Inflation and Investing in the Commodities Supercycle.

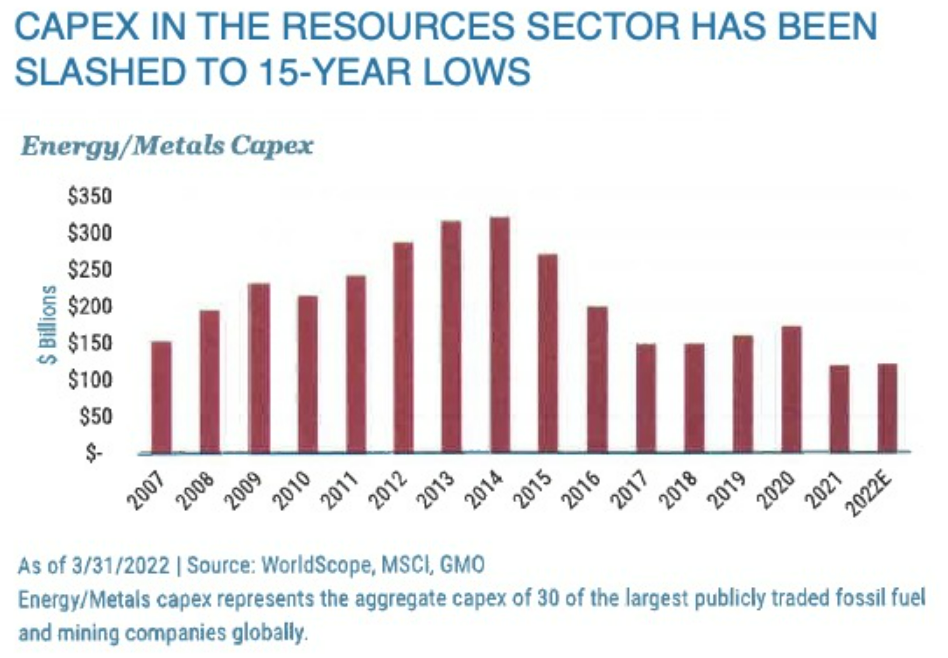

There are two ingredients required for a commodity supercycle: an extended period of underinvestment in supply, and a generational demand shock. Today we have both.

Auspice Investment Solutions

View our two minute explainer videos for an overview on Auspice commodity to complete solutions.

Latest Auspice Research

Some of the latest Auspice research is featured below. Email info@auspicecapital.com to chat to a member of our team and learn more.

WHAT IS THE OPTIMAL CTA ALLOCATION?

