To download the Auspice April Blog, click here.

“Last week’s events remind us of the events of 2008 and the Global Financial Crisis they produced. All norms have been overthrown. The way world trade has operated for the last 80 years may be of little relevance to the future.” – Howard Marks, Oaktree[1]

The market’s recent pullback wasn’t a trend shift—it was a tantrum.

In April, risk assets stumbled, with equities, bonds, and commodities under pressure amid trade wars and macro uncertainty. But beneath the surface, the real story wasn’t one of clear directional change—it was one of indecision. Volatility spiked, then fizzled. Commodities lurched, then corrected. In short: it was a lot of noise, but little direction.

Consider the price action of Silver below in Chart 1. Many trend-following CTAs were long Silver, having trended upwards in the months prior, only for it to reverse violently.

Chart 1: Silver performance in 2025

Source: https://www.rcmalternatives.com/2025/04/paging-mr-following-mr-trend-following/

The Challenge of Indecision

These short bursts of volatility are challenging for systematic trend followers. As highlighted by the Man Group in the recent RCM Alternatives blog “Patience in Alts”, there is typically a three-phase pattern during market corrections:

Initial Shock and Position Misalignment – Legacy positions lead to losses as rapid price movements contradict established trends.

Adaptive Recalibration – Trend models adjust positioning, de-risking where appropriate and identifying emerging trends.

Delivering Crisis Alpha – Strategies eventually align with sustained market moves, delivering the protection investors seek.

The position misalignment, and magnitude of sideways volatility, has been extreme—the SG Trend Index correcting 5.2% in April and -9.6% YTD. Some larger CTAs, typically less agile due to their AUM, have fared worse. $17bn Systematica, a CTA pioneer and institutional stalwart—their flagship BlueTrend was down 19% this year as of April 14 (more here).

This sort of whipsaw is part of the process, however, especially when macro conditions are in flux. As we wrote in our Auspice April Blog “Crisis Alpha: Lag Before the Pop”, the early innings of a trend regime change are rarely smooth. They require a willingness to sit through pain before reward. They test discipline, particularly when the environment is noisy, choppy, and directionless.

“Trend can indeed be a friend in times of market stress—but it’s a friend that tends to show up just before the real party begins.” – Man Group[2]

The Opportunity Remains

But let’s not mistake a tantrum for a turn. The long-term opportunity set remains not just intact but potentially expanded. Global macro drivers—deglobalization, fiscal largesse, commodity scarcity, and inflation uncertainty—are not going away. If anything, they are accelerating.

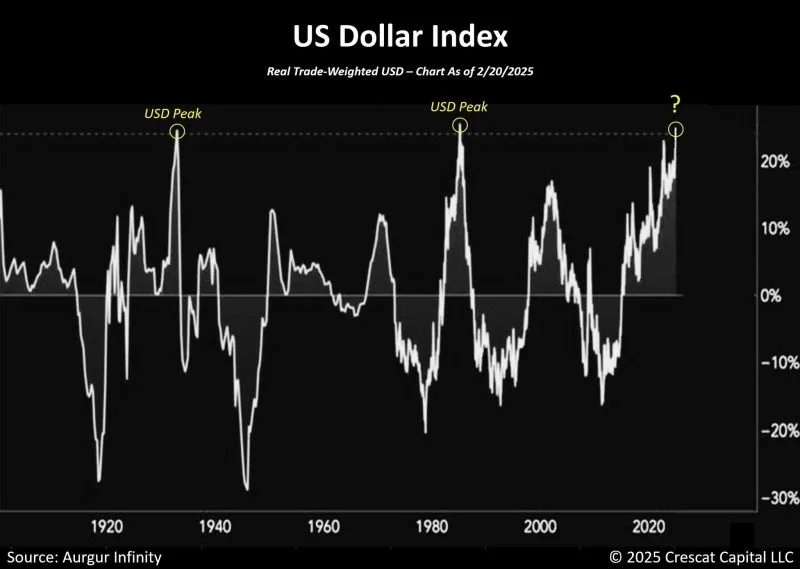

Consider one of the many drivers, a potentially weaker USD, and the tailwind it could provide. After years of strength, the greenback is showing signs of fatigue. While a decline in the USD is not required for commodities to perform, a structurally weaker USD historically bodes well for real assets, particularly commodities. As per Chart 2 below, recent price action suggests we may be at a generational reversal—and importantly opportunity—in both commodity and currency trends.

Chart 2 – Long Term US Dollar Index

Source: Crescat Capital LLC and Auspice. You cannot invest directly in an index.

Consider the 5-year performance of commodities following the most recent peaks of the USD in March 1985 and February 2002:

March 1985 US Dollar Peak: BCOM TR annualized 12.2%, GSCI TR annualized 19.6%.

February 2002 US Dollar Peak: BCOM TR annualized 16.3%, GSCI TR annualized 15.0%.

