This month’s Auspice Monthly Blog is focused on an upcoming update to the Auspice One Fund, and how to consider the Auspice One Fund alongside our flagship Auspice Diversified. To download the December Blog, click here.

After listening to our institutional and retail investors, Canada’s original and only pioneering 81-102 approved “return stacking / portable alpha” solution, the Auspice One Fund is evolving to serve you better. Instead of overlaying a value-tilted balanced mandate, we are simplifying - for every dollar invested, you get $1 of the long-standing protective CTA/managed futures fund, Auspice Diversified, and $1 of the S&P500. Two for one. As a “Liquid Alt” with daily liquidity. The fee is the same: you only pay for long-term performance net of the monthly fee: management fee or performance, not both.

Review - What is Return Stacking?

Return stacking is a portfolio structing strategy that has been employed by institutional investors for decades, with PIMCO first in the 1980s (see Graphic 1 below), and many large Canadian pension and sovereign wealth plans starting in the early 2000s. At Auspice we have long offered (and advocated) for this approach with institutional investors who have the infrastructure to use managed accounts and “notionally fund” the exposure – i.e. cover the margin required not the full trading level. This is a structural “alpha” that exists for futures based strategies.

Graphic 1 – PIMCO Portable Alpha Strategies

Source: https://www.cmegroup.com/education/courses/portfolio-management-with-equity-index-futures-and-options/alpha-beta-and-portable-alpha.html

At its core, return stacking generally is the combination of an “alpha” and a “beta” strategy into a single portfolio or fund. One (or both) of these components is generally attained through cash efficient derivatives (notionally funded). Given futures require only a small percentage of capital versus the gross exposure, capital can be used to create multiple exposures. For example, in the flagship Auspice Diversified we typically need less than 10 cents on the dollar to put on futures positions, with the other 90 cents earning a cash return. Rather than cash, 90 cents could be invested in equities, or even 100 cents on the dollar can be invested in equities via cash efficient equity index futures. This could also be funded for cents on the dollar, again earning a cash return on the bulk of investor capital.

Consider a 100% allocation to Auspice Diversified on top of a 100% allocation to the S&P 500 in Chart 1 - Live performance, the only thing hypothetical is the combination. In the bottom row the returns are overlayed, and the returns are slightly more than the sum of the parts due to the non-correlation of the strategies and rebalancing (quarterly).

Chart 1 – Auspice Diversified, S&P 500, and a return-stacking portfolio of both since June 2007

Source: Auspice Capital Advisors and Bloomberg. You can not invest in an index. Past Performance is not necessarily Indicative of future results. Returns for Auspice Diversified are gross, adjusted for the current 1& 15 fee structure in Auspice Diversified Trust Series X. The return stacking portfolio is rebalanced quarterly.

Of note the resulting risk metrics are not equal to the sum of its parts – the risk as measured by “volatility” does not increase proportionally and is similar to the standalone volatility of the S&P 500. The worst drawdown is significantly lower than the S&P 500 despite the use of leverage. Sharpe, Sortino, and Skew are also improved over the S&P 500. This is again due to the non-correlation of the two portfolios and is a key differentiator between return stacking and more traditional uses of leverage that tends to magnify volatility and drawdown – rather than reduce it.

Why Return Stacking?

Return stacking, particularly when done with uncorrelated and even negatively correlated strategies, can produce more attractive standalone risk-adjusted returns. “Standalone” is bolded because when considered in a portfolio of investments, a zero or negatively correlated investment such as Auspice Diversified (without the added equity exposure) may be more accretive to a portfolio, even if it has lower returns. This is a tradeoff – higher absolute and risk-adjusted returns, but with higher equity correlation and equity-like volatility.

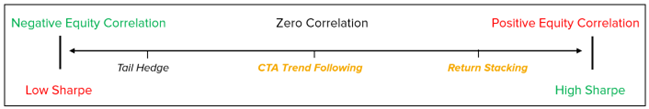

There tends to be a spectrum of returns that considers equity correlation and risk-adjusted returns (Sharpe). On the left side are the pure and most reliable diversifiers: tail-hedge strategies. These strategies have a strong negative equity correlation but generally a low or even negative Sharpe, and thus are not practical for most investors. In the middle you have Trend-Following CTAs that can have a low or even negative equity correlation. These tend to be most accretive to portfolios, albeit with Sharpe Ratios that don’t always stand out when correlation isn’t considered. CTAs tend to be the most practical diversifiers and largest components of “Crisis-Risk Offset” and “Risk-Mitigating Strategies” in portfolios of large pensions and sovereign wealth plans (see more on this here).

Finally, on the right side of the spectrum are return stacking portfolios that have higher Sharpe ratios albeit with higher equity beta and correlation. See Graphic 2 below.

Graphic 2 – Diversification versus risk-adjusted returns.

Source: Auspice Capital Advisors

The Auspice One Fund

For investors prioritizing returns over diversification benefits, return-stacking portfolios such as the Auspice One Fund may be most practical. A return stacking portfolio can also sit in a different part of an investor’s portfolio, for example in an equity bucket if a CTA is overlayed on top of a 100% exposure to equities. Investors get the equity returns, plus the diversifying CTA exposure on top. This is the update we’re employing in the Auspice One Fund in 2025. For every $100 invested, you get $100 in equity beta such as the S&P500, with $100 in the flagship Auspice Diversified, on top. You gain diversification without sacrificing your core holdings.

By simplifying, there is a clearer role in the portfolio and better understanding of the drivers of performance. For example, a large family office investor client utilizes the Auspice One Fund as an “equity-replacement”, allowing them to participate in the equity market with the added benefit of diversification and potential improved performance at critical times.

If you’re concerned about the equity outlook but want to maintain exposure, or are looking for a more balanced returns-seeking solution, the Auspice One Fund may be a practical solution for you.

We will have more information on the updates to the Auspice One Fund soon. For more information about any Auspice strategies, please email info@auspicecapital.com.

DEFINITIONS

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

IMPORTANT DISCLAIMERS AND NOTES

The indicated rates of return are the historical annual compounded total returns including changes in share and/or unit value and reinvestment of all dividends and/or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

Returns for Auspice Diversified are gross, adjusted for the current 1& 15 fee structure in Auspice Diversified Trust Series X.

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.