The Auspice Diversified Program was down 4.07% in September.

July Auspice Diversified Commentary

June Auspice Diversified Program Commentary

Download the commentary here.

The Auspice Diversified Program gained 0.66% in June despite significant market turbulence and correction.

Traditional markets followed up a volatile May with a correction in June hitting commodity based equity markets the hardest. Most fixed income markets continued to reverse sharply lower in June, a move that started early May.

Commodities were generally lower:

- Metals were again most opportune with gains made on the short side.

- Grains were also lower.

- Energies were mixed with Natural gas lower on the month and petroleum based slightly higher.

- Softs were soft.

- Currencies were volatile reversing directions a number of times with general weakness in the US Dollar Index.

It’s good to be short! Months like June highlight why we are direction agnostic and willing to participate in trends regardless of common opinion. With the equity markets at very least stalling and beginning to come off following the correction in Fixed Income and commodity, we are reminded that opportunity can come from being short as it did to end 2008. This is the time to consider adding or increasing CTA exposure if you are looking to protect traditional asset weightings or take an opportune and tactical view.

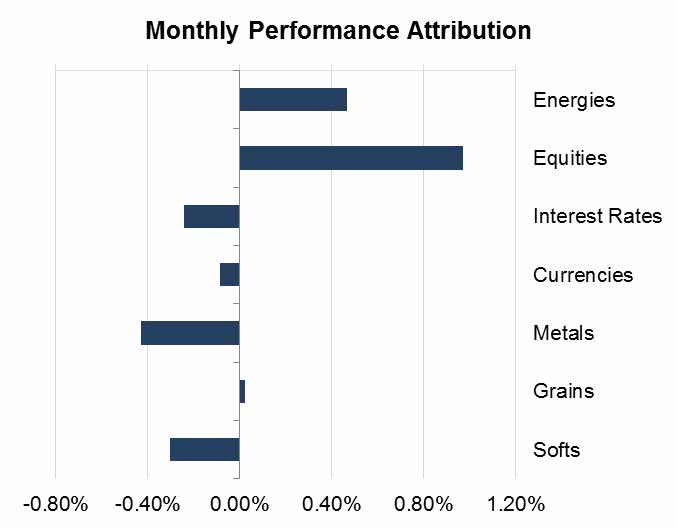

Sectors and Trades:

- Profitable in 3 of the 7 sectors traded. Gains were led by Metals, followed by Grains and Energy largely from the short side.

- The most challenging sectors were Currency and Equity Indices.

- The open equity risk continued to shift to commodity during June.

- We have cut Equity risk in half.

- Largest portfolio gains came from Gold and Copper from short side. Short Wheat, Natural Gas, and Coffee were also large contributors.

- Very profitable short in Japanese Yen was crystallized.

Key Points Regarding our Positions

Energies:

- Petroleum based energies were slightly positive led by Crude. We are on the sidelines currently.

- Natural Gas was weak and a new short was entered early in the month and quite profitable on the month.

- Sector was positive based on the Natural Gas trade.

Metals:

- Strongest sector with opportunities in Gold and Copper on the short side,

- Added new short in Palladium late in the month,We have resized the risk in this sector, crystallizing some of the short gains made.

Grains:

- Grains made gains on the back of the short in Wheat we have held since February.

- Long Soybeans corrected lower but still remains the strongest of the grains. Remain on sidelines in Corn which corrected sharply lower at month end.

Soft Commodities:

- Cotton continued to behave in an erratic manner rallying to start the month and giving it all back by the end, We tried a long position but exited quickly as the trend lacked persistence. Lumber was similarly whippy in the opposite order and we remain flat.

- Continued gains from short Coffee while long Orange Juice did not provide the breakfast blend it did in May. We are still long OJ and monitoring trend closely.

Currencies:

- Currencies continue to be a tough trade with sharp moves up and down within the month across most major markets.

- We exited the very profitable short Japanese Yen trade early in the month before the whippiness ensued. The trade returned approximately 7 times capital risked.

- After exiting long positions in both commodity currencies (Aussie and Canadian dollar) in May, we have flipped these to short.

- Exited recent new shorts in Euro, Pound and Swiss Franc.

- Exited recent new long the US Dollar index.

Rates:

- We are currently on the sidelines in all rates after exiting long positions.

Equity Indices:

- We gave back gains in long equity indices as the market started to correct globally in various amounts. This crystallized some profitable positions.

