To download the Auspice July 2024 Blog as a PDF, click here.

This month we provide important context on our recent portfolio expansion of Auspice Diversified, nearly doubling the commodity markets traded with the addition of lower liquidity and lesser correlated markets. Auspice is now at the “sweet spot” where we have the infrastructure to trade a broader, more diverse set of markets. Importantly, we can also provide meaningful exposure to these markets – something our larger peers cannot do. We strongly believe our best years lie ahead of us – but the opportunity is not infinite.

Trend Following 101

Trend following CTAs are arguably the most accretive diversifier you can add to a portfolio – indeed many of the largest pensions have divested from traditional hedge funds and allocated 5-10% to trend-following CTAs[1]. Yet, trend following any single market, like individual security selection, may not look great. The power comes from creating a portfolio of diverse opportunities that behave differently. This is why many CTAs trade a wide variety of commodity and financial markets.

Portfolio Construction 101

If you have read the basics on portfolio management you understand the benefits of portfolio construction, probably best summed by Markowitz that “diversification is the only free lunch”. His insight was simple yet profound: by diversifying across assets, investors can achieve higher returns without necessarily increasing risk, potentially even with lower risk.

The June Auspice Blog provides an example of this in action. Coincidentally, the MSCI ACWI equity benchmark and Auspice Diversified had the exact same return 2020-2023, albeit with very different paths and negative correlation to each other. With any sort of rebalancing, a portfolio of the two produces a higher return than each individually, importantly with substantially lower risk. The total result is greater than the sum of its parts. See Table 1 below.

Table 1. Auspice Diversified Trust Series X, and the MSCI ACWI. Jan 1st, 2020, to December 31st, 2023.

Source: Auspice Capital & Bloomberg, as at December 31st 2023. You cannot invest directly in an index.

Trend Following Portfolio Construction

This same portfolio construction concept is applied to trend-following CTA portfolios. By trend following a diversified portfolio of markets, we can achieve a much better, attractive result. But what markets, and how many?

At Auspice we focus on commodities for a number of reasons. Importantly, with 25 years’ experience commodity trading and investing (ex. Farmland), it’s our background and DNA. Second, and particularly relevant to this Blog, the correlation of commodity markets is much lower than any other asset class. As Founder/CIO Tim Pickering says, “cotton is not like coffee is not like crude is not like canola”. Third, outside of the 2011-2019 QE period, volatility and trend opportunity historically was greater in commodities than any other asset class. Historically, most “CTAs” (Commodity Trading Advisors) actually traded primarily commodity futures, whereas somewhat ironically, today many of our “CTA” peers trade more financial futures, for various reasons including capacity, producing different portfolio results.

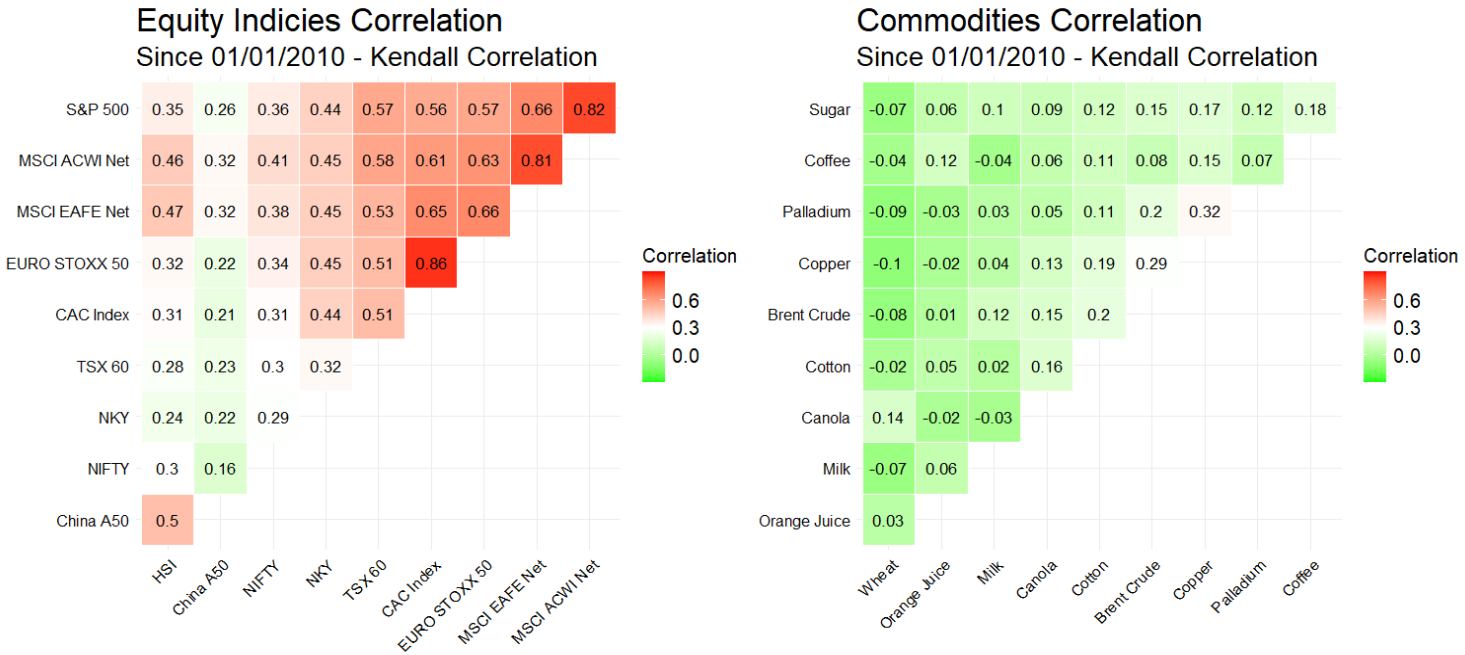

It is the second point that is of focus here – the intercorrelation of commodities is significantly lower than any other asset class. As an example, if you were to randomly pick 10 equity indices vs 10 randomly picked commodities, are they the same? The answer is an unequivocal no. You get more uncorrelated and independent bets (“orthogonal” factors or “principal components” for the fellow math geeks) in commodities versus financial markets. Sugar, Crude Oil, and Milk have much lower correlations to each other than the SP500, MSCI ACWI, and Euro Stoxx (see Table 2 below). Hence trading a portfolio of 50 commodity markets can provide much more diversification (and potentially better performance) than a portfolio of 100 or even 150 financial markets.

