Download the commentary here.

May Commentary & Performance

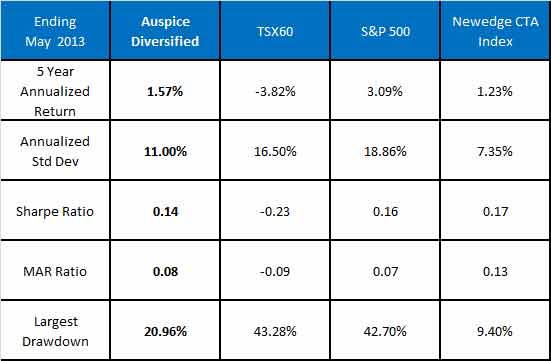

The Auspice Diversified Program was off 0.90% in May after gaining 0.99% in April.

- Traditional markets continued to be volatile in May while holding onto gains.

- Fixed income reversed sharply lower.

- Commodities were generally lower:

- Metals were most opportune with gains made on the short side.

- Grains had moves in both directions.

- Energies were lower on the month including Natural gas.

- Softs were mixed with strong moves in either direction.

- Currencies weakened vis-à-vis the US Dollar.

Broadly we are finding trends in both commodities and financial markets and from both long and short positions across the portfolio. While commodities are tilted short, the opportunity comes from capturing trends in both directions and shifting in an agile and agnostic fashion. Commodities remain a significant core allocation within our risk budget which differentiates Auspice from many other global CTA strategies.

Please take a look on our website at a new resource from the CME. The recent report called “Portfolio Diversification Opportunities”.

Sectors and Trades:

- Profitable in 3 of the 7 sectors traded.

- Gains were led by Grains and Metals in addition to Equity Indices.

- Most challenging sectors were Interest Rates and Softs.

- The open equity risk is shifted to commodity at month end.

- Largest portfolio gain in Gold from short side. Short Wheat and Long Soybeans was also a large contributor.

- Nikkei equity index exited at May 31.

Key Points Regarding our Positions

Energies:

- All Energies were lower on the month.

- We exited a recent short in Crude early in the month to be flat all components.

- Very choppy and range bound sector.

Metals:

- Sector continues to perform very well.

- Short taken in Gold in April was top performer in the portfolio.

- Short Copper despite a move higher

Grains:

- Top performing sector.

- Short Wheat and newly added long Soybeans provided the gains.

- On sidelines in Corn which was modestly higher.

Soft Commodities:

- After providing opportunity, we exited the long Cotton position as this market weakened significantly.

- Continued gains from short Coffee and long Orange Juice (a coincidental pairing!) did not offset Cotton loss.

Currencies:

- Small loss as most currencies traded lower vis-à-vis the US dollar and we made a number of position changes.

- Best trend was again from the short Japanese Yen (lower).

- Exited long positions in both commodity currencies (Aussie and Canadian dollar).

- New shorts in Euro, Pound and Swiss Franc.

- New long the US Dollar index.

Interest Rates:

- Exited all rate positions during month as markets fell.

- Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times which is common during transition in trends. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed.

Equity Indices:

- Equity indices were profitable as we are long.

- Nikkei exited on May 31 at over 9x capital to risk taken as many markets corrected aggressively in the last week and volatility and risk expanded.

- We are still on this train after reducing risk in February, adding in March, held positions in April.