Pension and Endowment Asset Allocation Post QE with Normalized Rates and Inflation.

The world has changed since 2020. Quantitative Easing (“QE”) is over, interest rates are no longer pegged at zero, and inflation has normalized closer to the long-term average 3.5% (US CPI) since 1948[1].

How does one construct a portfolio that can deliver in this environment?

This month we provide a glimpse into the asset class allocation of some of the largest North American pensions and endowments. As demonstrated below, many large institutional investors have 5-10% allocations to commodities and/or Commodity Trading Advisors (CTAs) in the managed futures sector.

At Auspice, we can provide you with portfolio specific analysis, customized to your needs, demonstrating how a commodity and/or CTA allocation can potentially improve your portfolio. To get started however, consider how some of the leading pension and endowments are currently positioned.

Portfolio snapshots with links for further detailed information for each pension are included below.

Highlights of Inflation Protection and Diversifying Strategy Allocations:

(data below is most recent publicly available data as of September 1st 2023)

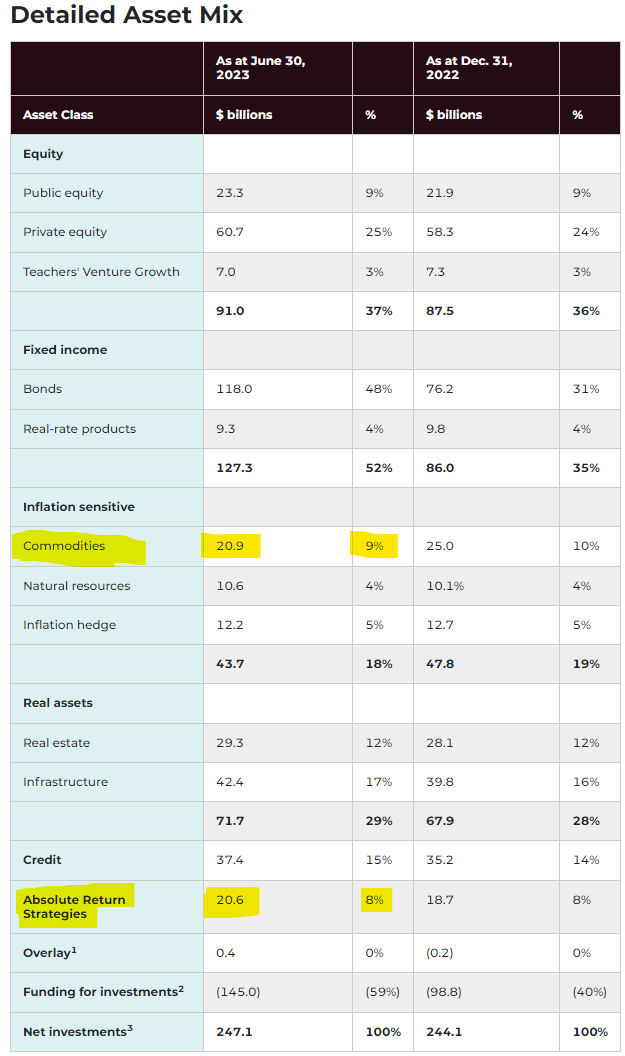

Figure 1 - Ontario Teachers’ Pension Plan (OTPP) as of June 30th, 2023

18% Inflation Sensitive

9% Commodities

5% Inflation Hedge

4% Natural Resources

8% Absolute Return (includes CTAs)

Figure 2 - University of Alberta (UofA) Endowment as of March 31st, 2023

20% Inflation Sensitive (includes commodities and real assets, real estate & infrastructure)

15% Diversifiers (includes CTAs)

Figure 3 – California State Teachers' Retirement System (CalSTRS), as of July 31st, 2023

10% (RMS) Risk Mitigation Strategies - See detailed explanation including Table 1

5% Trend-following CTAs ($16.6bn invested between 5 trend-following CTAs[2]!)

6% Inflation Sensitive (includes commodities)

Figure 4 – Employees’ Retirement System of Hawaii (HIERS), as of March 31st, 2023

35% Diversifying Strategies

5% Trend-following CTAs

Figure 5 – Illinois State Universities Retirement System (SURS), as of June 30th, 2023

5% Inflation Sensitive

17% Crisis Risk Offset

9% Trend-following CTAs

See OTPP (Figure 1) and CalSTRS (Figure 3 and Table 1) below for the most detailed asset allocation breakdowns, and Figures 6-8 in “Going Forward” concluding section for further consideration.