(September 2022) - Auspice Case Study: BTOP 50 and Auspice Diversified

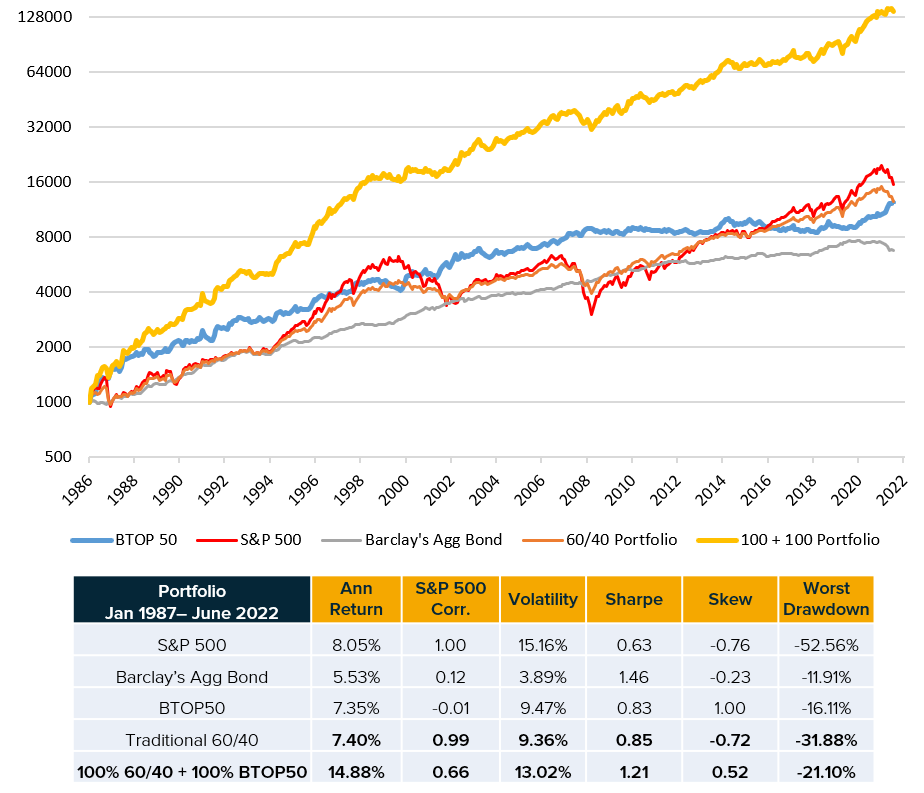

Increasingly the question of “how much to allocate” to trend-following CTAs has been posed to Auspice. This 2-page case study looks at the math and portfolio benefits.

COMMODITY INVESTING IN THE AGE OF ESG AND INFLATION

(November 2021) - Auspice White Paper

Whether for broad diversification or in response to increasing inflation risks, commodity futures may be the the most practical and effective solution for responsible investors looking for commodity exposure. This white paper considers commodity futures within ESG frameworks.

INSTITUTIONAL USE OF COMMODITIES & CTAS

(November 2021) - Auspice Case Study: US Pensions and Ontario Teachers’ Pension Plan

Some highly regarded institutional investors have been investing 5 - 10% of their portfolios in CTAs while Ontario Teachers’ Pension Plan invested 12% of their portfolio in commodity derivatives. See more in this 2-page case study.

POSITIONING FOR THE 2020S COMMODITY BULL MARKET

(March 2021) - Auspice Research Highlight

Adding a tactical commodity exposure potentially benefits a portfolio more than resource equity or long-only commodity benchmark approaches. Including a tactical broad commodity index allocation has the ability to improve overall performance while reducing volatility and drawdowns.

Video & Podcast Highlights

THE MEB FABER SHOW - Commodities, CTAs & The LME Scandal - August 29th, 2022.

In this podcast Tim talks all about trend-following and commodities. Tim shares why trend-following can serve as a great diversifier to stocks and bonds, and why it’s a great way to play the current commodity cycle. He ever shares his thoughts on the LME fiasco earlier this year and what his reaction was when he saw his trades were cancelled.

Watch on YouTube here or select a podcast platform here.

TOP TRADERS UNPLUGGED - Why Commodities & Why Now - April 10th, 2022.

Auspice Founder/CIO Tim Pickering is featured for a second time on #1 industry podcast "Top Traders Unplugged". In this episode, Tim and host Niels Kaastrup-Larsen discuss:

Why commodities play such an important role in a portfolio

How to create a strategy that adapts to different volatility regimes

Why they created The Auspice Broad Commodity Index

The role and importance of ESG in commodities trading

How commodity futures can be used as a risk mitigation tool

Why Ukraine is so important for commodities

How to effectively protect yourself against inflation

Blog Highlights

Featured posts from our monthly blog. For all blog posts, podcasts, and monthly strategy commentaries, please see our Resources section.

INDIA PART TWO – THE SURGE IN INDIAN CAPEX AND INFRASTRUCTURE SPENDING

(January 2023)

In January one chart in particular grabbed our attention, and we can’t understate its significance. The surge in Indian capex and planned infrastructure spending – on the back of the noted decade of underinvestment in the resource sector, may supersede the green transition as the biggest driver of a commodity supercycle. After a four-year period of flat to moderate capex growth, India is set to double its 2023 capex from 2020 levels. Read more.

INDIA: THE EMERGING DEMAND SHOCK TO FURTHER FUEL THE COMMODITY SUPERCYCLE

(December 2022)

Along with the structural set-up we have previously described, we believe there is a substantial additional important factor, one that could dwarf all the others, that our recent research has uncovered. India may create a new emerging demand shock that we believe is already well underway. Read more.

WHAT ARE YOU INVESTED IN? WHY?

