If you have chatted to us or read any of our material over the last two years you understand we have been very bullish on commodities. Across the board, from unprecedented fundamental supply shortages to long-term technical indicators – we firmly believe we are in the early innings of a commodity supercycle (see May and March blogs for more). You simply cannot fix the supply issues overnight and raising rates does not change that.

That said, where there are significant rewards – the benchmark GSCI TR has now outperformed global equities since 1970 (see Appendix A) – there is also significant risk. The volatility and drawdowns of passive long only commodity strategies have often historically prevented investors from being able to participate in this highly accretive asset class. There will be ups and downs. Even this past month, the Bloomberg Commodity index lost over 10%.

The key point here – passive versus active.

Consider the historical drawdowns of the long only benchmark GSCI commodity index versus the tactical Auspice Broad Commodity Index:

Notably, from peak to trough the GSCI experienced an 88% drawdown and today remains in drawdown, far below its 2008 peak. The Auspice Broad Commodity Index, on the other hand, has surpassed its previous highs (the flagship Auspice Diversified Program has performed even better), cutting off much of the downside when commodities inevitably correct, and capturing the upside when commodities rally.

We will reiterate – we remain bullish fundamentally. We firmly believe commodity markets are presenting a generational opportunity. That said, with 20+ years’ experience trading commodities, first and foremost we are risk managers. In the Auspice Broad Commodity Index we have pared back risk exposure in most markets and exited exposures completely in metals. In Auspice Diversified, we have pared back risk as well and are broadly short industrial and precious metals, and net short grains and soft commodities (alongside short equities and fixed income).

As demonstrated over the last two years, commodities can provide exceptional, diversifying returns and are arguably the most effective inflation hedge. That said, at 21% annualized volatility and a max drawdown of 88%, typical long only passive commodity investing is daunting.

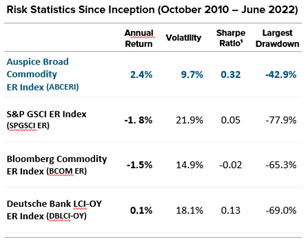

This is the most diverse and dynamic asset class and we believe it requires disciplined, risk-management focused, tactical trading to participate long-term. Since NYSE publication (Oct 2010) the Auspice Broad Commodity ER Index has outperformed the GSCI ER index by 4.2% annualized with less than half the volatility and significantly lower drawdown (see Appendix B).

Choose your exposure wisely.

Appendix A – Long Term Commodity and Equity Returns

Since 1970 the benchmark GSCI TR Commodity Index has outperformed global equity benchmark MSCI World and produced comparable returns to the S&P 500.

Appendix B – Broad Commodity Index Performance

Since Inception ABCERI has outperformed benchmark broad commodity index GSCI ER by 4.2% annualized with less than half the volatility and significantly lower drawdown. Since 2000 ABCERI has outperformed benchmark broad commodity index GSCI ER by 7% annualized with less than half the volatility and less than half the drawdown.

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

1. The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Price Return data is used (not including dividends).

2. The (MSCI) World Index, Morgan Stanley Capital International, is designed to measure equity market performance large and mid-cap equity performance across 23 developed markets countries, covering approximately 85% of the free float-adjusted market capitalization in each. This index offers a broad global equity benchmark, without emerging markets exposure.

3. The Auspice Broad Commodity strategy combines opportunistic commodity exposure with capital preservation. Returns for Auspice Broad Commodity Excess Return Index or “ABCERI” represent returns calculated and published by the NYSE. ABCERI index calculated and published by NYSE since Sep. 2010. Returns prior as published by the NYSE are considered hypothetical. The index does not have commissions, management/incentive fees or operating expenses. The Auspice Broad Commodity Excess Return (“ER”) Index does not include the return on cash collateral.

4. The S&P Goldman Sachs Commodity Excess Return Index (GSCI TR), is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The GSCI Total Return (“TR”) Index includes the return on cash collateral. The GSCI Excess Return (“ER”) Index does not include the return on cash collateral.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, or Auspice One Fund “AOF”, is only available to “Accredited Investors” as defined by CSA NI 45-106.