“Nothing sedates rationality like large doses of effortless money."

–WARREN BUFFETT

This same sentiment appears in many aspects of life. If you give a dog a treat every time you come home, he expects it. If you give a teenager everything they whimsically desire, they become spoiled. Think of forced tips for waiters or (Canadian) provinces that gain transfer payments.

Like the old proverb, "give a man a fish and he eats for a day, teach a man to fish and he has enough fish for a lifetime”. Or the generous man who offers his dock to that fisherman only to learn the fisherman came to expect the access as a handout, for free. The truth is if you provide everything to a group of people or society for nothing, they come to expect it and lose appreciation for it.

Which brings us back to investing - and another example of this same psychology at play.

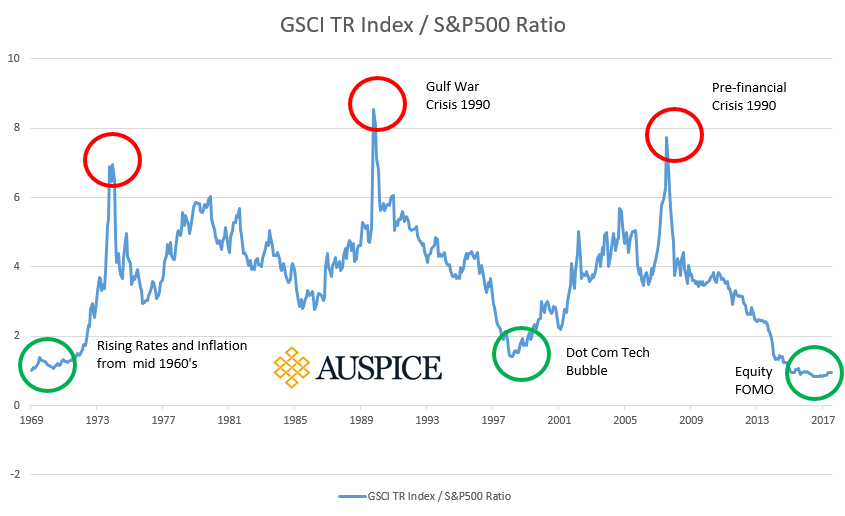

Periods of extraordinary or prolonged gains causes investors to have unrealistic expectations. They begin to discount volatility or even lose sight of the real risks and magnitudes. I believe this is where we are now.

This isn't only applicable to retail investors, the pros at institutions fall into the same traps - except bigger. For example, using alternatives is now commonplace. But which ones? The answer is often whatever has been the top performing recently and the most familiar. For example, equity hedge funds used to hedge equity exposure often ends in tears. The problem is that many “alts” have high correlation to the stock markets they are attempting to protect and this means added negative skew (downside volatility is higher than upside). Doing the easy thing has little political or corporate risk as everyone is doing it. Lots of small gains and modest yield feels good but comes at a price as eventually these markets converge and correct violently. Doing the right thing is hard and can be uncomfortable.

So while investors and commentators appear to be drunk on years of returns and dividends or high on Cannabis stock returns, I believe the reckoning is coming. And while I can’t see the catalyst through my crystal ball, and each time it’s different, one thing rings true: I have been to this rodeo before...

Let the Calgary stampede begin.

If you are planning a visit to Calgary during the Stampede or this summer, please let us know. For more about the innovative Auspice CTA and commodity strategies and the potential portfolio benefits, please give us a call.

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.