published prior to February 28th, 2023, when The Auspice Diversified Trust and the Auspice One Fund Trust (collectively, the Funds) were offered via offering memorandum only and the Funds were not a reporting issuers. The expenses of the Funds would have been higher during such prior period had the Funds been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Funds to permit the disclosure of the prior performance data for the Funds for the time period prior to it becoming a reporting issuer.

Research

Research is the foundation of what we do. We understand that markets evolve and that we need to adapt. We engage in a process of continuous evaluation and research to identify sources of returns and the methods with which to effectively capture them.

The contents on this web page were published prior to February 28th, 2023, when The Auspice Diversified Trust and the Auspice One Fund Trust (collectively, the Funds) were offered via offering memorandum only and the Funds were not reporting issuers. The expenses of the Funds would have been higher during such prior period had the Funds been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Funds to permit the disclosure of the prior performance data for the Funds for the time period prior to it becoming a reporting issuer.

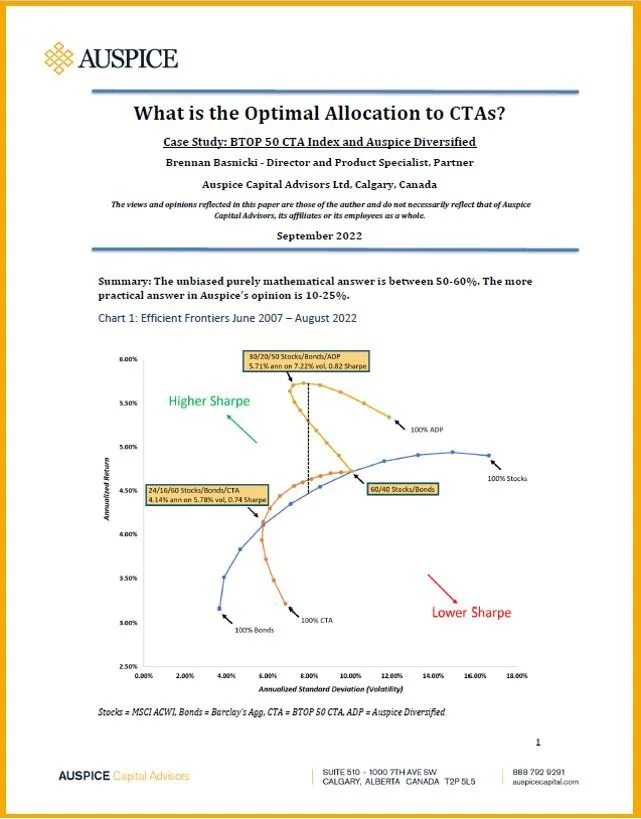

What is The Optimal CTA Allocation?

September 19, 2022

Commodity Investing in the Age of ESG and Inflation

November 8, 2021

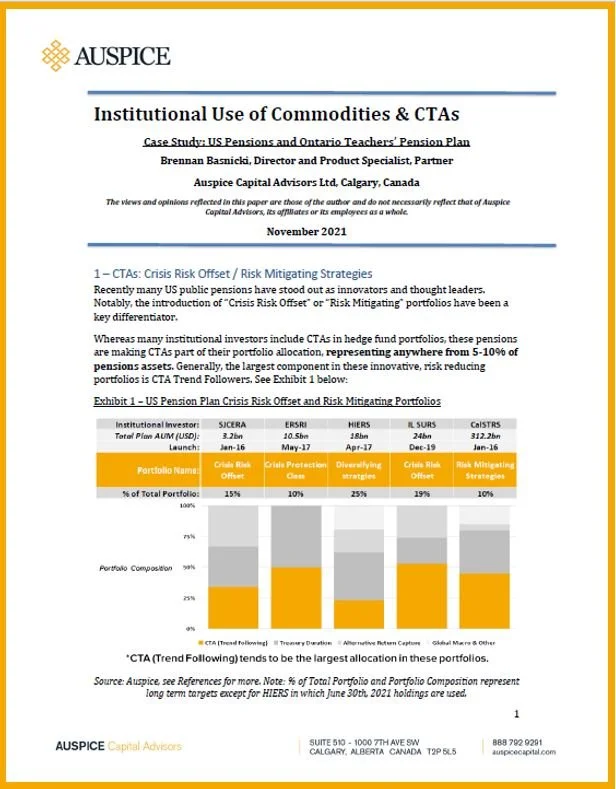

Institutional Use of Commodities & CTAs. Case Study: US Pensions & Ontario Teachers’

November 1, 2021

Positioning for the 2020s Commodity Bull Market

Commodities: Canadian Crude - You are Missing an Opportunity

Commodities: Portfolio Benefits - Is there a real black gold?