- After exiting the Nikkei May 31, we also exited the Nasdaq and the Hang Seng.

- We continue to hold the strongest of the markets in S&P, Russell and CAC 40.

- Exposure to long equity has been cut by 50% in the last month.

May Auspice Diversified Program Commentary

Download the commentary here.

May Commentary & Performance

The Auspice Diversified Program was off 0.90% in May after gaining 0.99% in April.

- Traditional markets continued to be volatile in May while holding onto gains.

- Fixed income reversed sharply lower.

- Commodities were generally lower:

- Metals were most opportune with gains made on the short side.

- Grains had moves in both directions.

- Energies were lower on the month including Natural gas.

- Softs were mixed with strong moves in either direction.

- Currencies weakened vis-à-vis the US Dollar.

Broadly we are finding trends in both commodities and financial markets and from both long and short positions across the portfolio. While commodities are tilted short, the opportunity comes from capturing trends in both directions and shifting in an agile and agnostic fashion. Commodities remain a significant core allocation within our risk budget which differentiates Auspice from many other global CTA strategies.

Please take a look on our website at a new resource from the CME. The recent report called “Portfolio Diversification Opportunities”.

Sectors and Trades:

- Profitable in 3 of the 7 sectors traded.

- Gains were led by Grains and Metals in addition to Equity Indices.

- Most challenging sectors were Interest Rates and Softs.

- The open equity risk is shifted to commodity at month end.

- Largest portfolio gain in Gold from short side. Short Wheat and Long Soybeans was also a large contributor.

- Nikkei equity index exited at May 31.

Key Points Regarding our Positions

Energies:

- All Energies were lower on the month.

- We exited a recent short in Crude early in the month to be flat all components.

- Very choppy and range bound sector.

Metals:

- Sector continues to perform very well.

- Short taken in Gold in April was top performer in the portfolio.

- Short Copper despite a move higher

Grains:

- Top performing sector.

- Short Wheat and newly added long Soybeans provided the gains.

- On sidelines in Corn which was modestly higher.

Soft Commodities:

- After providing opportunity, we exited the long Cotton position as this market weakened significantly.

- Continued gains from short Coffee and long Orange Juice (a coincidental pairing!) did not offset Cotton loss.

Currencies:

- Small loss as most currencies traded lower vis-à-vis the US dollar and we made a number of position changes.

- Best trend was again from the short Japanese Yen (lower).

- Exited long positions in both commodity currencies (Aussie and Canadian dollar).

- New shorts in Euro, Pound and Swiss Franc.

- New long the US Dollar index.

Interest Rates:

- Exited all rate positions during month as markets fell.

- Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times which is common during transition in trends. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed.

Equity Indices:

- Equity indices were profitable as we are long.

- Nikkei exited on May 31 at over 9x capital to risk taken as many markets corrected aggressively in the last week and volatility and risk expanded.

- We are still on this train after reducing risk in February, adding in March, held positions in April.

April 2013 Auspice Diversified Program Commentary

Download the Commentary here.

The Auspice Diversified Program was up 0.99% in April.

Note: We have streamlined the monthly commentary. If you are looking for any additional info please contact Auspice. Feedback is welcome.

- Global markets were volatile in April with US equities falling hard only to bounce back and end the month strongly. Canadian equities ended weak.

- Commodities were volatile:

- Most gains were made on the short side.

- Grains rallied hard off their bottom.

- Energies sold off before rallying at month end to make back some gains. Natural gas was stronger on the month.

- Softs were mixed with strong moves in either direction.

- Interest rates were strong and pushed to all times highs.

Broadly, the markets were not only volatile but have shown signs of trend. We are participating in markets that we have previously reduced risk in like equities and interest rates. While commodities have been challenging in the last year or so, there are trends developing for those able to be agile and agnostic to direction. Commodities remain a focus given the opportunities to capture trend.

REQUEST A FREE CME BROCHURE

If you are interested in a new brochure from the CME discussing the diversification benefits of Managed Futures, please contact us.

Save the Date!

For those in western Canada, please save June 4/5/6 for a CME sponsored event on managed futures that Auspice has been invited to participate in. There are limited seating so please contact Auspice if you have interest.

Sectors and Trades:

- Profitable in 3 of the 7 sectors traded.

- Gains were led by Equities and Interest Rates in addition to Metals.