And while live CTA index performance isn’t available in 1985, it is available via the BTOP50 commencing 1987. For the three-year period commencing January 1st, 1987, the US Dollar continued to decline, and the BTOP50 CTA benchmark deliver 23.3% annualized. Following the February 2022 US Dollar peak, the BTOP50 CTA benchmarks delivered 7.9% annualized over the next five years.

The Case for Commodities

Commodities, as an asset class, have been consolidating after a powerful 2020–2022 run. The Bloomberg Commodity Index (BCOM TR) remains well off its 2022 and 2008 highs, but the Auspice Broad Commodity Index Total Return (ABCTRI) recently hit fresh all-time highs in March before giving back some gains in April amid broader market volatility. This divergence underscores the importance of design: rules-based tactical commodity exposure and risk management is essential for long term asset allocation.

Chart 3: Broad Commodity Performance since 2000:

Source: Auspice Capital and Bloomberg. You cannot invest in an index. There is a risk of loss in trading commodity futures. Past performance is not necessarily indicative of future results. The performance of Auspice Broad Commodity Index prior to 9/30/2010 represents index data simulated prior to third party publishing as calculated by the NYSE.

Risk managed commodity exposure may prove critical as inflation risks and interest rate uncertainty prevail. As Howard Marks mentioned in his recent memo[3], and consistent with what Auspice has been communicating for some time regarding cost-push inflation: “inflation-fighting measures such as higher rates are probably less likely to succeed against inflation caused by the addition of tariffs to selling prices than they would be against the more typical demand-driven inflation” (April 9th, 2025).

The Power of Patience

The key is patience—and process. At Auspice, we are unapologetically agnostic in our approach. We don’t predict. We follow. And while following can feel frustrating when markets are stuck in the mud, it’s precisely this discipline that allows us to capitalize when trends re-emerge.

We’ve seen it before. From the breakout in natural gas in 2021 to the upside in gold and cocoa more recently—the inflection always feels late, until it’s suddenly obvious. As RCM’s “Paging Mr. Following” rightly put it: “Trend following doesn’t predict the news, it follows the price”. And sometimes, price takes its time.

Positioned for What's Next

In April, trend-following strategies experience a setback. But this drawdown is not a sign of failure—it’s the cost of admission for the next opportunity. Temporary setbacks are a feature, not a flaw, of systematic investing—and often a necessary prelude to capturing the next major trend. Because what comes next may be a repricing of everything.

“We are now facing a radically different economic and market environment that threatens the existing world order and monetary system.” – Bridgewater[4]

As regime shifts play out—slowly, then suddenly—diversified trend-following strategies with a commodity tilt (as is the case for Auspice Diversified) may be uniquely positioned to benefit.

Commodities are historically under-owned.

Inflation pressures haven’t disappeared.

Capital is just beginning to rotate back toward real assets.

Now is not the time to flinch. It’s time to stay focused. Volatility without direction is frustrating. But for patient investors with a long view and a systematic process, these moments offer something rare: the ability to wait without guessing — and to profit when the wait is over.

If you have any questions about the Auspice product suite, email us today at info@auspicecapital.com

DEFINITIONS

Indexes

· Auspice Broad Commodity is a tactical long strategy that focuses on Momentum and Term Structure to track either long or flat positions in a diversified portfolio of commodity futures which cover the energy, metal, and agricultural sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available in total return (collateralized) and excess return (non-collateralized) versions. Both the NYSE listed COM ETF and the TSX listed CCOM ETFs track the Auspice Broad Commodity Index.

· The Bloomberg Commodity Index Total Return (BCOM TR) Index is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities on the commodity markets. No one commodity can compose more than 15% of the BCOM ER index, no one commodity and its derived commodities can compose more than 25% of the index, and no sector can represent more than 33% of the index.

· S&P GSCI Total Return Index – A production-weighted commodity index covering a broad range of raw materials, including energy (crude oil, natural gas, gasoline, heating oil), metals (gold, silver, aluminum, copper, lead, nickel, zinc), agriculture (wheat, corn, soybeans, cotton, coffee, sugar, cocoa), and livestock (live cattle, feeder cattle, lean hogs). Its weighting heavily favors energy, making it sensitive to crude oil price movements.

IMPORTANT DISCLAIMERS AND NOTES

There is a substantial risk of loss in trading futures and options. Past performance is not necessarily indicative of future results.

The indicated rates of return are the historical annual compounded total returns including changes in share and/or unit value and reinvestment of all dividends and/or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.

[1] https://www.oaktreecapital.com/insights/memo/nobody-knows-yet-again

[2] https://www.rcmalternatives.com/2025/04/patience-in-alts-man-group-shows-trend-in-trends-initial-struggles/

[3] https://www.oaktreecapital.com/insights/memo/nobody-knows-yet-again

[4] https://finance.yahoo.com/news/bridgewater-dire-warning-trade-war-163819529.html?guccounter=1