Table 2. Correlations of Equity Indices (left) versus Commodities (right)

Source: Auspice Capital and Bloomberg, as at June 31st 2024.

Trend Following 2.0 – Alternative & Exotic Markets

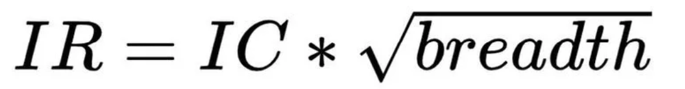

This portfolio math, also known as “Grinold’s Fundamental Law of Active Management” (see Snapshot 1, below), has been expanded on in recent years with some CTAs trading “alternative” or “exotic” commodity markets; interest rate and credit default swaps, OTC markets, and other markets that are more independent from typical global macro factors. By moving beyond “traditional” CTA markets, a portfolio can include an even more diverse set of markets and achieve better results. Importantly, in Grinold’s Fundamental Law of Active Management “breadth” is a function of independent (or uncorrelated) markets, factors, or bets – not typical highly correlated financial markets.

Snapshot 1. Grinold’s Fundamental Law of Active Management.

“IR” = Information Ratio; or risk adjusted portfolio performance. “IC” = predictive skill in a model or strategy. “Breadth” = the number of independent bets or factors. Source: Auspice Capital. Learn more here.

There are implications however – many alternative markets are less liquid and may have operational and cost factors to consider. Some CTAs may sacrifice some “crisis alpha” and daily liquidity (important considerations for many investors) in order to achieve diversification and potentially better returns.

Trading markets beyond those on major exchanges requires much more infrastructure, difficult for smaller managers. Additionally, these markets also tend to be smaller, and in commodities, may also include trading limits. Smaller markets also mean lower liquidity which can result in significant slippage and increased risk – a major constraint for larger CTAs. Hence, we arrive at the “Commodity Paradox” as described by one allocator recently: small managers can provide meaningful exposure to commodity markets but lack infrastructure; large managers can develop the infrastructure but are constrained by capacity, trading limits and lower liquidity. As a CTA fund manager surpasses approximately $2-3bn in AUM it becomes significantly constrained in commodities and is forced into larger, major markets, many of which are financials which have higher correlations. As a result, the commodity exposure becomes smaller, almost non-existent for large CTAs, despite their efforts to add alternative and exotic markets.

Auspice and the Trend Following Sweet Spot

Auspice has achieved strong growth over recent years, AUM has grown by a multiple since 2020 to almost $1B today. Alongside this, we have continued to invest in our team and infrastructure while developing further institutional relationships. At over $900mm we have infrastructure and bandwidth but remain nimble – a major differentiator from some of our larger asset gathering CTA peers who have swelled over $5, or even $10bn in AUM.

On the back of one such institutional relationship, we conducted significant research into Chinese, lower liquidity, and emerging market commodity futures. In short, the Chinese commodity futures do not fit the Auspice Diversified public fund mandate for regulatory and structural reasons. However, the lower liquidity and emerging market commodity futures do. We have made a substantial effort to add these markets, providing more diversification and an expanded "opportunity set" for the strategy. This has almost doubled the number of commodity markets included in the program and includes more esoteric commodity markets such as Aluminum, Sunflower Seeds, (South African) Maize, Cheese, Milk, Lead and Tin. Indeed, the new markets are so differentiated that they are being added (or overlayed) on top of the existing portfolio with few other changes. The expected result is better risk metrics for the portfolio including no change (potentially lower) in volatility, smaller duration and magnitude of drawdowns, and importantly - higher returns.

We think Auspice is in the AUM sweet spot where we not only have infrastructure to do this, but importantly, the weightings of the new market exposures are actually meaningful to the portfolio. It is one thing to “include” and trade a market, it is entirely different to allocate and manage meaningful risk to smaller markets. As we approach $1bn in Auspice Diversified AUM and then $2bn and beyond, we may no longer have this edge. Accordingly, we have capacity now, but it will not be infinite.

If you don’t have a 5-10% allocation to tactical commodity or CTAs strategies, contact us today at info@auspicecapital.com.

IMPORTANT DISCLAIMERS AND NOTES

The returns for Auspice Diversified Trust ("ADT") are “net” (including management and performance fees, interest and expenses). Returns represent the performance for Auspice Managed Futures LP Series 1 (2% mgmt, 20% performance) including and ending November 2019. From this point, returns represent the performance for Auspice Diversified Trust Series X (1% mgmt, 15% performance) which started in July 2014.

The indicated rates of return are the historical annual compounded total returns including changes in share and/or unit value and reinvestment of all dividends and/or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.

[1] See Table 2 at https://static1.squarespace.com/static/53a1ca9ce4b030ded763dbc2/t/65c3b710f371aa01cc0cb785/1707325203202/AUSPICE_TEN_REASONS_TO_INVEST_2024+Feb+7th.pdf