- Most challenging sectors were in Energies and Grains due to sharp reversals intra-month.

- While the bulk of the positions are in the financial markets, the open equity risk is evenly split between commodity and financial markets.

- Largest portfolio gain came from Gold on the short side. Copper was also a large contributor.

- Japanese Yen short coupled with long the Nikkei index continues to provide benefit and were the strongest performers in their respective sectors.

Key Points Regarding our Positions

Energies:

- Petroleum based energy sold off aggressively to bounce back somewhat at month end.

- We entered a new short in Crude while exiting a long Gasoline position prior to the sell-off.

- We have covered our NatGas short and remain on the sideline in Heating Oil.

- Very choppy sector with Natural Gas showing potential for a breakout higher.

Metals:

- As in March, the sector performed very well, prices dropped significantly.

- A new short was taken in Gold at the beginning of the month and was top performer in the portfolio.

- Short Copper was second most significant portfolio contribution.

- Exited a long position in Palladium early in the month as metals broke down.

ADDITIONAL REFERENCES

- A recent article in Advisors Edge dispels some of the myths regarding Managed Futures.

- For those interested, Michael Covel, a leading author specializing in Managed Futures and trend following, interviewed Tim Pickering on his background and the unique aspects that make Auspice a Next Generation CTA. Listento the podcast through iTunes.

- Additionally, for those interested in more ideas about investing in alternatives, please check out www.amfmblog.com.

Grains:

- Like energies, Grains were whipsawed after weakness ending March and was followed by a rally in April.

- After exiting Corn at the end of March, we exited Soybeans early in April.

- Short Wheat position has been held.

Soft Commodities:

- Gains from short Coffee and long Orange Juice (a coincidental pairing!)

- Exited a long position in Lumber prior to the market collapsing.

- Cotton still long but slightly off on the month.

Currencies:

- Currencies continue to be choppy with the best trends coming from the Japanese Yen (lower) and Canadian Dollar (higher).

- Exited both the British pound (short) and Swiss Franc (short) during the month. Exited long US Dollar index.

- No Euro position at this time.

- Remain long Aussie dollar despite a choppy month.

- Currency is overdue for trending behavior, however still quite choppy.

Interest Rates:

- Added long positions in 2 year notes and US Long Bonds.

Equity Indices:

- We are still on this train after reducing risk in February, adding in March, held positions in April.

- Strongest was the Nikkei followed by the Nasdaq.

- Not all equities were higher as the Russell 2000 was off as was the Canadian market.

- Even within the equity momentum, being tactile and agile is key.

- Petroleum based energy sold off aggressively to bounce back somewhat at month end.

- We entered a new short in Crude while exiting a long Gasoline position prior to the sell-off.

- We have covered our NatGas short and remain on the sideline in Heating Oil.

- Very choppy sector with Natural Gas showing potential for a breakout higher.

Metals:

- As in March, the sector performed very well, prices dropped significantly.

- A new short was taken in Gold at the beginning of the month and was top performer in the portfolio.

- Short Copper was second most significant portfolio contribution.

- Exited a long position in Palladium early in the month as metals broke down.

ADDITIONAL REFERENCES

- A recent article in Advisors Edge dispels some of the myths regarding Managed Futures.

- For those interested, Michael Covel, a leading author specializing in Managed Futures and trend following, interviewed Tim Pickering on his background and the unique aspects that make Auspice a Next Generation CTA. Listento the podcast through iTunes.

- Additionally, for those interested in more ideas about investing in alternatives, please check out www.amfmblog.com.

Grains:

- Like energies, Grains were whipsawed after weakness ending March and was followed by a rally in April.

- After exiting Corn at the end of March, we exited Soybeans early in April.

- Short Wheat position has been held.

Soft Commodities:

- Gains from short Coffee and long Orange Juice (a coincidental pairing!)

- Exited a long position in Lumber prior to the market collapsing.

- Cotton still long but slightly off on the month.

Currencies:

- Currencies continue to be choppy with the best trends coming from the Japanese Yen (lower) and Canadian Dollar (higher).

- Exited both the British pound (short) and Swiss Franc (short) during the month. Exited long US Dollar index.

- No Euro position at this time.

- Remain long Aussie dollar despite a choppy month.

- Currency is overdue for trending behavior, however still quite choppy.

Interest Rates:

- Added long positions in 2 year notes and US Long Bonds.

Equity Indices:

- We are still on this train after reducing risk in February, adding in March, held positions in April.