(November 2022)

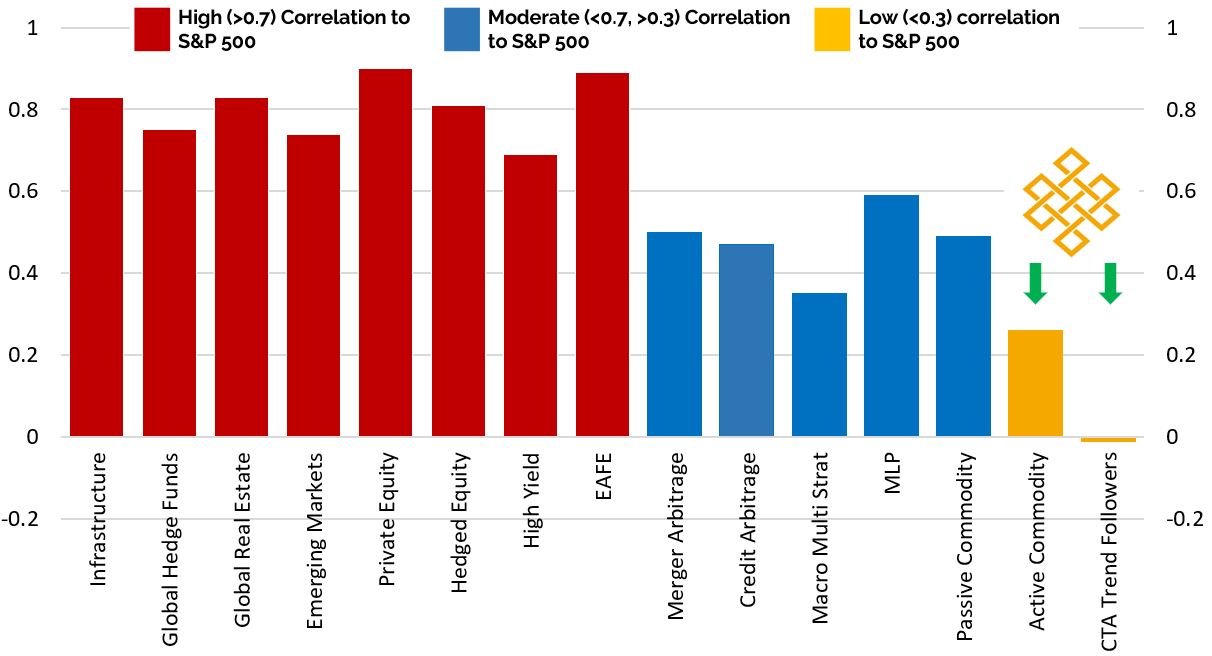

This month’s blog is brief. From the largest pensions to the most traditional bank platforms, investors are increasingly embracing alternative investments. We believe two reasons often come to the forefront: Diversification and Potential Returns Enhancement. If Diversification and returns enhancement indeed are the motivations to embrace alternatives, we may recommend investors think hard about what they're invested in, how much, and why. Read More.

COMMODITY ALLOCATION VS TRADING

(October 2022)

As the Auspice Broad Commodity Index (underlying strategy to NYSE “COM” and TSX “CCOM” ETFs) went to a 100% cash position in October we performed some analysis. To some, buying a “commodity” ETF that is currently 100% cash seems counterintuitive. Historically this has only occurred three times since 2000. In September 2014 this occurred and there was significant outperformance vs long only commodity benchmarks (2-year 43.78% cumulative outperformance ABCERI vs S&P GSCI ER). In September 2008 and March 2020, the performance following was amongst the strongest performing periods. See case studies below. Read More.

60/40 VERSUS FIVE TOP PENSIONS AND ENDOWMENTS

(September 2022)

As we know, there are many options to diversify beyond stocks and bonds – something more capable, larger institutional investors have long embraced. With Quantitative Easing (QE) over and inflation sinking it, most investors are re-evaluating portfolios if not already done.

Some pensions like Ontario Teachers’ (OTPP) and Hawaii (HIERS) are ahead of the game and have announced exceptional results, delivering 1.2% and -1.7% in the first half performance, far superior to the traditional 60/40 portfolio result of -16.3%.

What are the pensions and endowments doing exactly? How are they performing? This month we look at five of the best. Read More.

COMMODITY SUPERCYCLE UPDATE – WHERE ARE WE TODAY?

(August 2022)

Commodities outperformed equities for almost 40 years prior to the Global Financial Crisis. Given the continued deterioration in 2022 commodity capex and supply alongside further drivers, we are likely in the early innings of an emerging commodity supercycle. Read More.

RETURN STACKING – WHAT, WHY, WHERE, AND HOW

(JULY 2022)

What exactly is return stacking, why should you consider it, where does it fit within a portfolio, and how has it performed in the recent environment? Read More.