Canadian Crude - Opportunities in the discount

Commodities Update ending 2018: When is the right time? Benefits and Timing the Cycle

Canadian Crude - Trading the WCS Spread

Canadian Oil Is On Sale

Canadian Oil: The Importance And The Opportunity

Leadership Report: Canadian Oil Value, Liquidity and Hedging

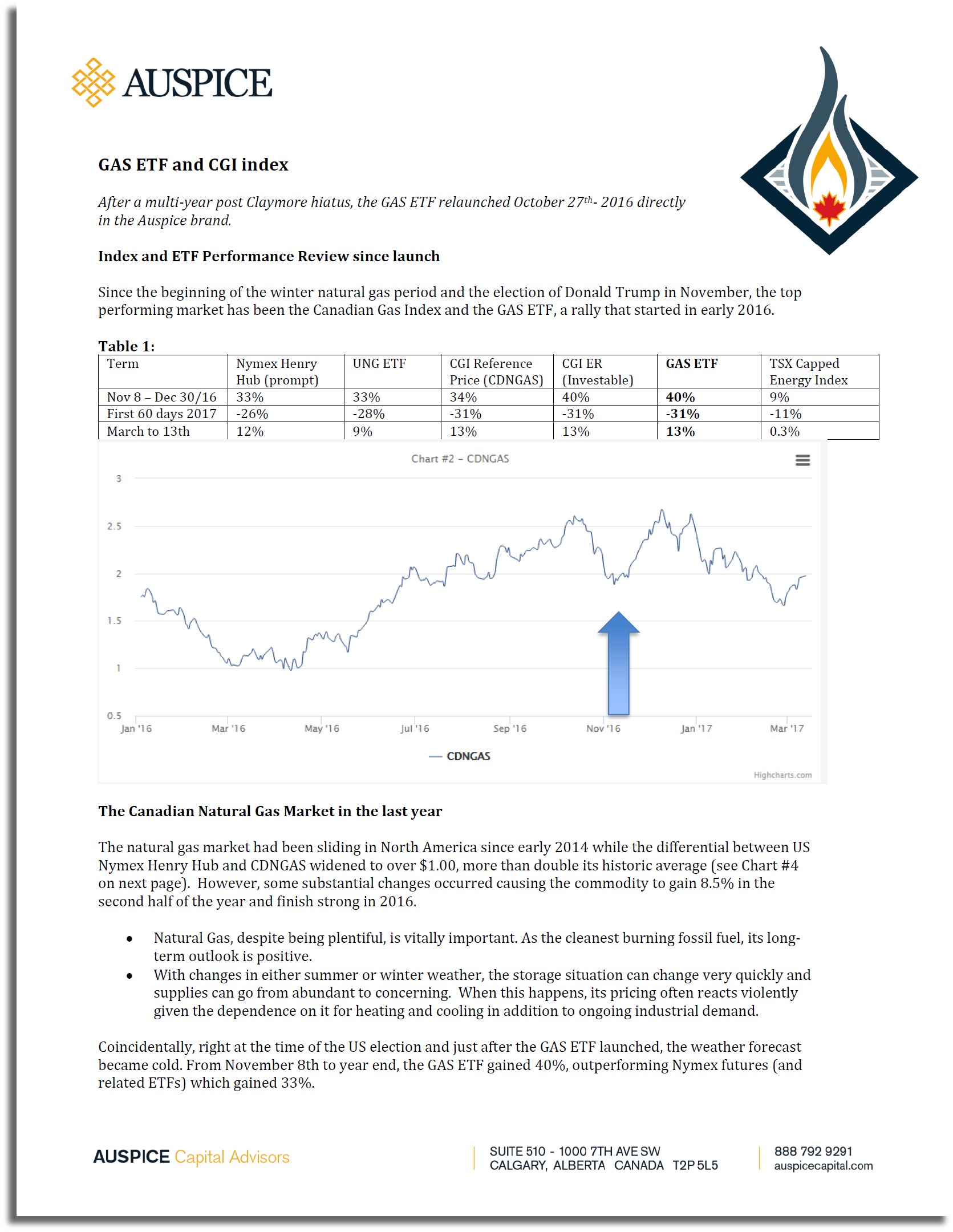

Natural gas and GAS performance to June 2017

Natural gas and GAS performance to May 2017

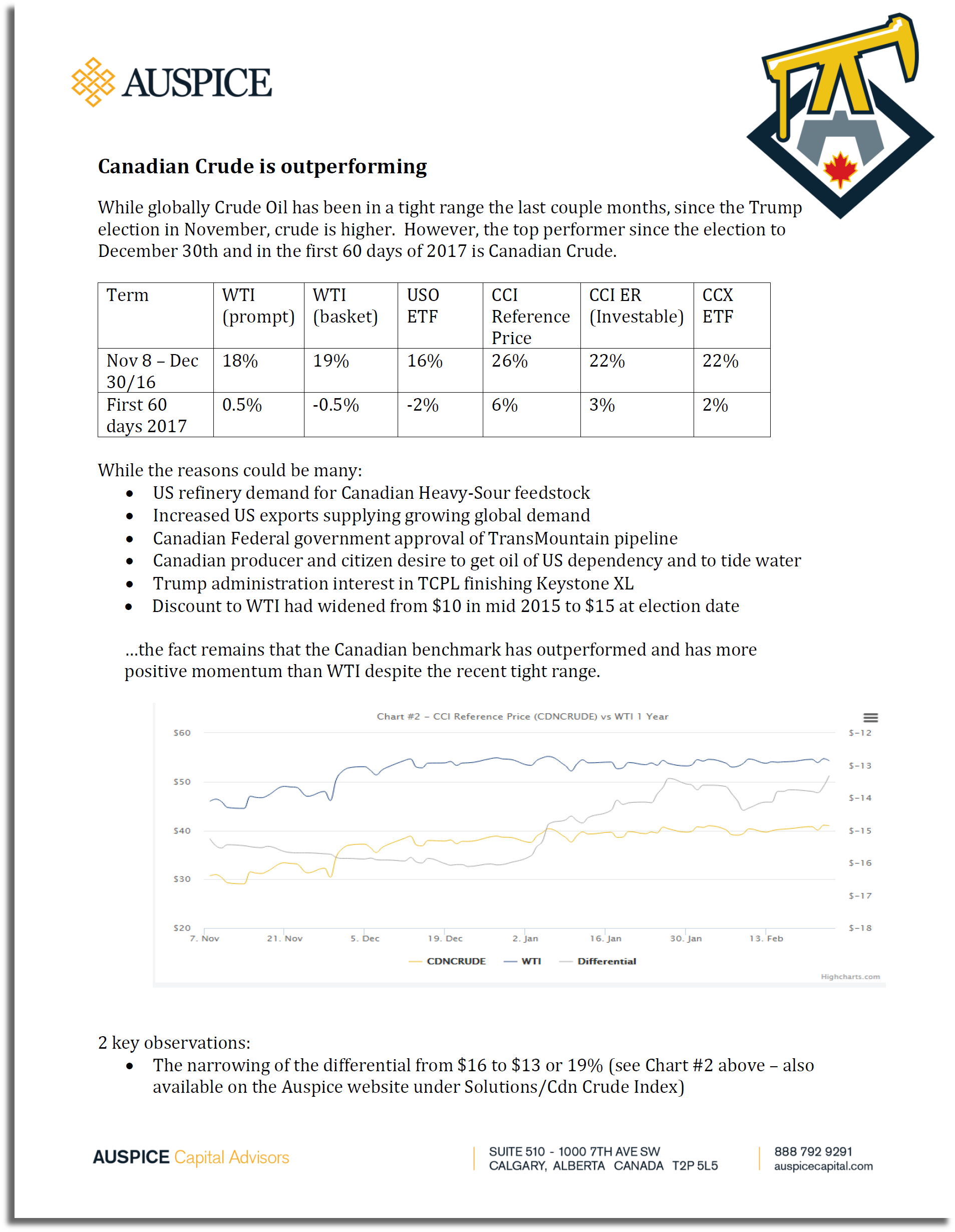

Crude Performance and CCI outperformance to Feb 2017

Canadian Oil Pure Play

Auspice Canadian Oil Sands Facts 2015

Auspice, 2015

Myths about the Canadian Oil Sands continue to abound. Click here to read some of the facts on our industry, with third-party information and quotations.

Why the Canadian Crude Index ETF

August, 2015

Current Crude Oil prices may offer opportunities for investors with a long-term view. Please click the image to read our article: “Why CCX now versus other Oil ETFs”

Commodity Investing: Alpha, Beta, & Something In Between

Published Benefits And Pension Monitor - Auspice, June 2011

Videos & Podcasts

July 8th, 2024

Opportunities in Commodity Investing Webinar

With commodities taking center stage due to geopolitical tensions, supply chain challenges, and the evolving landscape of sustainable finance, this session is designed to equip you with the knowledge to navigate these complexities effectively. Join Auspice found Tim Pickering and Hussein Allidina of TDAM Commodities as they explore the current commodity market landscape and help identify strategic opportunities and challenges in the space.

