Despite social distancing and working from my home office this month, I spent a lot of time talking to people. Ironically, more than normal. I talked to: family to friends, clients, both retail and institutional, current business partners, future business partners, and pensioners, as well as others from all walks of life: many entrepreneurs, teachers, doctors, dentist, farmers, loggers, mechanics - the list goes on.

Many of these people wanted to talk about investing. Perhaps some because we did so well in March and Q1. The question was often "What should I do now?" or "When do I step in back in?".

The thing that struck me was this: The fear of missing out. It is clear most investors want to take advantage of the depressed market in some way. They seemed (surprisingly) comfortable being bold. Perhaps this is muscle-memory from a decade of buying the dip and. Perhaps that is a good strategy again here. But when?

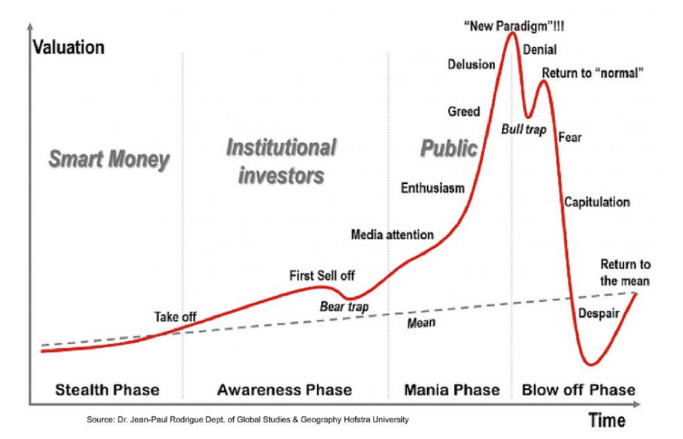

If the chart above doesn't scare you, it should. Where are we in the cycle? The bounce back in equities is shocking – Is the market really in better shape than it was half-way through 2019 when the market rose 29% (SP500)?

Emotions are key here, and very few people could say this isn't an emotional time in some regard. To some degree, the markets are just the result or manifestation of human emotion. As such, risk management is key. If you decide to step in, don't do it without protection. It’s akin to wearing a seatbelt. The volatility at this time is unprecedented and can make a good idea turn into a bad one rather quickly. You can close your eyes, but if your retirement savings are on the line, I wouldn't recommend it. It’s a time to be cautious.

This advice applies to governments too. If you are heavily dependent on oil revenues - the opportunity to hedge is gone. But if you are formulating a plan to rebuild, it should include risk management and this includes having a hedging strategy. Building a stronger economy through diversification of revenue sources alongside risk management will create a better ability to budget and forecast. It’s a lot like building a stronger portfolio for retirement.

For an investor, it may be prudent to build a stronger portfolio. A good way to do this is by combining non-correlated strategies. Finding those strategies that will perform well in both bull and bear markets while carefully managing the downside risk. Upside opportunity, with downside protection.

My advice is to be patient. You can be bold if you layer on a bit of cautiousness. I.e.. You can be both.

My last advice: give us a call - we may have just the solution for you…

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.