To download the Auspice January Blog, click here.

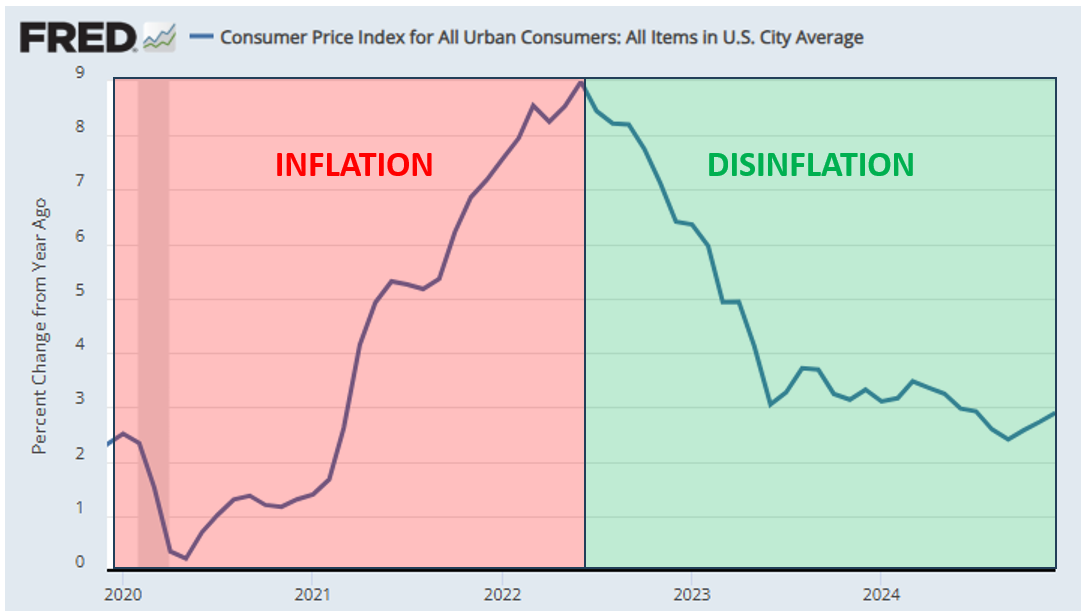

There is a growing consensus that there are significant inflation risks ahead. At a minimum, many would agree that the period of disinflation, the temporary slowing of the pace of price inflation, is in the past. The downward trajectory of declining CPI has failed to continue below 3%, having even increased recently.

