While history doesn’t necessarily repeat, it often teaches us lessons about the past and flows of human interests including investments. 2019 can be remembered by a year of geopolitical tensions, global trade and macroeconomic issues, rangebound commodity prices (until a late year rally) and an undeniable stream of climate change claims to sift through. Note this too has been topical before as I remember a university friend wanting a recycle symbol tattoo on his arm circa 1995. Not sure if he ever got it but he did end up in the oil and gas industry.

I started my career in 1995. TD Bank recruited at the University of Calgary for their “Trading Development Program”. I was very excited as I went into business school wanting to learn about trading. I literally had to borrow a suit for the interview as my existing suit was not very business-like (more “Night at the Roxbury”). I was ecstatic to be offered the job in my fourth year and moved to Toronto the following summer to join the program in August 1995. It was an exciting time as the stock market was roaring and the “Dot-Com” boom was on. After much of the year in training, I was offered a role on the money market desk - a great win for anyone on the program. But what happened next changed everything.

As luck would have it, TD lost their energy and commodity trader. I was asked what I knew about this area given I was the “kid from Calgary” with a farming family background who wore cowboy boots on Fridays. The honest answer was “not much” but was very interested. I was offered the job and told “the world is your oyster” by the global head of trading. I was elated but the others on the program and my new friends on the trading floor reacted far differently. Many thought I was throwing my career away. As far as they were concerned, commodities were so far out of favor they were dead. It was about tech stocks and the " 'net". And for the next 5 years they weren’t wrong. The boom continued until 2000 when the market peaked, but by that point I had already made my second surprising move - I left in 1999 to join Shell Oil’s trading division right as oil was $11/bbl. Again, people said I was throwing my career away. My thought was “do you think oil stays at $11??”.

It didn’t. Moreover, the stock market began a much-needed correction in 2000 and commodities were the place to be for the next decade.

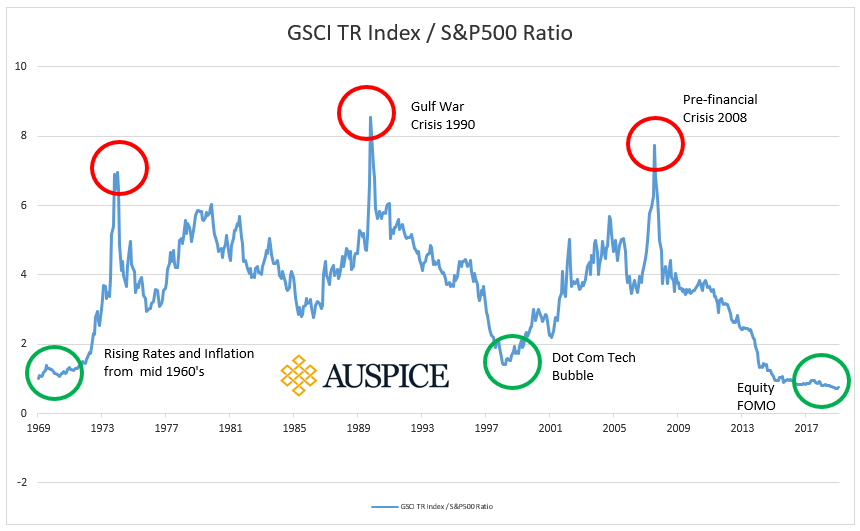

It is now 2020 - but I have been here before. The commodity to equity ratio has never been this low (see chart) and it is commonplace to hear of commodities being irrelevant and naively being removed from some asset allocation models.

But here is what I know - commodities have never been more relevant than today. The need for materials including petroleum products (in almost everything), metals, agricultural for foods and other soft commodities is not miraculously going away. It is foolish to think it is.

This is the important part - while the world continues to grow and want things, the supply side has got harder, more expensive, less profitable and thus less focused on. Capex is down in most commodity sectors. ESG themes have made things more challenging and expensive regardless of your stance. Could we have a supply crunch? I believe it may be upon us.

As a commodity tilted (not exclusive) manager, we are biased in one sense but truly putting our money where our mouth is on another. Others agree.

On November 25th (Reuters), Goldman Sachs said its top 2020 trade recommendation is to be long its commodities index, with the best returns likely to come from oil, reasoning that a decline in overall capital expenditure would in turn result in reduced supply. .... a "sharp and visible drop" in capex. Link here.

While we don’t have a crystal ball and know exactly what markets will go where, we believe it will likely be an increasingly volatile marketplace due to global economic unrest, an upcoming US election, a massive Chinese economy, discourse in Hong Kong, and trade unrest with the largest players. Commodities will be included in this volatility.

This sector has been called out before - typically at the bottom. And unless you have found efficient ways to make cellphones and batteries from pixie dust, pilot planes and ships on solar, or grow all your food in your home, commodities are what make this world go ‘round...

We are happy to discuss diversification and products that include commodities for your portfolio. Give us a call.

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.