Watch on AIMA’s website here

May 5th, 2024

Furthering The Replication Discussion w/ Michael Covel

Listen in on Michael Covel's discussion with Auspice Founder/CIO Tim Pickering covering Trend Following, CTA replication, and their long history in ETFs as a delivery mechanism. They discuss risk management, fee reduction and alpha generation, and the business of being a CTA, innovator and pioneer in the sector.

Listen below or select your preferred platform here

October 8th, 2023

Innovation and Evolution.

See this 1min clip on Innovation and Evolution at Auspice from Auspice Founder/CIO Tim Pickering at a panel discussion in Philadelphia (full panel episode available in second video below).

September 28th, 2023

Talking Commodities, Stacking, and Systematic w/ Auspice, Newfound & Campbell.

Is 60/40 Dead? How are allocators updating their portfolios for this environment?

Auspice Founder/CIO Tim Pickering, Corey Hoffstein from Newfound Research, and Brian Meloon from Campbell and Company discuss Commodities, Return Stacking, and Systematic on a live panel discussion in Philly.

Watch on YouTube here.

August 29th, 2022

Commodities, CTAs & The LME Scandal.

In this podcast Tim talks all about trend-following and commodities. Tim shares why trend-following can serve as a great diversifier to stocks and bonds, and why it’s a great way to play the current commodity cycle. He ever shares his thoughts on the LME fiasco earlier this year and what his reaction was when he saw his trades were cancelled.

Watch on YouTube here or select a podcast platform here.

July 14th, 2022

Current State of Energy Markets and the Commodity Supercycle - July 14th, 2022.

In this 10min interview Auspice Capital Advisors Founder and CIO Tim Pickering discusses the current state of energy and commodity markets amongst a longer term commodity supercycle. Tim discusses:

Inflation and governments raising rates.

Declining CapEx and the structural imbalance in commodities.

Energy companies’ role in the greening of our economy.

Canada’s role.

Long term commodity views.

A great, succinct summary that clearly covers the key themes driving commodity markets today!

May 25th, 2022

Navigating through Inflation and Volatility with Alternative Investments

Hear a panel of experts’ views on Navigating through Inflation and Volatility with Alternative Investments during a conversation where they shared their opinions on inflation, volatility and commodities.

Panel of experts:

Tim Pickering, Founder and CIO, Auspice Capital

Andrey Omelchak, President & CIO, LionGuard Capital Management

René Fournier, CIO, Walter Group

Moderator: Charles Lemay, Partner, Walter Global Asset Management

April 29th, 2022

Institutional Technical Analysis: Research, Trading, Portfolio Management & Allocation.

This Presentation was part of the 2022 CMT Annual Symposium on April 28th-29th in Washington, DC.

Technical Analysis is a universally applicable discipline. Auspice Partner Brennan Basnicki and panelists share their perspectives on how the tools of technical analysis have been applied across every role in the financial services industry in this dynamic panel discussion. Whether sitting on the buy side, sell side, or as a market maker, these three panelists have helped their firms and clients identify trends, manage risk, and capture alpha. The broad reach of their collective experience will highlight the many time frames, asset classes, and industry roles that are better informed through the application of our craft.

April 25th, 2022

Understanding Commodity Investing.

On the latest episode of the CFA Society Calgary Podcast “Calgary Connects” Tim Pickering, Founder, CIO and Lead Portfolio Manager at Auspice Capital, joins for a conversation that dives into commodities and commodity investing.

Host Matthew Andrade and Tim Pickering discuss what commodities are and how they fit into a portfolio, convergent vs. divergent return streams, how risk plays into decision making, and much more.

April 10th, 2022

Why Commodities & Why Now.

Auspice Founder/CIO Tim Pickering is featured for a second time on #1 industry podcast "Top Traders Unplugged". In this episode, Tim and host Niels Kaastrup-Larsen discuss:

Why commodities play such an important role in a portfolio

How to create a strategy that adapts to different volatility regimes

Why they created The Auspice Broad Commodity Index

The role and importance of ESG in commodities trading

How commodity futures can be used as a risk mitigation tool

Why Ukraine is so important for commodities

How to effectively protect yourself against inflation

And much more.

April 4th, 2022

Portfolio benefits with commodities futures.

Gavin Graham and Auspice Founder/CIO Tim Pickering discuss real diversification, hedging inflation, avoiding the market crash, ESG benefits of futures and what sets up a commodities super cycle.