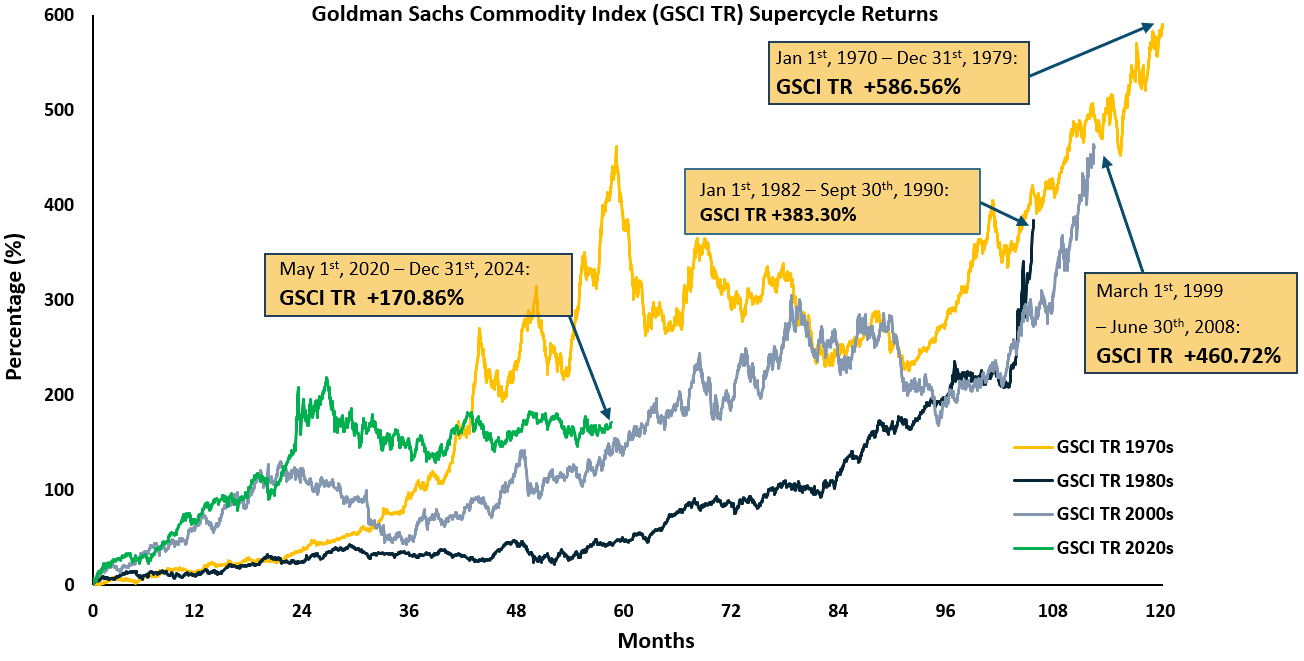

We have seen this cycle in the past, often coinciding with consolidations within a strong commodity cycle, such as we have experienced recently. Even in strong commodity periods such as the 1970s, 1980s, and 2000s, there are often 2 to 3-year corrections. See Chart 1 below.

Chart 1: Commodity cycle returns:

Source: Auspice Capital and Bloomberg. You cannot invest in an index.

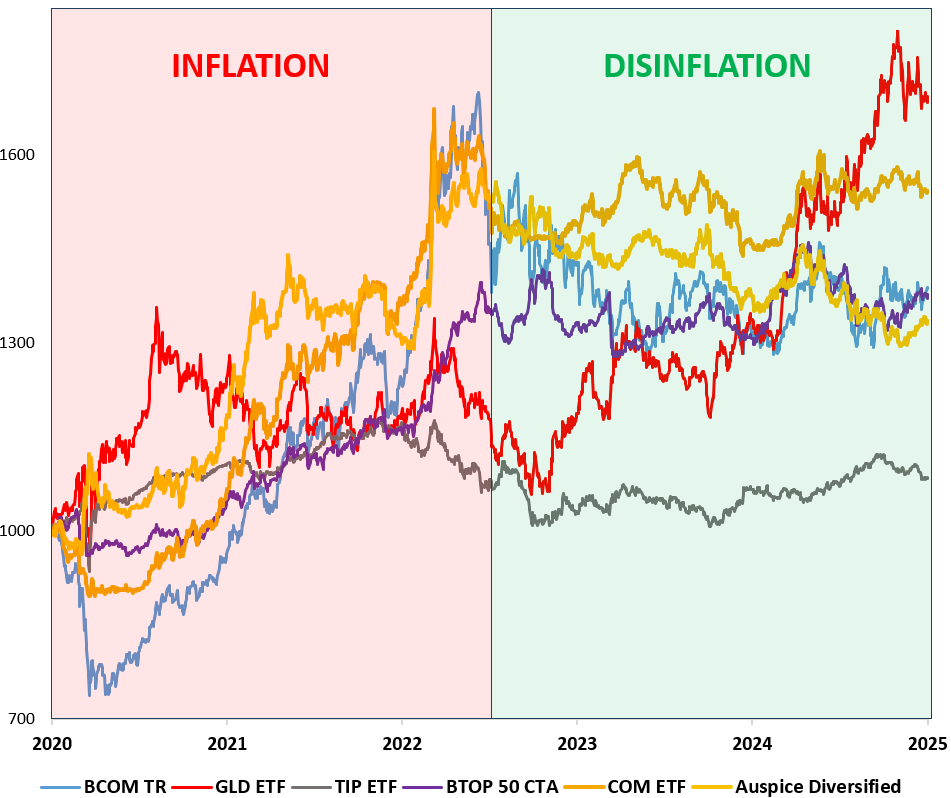

If a new wave of inflation pressure is on the horizon, what will prove to be an effective hedge? Looking back at the last five years, we can dispel some myths, and this may provide clarity particularly around the role of Gold and TIPS. If we split the last five years equally into two 2.5-year periods, the first half was inflationary, and the second half a period of disinflation. See Charts 2 and 3.

As inflation occurred, the worst of the options was TIPS as represented by the TIP ETF (grey line). Over the 5-year period, including inflation and disinflation, TIPS was the worst performer.