Figure 1 - Ontario Teachers’ Pension Plan (OTPP) as of June 30th, 2023

Figure 2 - University of Alberta (UofA) Endowment as of March 31st, 2023

Source: https://www.ualberta.ca/university-services-finance/reports/2023-annual-investment-report-final.pdf. For further detailed information see https://www.ualberta.ca/university-services-finance/reports/uep-and-neip-external-investment-relationships-march-31-2023.pdf

Figure 3 – California State Teachers’ Retirement System (CalSTRS), as of July 31st, 2023

Source: https://www.calstrs.com/investment-portfolio. For further detailed information see https://www.calstrs.com/investment-portfolio

For reference, RMS (“Risk Mitigation Strategies”) is an evolution away from traditional hedge fund portfolios, often with nominal diversification and return-enhancing benefits (moderate to high equity correlation, low volatility portfolios), towards more effective diversifying portfolios (close to zero equity correlation, moderate to high volatility portfolios).

As per CalSTRS Risk Mitigating Strategies Policy:

“The objective of the RMS asset class is to invest in strategies that provide further diversification of CalSTRS overall investment portfolio”.

“The RMS asset class will invest in a number of investment strategies including long duration U.S. Treasuries, Trend following, Global Macro, Systematic Risk Premia, and other types of strategies. The Chief Investment Officer (CIO) with concurrence of the General Consultant approves any allocation to a new strategy. The target allocation and ranges for the RMS sub-strategies are as follows:”

Table 1 – CalSTRS Risk Mitigation Strategies (RMS) Portfolio Allocation

Source: https://www.calstrs.com/files/8ec906947/riskmitigatingstrategies.pdf

For a case study on major pension plans Risk Mitigating Strategies (“RMS"), and similar Crisis Risk Offset (“CRO”) and Diversifying Strategies (“DS”) portfolios, see here.

For a deep dive into Risk Mitigating Strategies and Crisis Risk Offset, we recommend the 2023 Risk Mitigating Strategies (RMS) Framework by Meketa Investment Group. Meketa has been a pioneer on this evolved approach to diversification, and has supported many of the noted public pensions in their portfolio construction.

Figure 4 - Employees’ Retirement System of Hawaii (HIERS), as of March 31st, 2023

Source: https://ers.ehawaii.gov/wp-content/uploads/2023/05/2023-Q1-HIERS-Total-Quarterly-Performance-Reporting.pdf. For further detailed information see https://ers.ehawaii.gov/wp-content/uploads/2023/05/2023-Q1-HIERS-Managers-AUM.pdf

Figure 5 - Illinois State Universities Retirement System (SURS), as of June 30th, 2023

Source: https://surs.org/wp-content/uploads/invupdate.pdf

Going Forward

Auspice believes we are in the early days of this new cycle of elevated rates and inflation, and that commodities and CTAs are returning as a core part of long-term asset allocation. Indeed, institutional investors seem to agree, managed futures have been the most popular hedge fund strategy so far this year, according to the Latest Nasdaq eVestment Hedge Fund Industry Asset Flows Report[3].

If we look just at commodities, the current cycle may be a fraction of what was experienced in the 1970s.

Figure 6 – Commodity Performance in the 2020s Versus the 1970s

Source: Auspice Capital and Bloomberg. See more at https://seekingalpha.com/article/4628847-com-top-etf-to-invest-in-emerging-commodity-supercycle

This is consistent with an analysis of the performance and duration of all previous commodity supercycles since 1900.

Figure 7 – Commodity Supercycle Total Returns: 1900-2021 (first year = 100)

Source: https://event.on24.com/wcc/r/4185518/C77B46A1BF1D29190A8FE6BF1D785E4A?partnerref=USCF

Figure 8 – Commodity Supercycle Asset Class Excess Returns (Annualized): 1900 to 2021. (Return in excess of US T-Bill return)

Source: https://event.on24.com/wcc/r/4185518/C77B46A1BF1D29190A8FE6BF1D785E4A?partnerref=USCF

Leading pensions and endowments have diversified their portfolios away from the traditional 60/40 allocation. As depicted above, many have made 5-10% allocations to commodities and/or trend following Commodity Trading Advisors (CTAs).

If you don’t have a 5-10% allocation to commodities and/or CTAs and would like more information, or have any questions about the Auspice product suite, email us today at info@auspicecapital.com.

DEFINITIONS

The S&P Goldman Sachs Commodity Excess Return Index (“S&P GSCI ER”), is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The Total Return version (“S&P GSCI TR”) includes the return on cash.

IMPORTANT DISCLAIMERS AND NOTES

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, none of the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. None of the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content

REFERENCES

[1] https://fred.stlouisfed.org/series/CPIAUCSL

[2] https://www.calstrs.com/investment-portfolio

[3] https://www.hedgeweek.com/2023/08/25/321797/managed-futures-back-favour-investors