Mostly, headlines are noise, and if we’re smart about it, we have all learned to filter. They are after all, designed to grab your attention. You become immune especially in light of the current volatility, economic and pandemic related reality. But every once in a while, a headline just takes you aback. Moreover, when it is in your field of expertise, and the focus of a company you founded, sometimes you take exception.

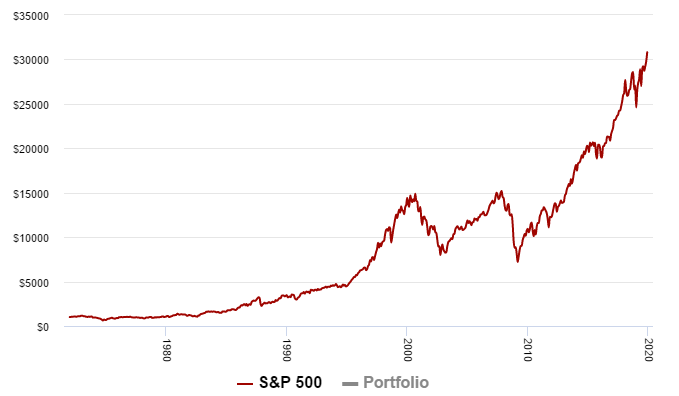

We have long believed that investment decisions should be driven by the facts. In the case of a quant manager like Auspice, we focus on return drivers like trend and momentum aspects. Is an asset rising? We may be interested in buying. Is it falling? We may short it. Basically, we divorce ourselves from market fundamentals and opinion, especially "popular opinion" as highlighted by media. If we "stick to the facts" we are able to provide a non-correlated return stream that is accretive to an investor's portfolio and ideally outperform in times of volatility and crisis. That’s the job. We do what we need to do to remain agnostic. We don't fall in love with ideas or investments. We don't love crude oil more at $30 than $50 to justify buying it as it may just go to $0. Or -$37.

As such, when I read headlines like "Value Managers Fight Back - On the back of the worst quarter ever for value stocks, AQR’s Cliff Asness and others defend the long-struggling style.”[1] I can't help but laugh and be a little annoyed.

“Investors are simply paying way more than usual for the stocks they love versus the ones they hate, without that behavior being rooted in anything we can find that seems like a great, rational economic story,” he said. For patient value investors, that irrationality is ultimately good. “If we’re right, that’s exciting. We say timing is an investing sin, but we’ve also said we can sin a little at true extremes. We don’t know when, but we believe value will come back, and be big.”

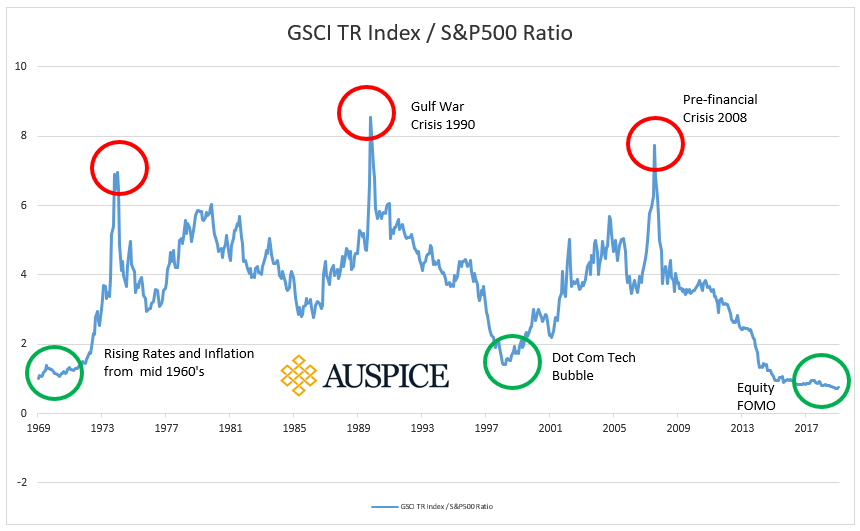

I have told investors that if I start injecting fundamental belief into how we invest or justify losses, it’s time to fire us. It doesn’t mean we don’t have opinions; we have many. For example, the commodity to equity ratio has been low a long time. But if we had tried to pick a bottom, simply on this relative value idea, we would have lost a lot of money. It has gone lower. For a long time.

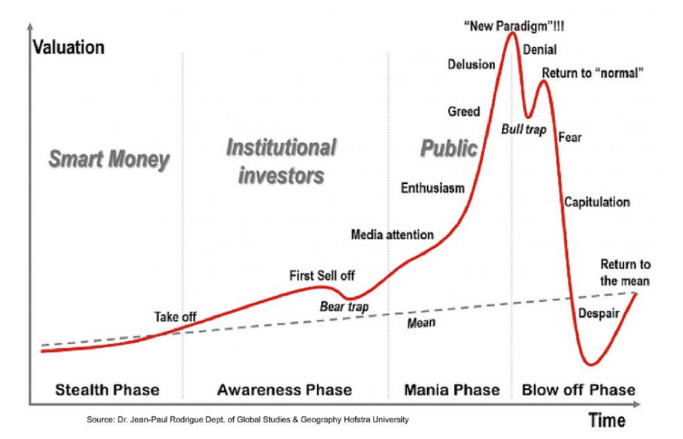

For some, so called “value stocks”, have got very low priced, i.e. “great value”. Perhaps one could argue irrationally low, but I am not one to say. If they have been falling for so long, the real opportunity loss is having not shorted them. That would be the rational and agnostic thing to do if the goal is to “make money” versus fall in love with a story. One that can stay irrational longer than one can stay solvent.

Stay agnostic. Give us a call - we may have the right solution to help your portfolio.

[1] https://www.institutionalinvestor.com/article/b1lp9wzz1756nr/Value-Managers-Fight-Back?utm_medium=email&utm_campaign=The%20Essential%20II%2005192020&utm_content=The%20Essential%20II%2005192020%20Version%20A%20CID_b35d4a508d200c6d5857cde9893d6533&utm_source=CampaignMonitorEmail&utm_term=Value%20Investors%20Fight%20Back

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.