As inflation occurred, the 2nd worst performer was Gold as represented by the GLD ETF (red line). Subsequently, Gold has since performed well during the period of disinflation.

Auspice Diversified (gold line) and the COM ETF (orange gold line) were the top performers during inflation, both up a cumulative 52% for the period. Given their low to negative correlations, both Auspice Diversified with a -0.22 S&P 500 correlation, and COM with a +0.22 S&P 500 correlation, are accretive to most portfolios. Auspice Diversified outperformed during the violent equity selloff during COVID providing a risk-off and crisis hedge, both performed during the “60-40 crisis”, a sell-off for both equities and bonds in the first half of 2022, while the COM ETF outperformed more recently. They have both consolidated in the period of disinflation, as commodities have broadly as represented by the Bloomberg Broad Commodity benchmark BCOM TR (blue).

Chart 2: Inflationary period followed by period of disinflation, each 2.5 years:

Source: Auspice Capital and https://fred.stlouisfed.org/series/CPIAUCSL.

Chart 3: Performance during period of inflation and disinflation:

Source: Auspice Capital and Bloomberg. You cannot invest in an index.

We are not negative or bearish on Gold, we are actually long in both Auspice Diversified and Auspice Broad Commodity (underlying to the NYSE listed COM & TSX listed CCOM ETFs). It has upwards momentum, and it has good diversification properties alongside other commodities. But it is one commodity amongst the most diverse asset class of commodity opportunities.

However, we strongly disagree with the notion that Gold is an effective inflation hedge, and the recent experience is clear. Gold has been a great performer in the period of disinflation, but so too were equities, bitcoin, and many other risk assets. In fact, these other assets outperformed Gold by a wide margin. They may be better options if your outlook is for a continued period of disinflation.

Regarding TIPS, we see a limited role in the portfolio and have yet to see compelling evidence to suggest otherwise. The amount of TIPS required to provide a reliable and impactful hedge is significant, and typically not effective in most investor portfolios.

Conclusion - Positioning for 2025 and Beyond

At Auspice we do not make money every month, quarter or year. We are a patient investor, providing both a reliable hedge and tactical commodity exposure at a very modest volatility, closer to bonds than equities.

In 18 years, our flagship Auspice Diversified has never missed delivering strong performance during periods of equity corrections and inflation. Auspice Broad Commodity, with a long/flat strategy, is the #1 broad commodity index by a significant margin, having outperformed both the BCOM & GSCI by >4% annualized since 2010 inception. Importantly, as evident in Chart 3, it also has delivered outperformance with a fraction of the risk and drawdown experienced in the BCOM and other traditional benchmarked products.

If you’re building a portfolio – a portfolio designed to deliver in a variety of environments, you should understand what you’re invested in, and why.

For further information, or to contact the team at Auspice, email info@auspicecapital.com.

DEFINITIONS

· Auspice Broad Commodity is a tactical long strategy that focuses on Momentum and Term Structure to track either long or flat positions in a diversified portfolio of commodity futures which cover the energy, metal, and agricultural sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available in total return (collateralized) and excess return (non-collateralized) versions. Both the NYSE listed COM ETF and the TSX listed CCOM ETFs track the Auspice Broad Commodity Index.

· The Bloomberg Commodity Index Total Return (BCOM TR) Index is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities on the commodity markets. No one commodity can compose more than 15% of the BCOM ER index, no one commodity and its derived commodities can compose more than 25% of the index, and no sector can represent more than 33% of the index.

· The Barclay BTOP50 CTA Index seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. The BTOP50 employs a top-down approach in selecting its constituents. The largest investable trading advisor programs, as measured by assets under management, are selected for inclusion in the BTOP50. The index does not encompass the whole universe of CTAs. The CTAs that comprise the index have submitted their information voluntarily and the performance has not been verified by the index publisher.

· The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

IMPORTANT DISCLAIMERS AND NOTES

The returns for Auspice Diversified Trust ("ADT") are “net” (including management and performance fees, interest and expenses). Returns represent the performance for Auspice Managed Futures LP Series 1 (2% mgmt, 20% performance) including and ending November 2019. From this point, returns represent the performance for Auspice Diversified Trust Series X (1% mgmt, 15% performance) which started in July 2014.

The indicated rates of return are the historical annual compounded total returns including changes in share and/or unit value and reinvestment of all dividends and/or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.