To download the Auspice September 2024 Blog as a PDF, click here.

In an April 7th Special to the Financial Post “Will The Tech Boom Feed the Commodity Cycle?” Auspice Founder and CIO Tim Pickering described how the link between Big Tech and Commodities is strong and growing stronger (see full article in the April August Blog, here). Notably, Big Tech may be the next big commodity buyer – at a time when supply is increasingly tight and prices are already on the rise.

“The link between commodities and the current tech boom and AI is driven by the demand for data centres, computer chips and electric vehicles (EVs). For each of these technologies to grow, the demand for commodities is massive.”[1]

In September we saw what we believe to be the beginning of this long-term driver affect commodity markets. Uranium prices spiked significantly on the back of Microsoft’s deal to restart the Three Mile Island Nuclear plant. This is the first time Microsoft has secured a dedicated, 100% nuclear facility for its use[2] and represents a massive potential supply of energy that will not be available on the grid for broad base use in the future. A report from a power industry consultancy “declared the era of flat power demand over, thanks to growing demand from data centers and industrial facilities.”[3]

Microsoft isn’t the only tech company looking to secure power to fuel its AI & data center buildout – earlier this year Amazon agreed to spend $650mm to acquire a data center campus connected to a nuclear power plant in Pennsylvania.[4] The dramatic increase in power demands from AI cannot be understated. In some countries, including Saudi Arabia, Ireland and Malaysia, the energy required to run all the data centers they plan to build at full capacity exceeds the available supply of renewable energy.[5]

From renewable energy to Oil and increasingly Natural Gas as a transition market – energy demand is going to increase significantly. Alongside, the demand for Iron Ore (rebar, steel beams) and concrete for data center construction, and demand for the broad range of precious and industrial metals in the chips themselves - is just starting to increase. The link between big tech and commodities is growing stronger.

The magnitude of this driver, at a time when commodity supply is tight, cannot be understated. By 2034, global energy consumption by data centers is expected to be as much as is used by all of India.[6] As mentioned in the Financial Post, this is part of a broader trend to secure commodity supply and production. Major brands including the Ikea Group are following automakers’ lead in securing raw materials and energy, seeking greater control over their production. From automakers to Big Tech, this trend, alongside the broader trend towards deglobalization and protectionism, provides an indication of how tight supply truly is, and what the opportunity for long term commodity investors may look like.

What does the Microsoft deal translate to from an investment timing perspective? Since highlighting the connection between big tech and commodities in April, commodities have largely traded sideways and consolidated. Some headline commodity markets – Gold, Silver, Copper, and Uranium have done well. However, as evidenced by the diversified BCOM commodity benchmark, just +1.7% YTD through September, at this point they are either the exception, or maybe leading - it is too early to tell.

We believe that the Microsoft deal is a first of its kind “Tech-driven, Commodity demand catalyst” that will increasingly be common over the next decade. Importantly, if history is any guide, this may present an opportune time to add diversified Commodity exposure. As we have highlighted previously, the current commodity consolidation, now 2.5 years since the highs experienced in the first half of 2022, is consistent with those experienced in prior cycles of commodity strength and approaching the longer end of the typical range. See the green line (commodities in the 2020s) alongside other periods of strength in Snapshot 1 below:

Snapshot 1 – Recent Commodity Supercycles as Represented by the GSCI.

Source: Auspice Capital and Bloomberg, as at September 30th, 2024.

Only time will tell whether this cycle plays out in a similar fashion as prior cycles. If there is one thing we are most confident in, it’s that there will be volatility. Indeed, even through the consolidation of the last two years we have begun to see volatility spikes that we haven’t seen since the last cycle. This year Cocoa, Coffee, and Sugar have experienced surges on the back of regional supply interruptions. Whereas a decade ago there was supply to backfill any regional dislocations, today global stocks of commodities are tight, and regional disruptions are producing global price volatility.

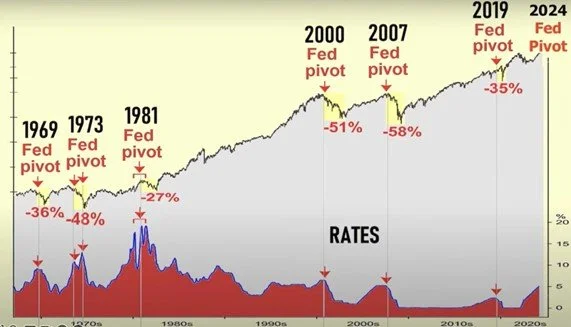

Last, we believe this bullish commodity potential is coming at a time when caution in Equities is warranted. Rate cuts historically have coincided with major equity market turns and subsequent declines. Indeed, aside from the 1987 Black Friday selloff, every major equity market decline has corresponded with a reduction in interest rates. See Snapshot 2.

Snapshot 2 – US Fed Rates Cuts and Equity Performance.

Source: Alternative Capital IL, here.

If you don’t have a 5-10% allocation to tactical commodity or CTAs strategies, now may be an opportune time to rebalance out of recent equity strength and into tactical commodity strategies.

To connect with the Auspice team contact us today at info@auspicecapital.com.

DEFINITIONS

The S&P Goldman Sachs Commodity Total Return Index (“GSCI TR”) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The S&P GSCI Total Return index measures a fully collateralized commodity futures investment that is rolled forward from the fifth to the ninth business day of each month.

IMPORTANT DISCLAIMERS AND NOTES

The returns for Auspice Diversified Trust ("ADT") are “net” (including management and performance fees, interest and expenses). Returns represent the performance for Auspice Managed Futures LP Series 1 (2% mgmt, 20% performance) including and ending November 2019. From this point, returns represent the performance for Auspice Diversified Trust Series X (1% mgmt, 15% performance) which started in July 2014.

The indicated rates of return are the historical annual compounded total returns including changes in share and/or unit value and reinvestment of all dividends and/or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.

REFERENCES

[1] https://financialpost.com/investing/will-tech-boom-feed-commodity-cycle

[2] https://www.bloomberg.com/news/articles/2024-09-20/microsoft-s-ai-power-needs-prompt-revival-of-three-mile-island-nuclear-plant

[3] https://www.wired.com/story/the-ai-boom-is-raising-hopes-of-a-nuclear-comeback/

[4] https://www.bloomberg.com/news/articles/2024-09-20/microsoft-s-ai-power-needs-prompt-revival-of-three-mile-island-nuclear-plant

[5] https://www.bloomberg.com/graphics/2024-ai-data-centers-power-grids/

[6] https://www.bloomberg.com/graphics/2024-ai-data-centers-power-grids/