December 15th, 2021

Auspice has released a series of two minute explainer videos to provide an overview of Auspice commodity to complete solutions.

November 19th, 2021

Auspice Founder/CIO Tim Pickering and Direxion Head of Alternatives Ed Egilinsky explore key insights and actionable strategies on these topics and more:

When transitory inflation gets sticky

The real price of infrastructure and alternative energy initiatives

Why has gold failed to shine?

When investing in commodities, sometimes “cash is king”

July 14th, 2021

One of our favorites - Jason Buck hosts Tim Pickering on episode 27 of the Mutiny Fund podcast. You don’t want to miss this one!

June 15, 2021

There are two ingredients required for a commodity supercycle: an extended period of underinvestment in supply, and a generational demand shock. Today we have both.

As interest rates and inflation rise, and the forward prospects of the 60/40 portfolio are compressed, institutional and retail investors are increasingly taking note. Our first 2min explainer video provides a brief introduction to this key investment theme.

May 6, 2021

ETF Trends' CEO, Tom Lydon, along with Ed Egilinsky, Head of Alternatives at Direxion and Tim Pickering, Founder, President and CIO at Auspice, discuss:

Expectations for extraordinary global growth in a post-vaccine world

The state of supply for oil and other commodities

The role of commodities under the cloud of accelerating inflation

A strategic, adaptive approach to whip-sawing commodity markets

Accepted for one hour of CFP/CIMA CE credit for live and on-demand attendees

CFA Institute members are encouraged to self-document their continuing professional development activities in their online CE tracker. For video click image below, or here.

March 24, 2021

Given the outperformance of equities in the last decade, the return potential and portfolio diversification benefits of commodities are underappreciated, with a potential super-cycle of opportunity ahead.

Hear about the various ways of adding commodity exposure, their benefits and risks. This includes resource equities, commodity benchmark indexes, tactical strategies and CTA/Managed Futures. The panel also discusses the commodity sector from a cyclical perspective and examine the potential opportunity at the current time.

November 30, 2020

Join MIJ for a fascinating discussion with Auspice Capital’s founder Tim Pickering to learn about the importance of maps, process and tinkering at the edges. Tim’s unique ability to simplify complex topics like “diworsification” and skew have been honed from years of interaction with some of Canada’s leading investment institutions. Podcast available online below or on your favorite player: Spotify, Apple, Stitcher.

September 22, 2020

Tim Pickering is special guest on The Derivative on the RCM Alternatives podcast. Here’s a little preview, or you can listen to the whole thing on your favorite player: Spotify. Apple. Stitcher.

July 25, 2019

Tim Pickering, chief investment officer of Auspice Capital and manager of the Canadian Crude Oil ETF, explains where he's seeing increased demand for Canadian crude.

Oct 6, 2017

Tim Pickering of Auspice Capital Investors joins Global News, calling the Energy East cancellation “a real blow” to Alberta and Canadian economies.

Nov 22, 2016

Tim Pickering, Founder, President & CIO of Auspice joins Bloomberg TV Canada's Mark Bunting to discuss how Trump presidency, pipelines and OPEC will drive Canadian crude oil prices.

January 5, 2016

Tim Pickering talks to CBC about the Canadian Crude Index.

October 14, 2015

Paul Waldie talks with Auspice Capital's Tim Pickering about the Canadian oil industry

Apr 21, 2015

Auspice Capital says its new Canadian Crude Index "represents a simple, transparent and liquid benchmark for oil that is produced in Canada." Founder and President Tim Pickering tells us about his plan to launch an ETF based on the bellwether.

December 23, 2014

Tim Pickering, President & CIO, Auspice Capital, joins BNN to offer insight on investing in managed futures and a look at Horizons 'best performing Canadian-listed ETF".

Top Traders Interview

December 21, 2014

What is the difference between simply following a trend and capturing it? Why is growth not consistent and gradual and why do we want it to be?

Tim Pickering chats with Niels Kaastrup-Larsen from Top Traders Unplugged.

Tim Pickering: A Case for the CTA Value Added Index

December 6, 2013

Tim Pickering of Auspice Capital discusses the CTA Value Added Index and makes a case that it is evident, historically, not only in times of financial crisis. Download on iTunes

Ep. 11: Trend Following - Tim Pickering interviewed by Michael Covel

April 27, 2012

Michael Covel talks to Tim Pickering, founder/president and lead portfolio manager of Auspice Capital. Pickering has over 15 years of commodity and financial trading experience. Prior to forming Auspice, Pickering was Vice President of Options Trading at Shell Trading Gas and Power in the Houston and Calgary offices.