- Strongest was the Nikkei followed by the Nasdaq.

- Not all equities were higher as the Russell 2000 was off as was the Canadian market.

- Even within the equity momentum, being tactile and agile is key.

March 2013 Auspice Diversified Program Commentary

Download the Commentary here.

The Auspice Diversified Program was up 0.28% in March.

The strategy was successful in navigating the choppy global markets in March. Within most sectors, agility was an asset as there was deviation in long and short direction.Broadly, we are experiencing a choppy commodity market and a strong but risky equity market. To be effective, it is important to take a tactical approach coupled with stringent risk management. Discipline provides comfort in this environment and hopefully illustrates a significant benefit as trends develop. Most recently, we highlighted in February that we cut equity risk but remained long the strongest markets which has continued to benefit the portfolio while reducing the risk.

REQUEST A FREE CME BROCHURE

If you are interested in a new brochure from the CME discussing the diversification benefits of Managed Futures, please contact us.

Within commodities, we are participating in some good trades both short and long. Outperformers are identified and are held, such as long Cotton. Short opportunities were also beneficial as experienced with Copper. The portfolio further benefitted from long Palladium and short Wheat positions.

The key to the strategy remains being tactical and agile with the overriding goal of capital preservation. At some point, there will be a shift as equities have been good for a long time, the interest rate trade has been captured already and commodity has underperformed for some time. While we are unable to know how or when, we know things won’t stay the same and in that movement comes volatility and opportunity. Patience is important while other areas of the portfolio are doing well.

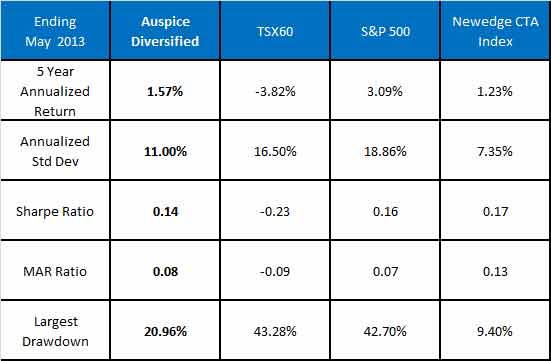

The 5 year statistics (Apr 08 - Mar 13) are: +1.37% annualized return with 11.01% volatility while the 6 year annualized is 4.54%. The worst drawdown for the period was 20.96% with an average Margin to Equity ratio of 6.20%. It should be noted that during this 5 year period, Auspice Diversified remains ahead of the benchmark industry index. The Newedge CTA index is +1.21% annualized over the same period.

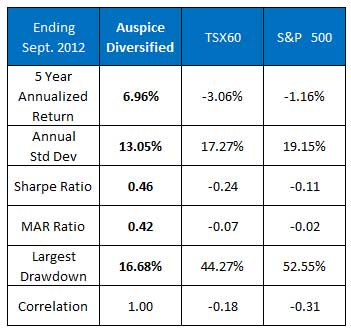

Most global equity markets remain down to small positive (-2% to +3% annualized range) with 35-50% more volatility and deeper drawdowns of 40-55%. For example, the TSX60 is -1.46% annualized for the period with over 44% drawdown.

Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile versus traditional investments due to our attention to risk management and downside protection.

Interesting Trades:

The Auspice Diversified Program was profitable in 4 of the 7 sectors traded. It has been a few months since the gains came from a majority of the sectors and this is positive to see. Moreover, gains came from both commodity and financial sectors. Gains came from Metals and Softs complimented by Equity Indices and Currencies. The strongest sector was Metals followed by Equity indices even though we had reduced risk and crystallized some of the gains in February.

- Strongest commodity gains holding long Cotton and Palladium while short Wheat, Copper and Coffee.

- Equity markets made gains long on reduced exposure.

- Japanese Yen short coupled with long the Nikkei index continues to provide benefit.

- We have exited the strong part of the Grain market in Soybeans and held the short in Wheat for a solid gain.

Key Points Regarding our Positions

Energies: The sector was not profitable led by aggressive corrections higher after the opposite occurred in February (lower). The month started weak causing us to cover our long position in Heating Oil which largely traded sideways thereafter. The strength was in WTI Crude and we covered our short while continuing to hold a long position in Gasoline which underperformed Crude. We remain short Natural Gas which is still currently in an established range from 2012. Despite media attention, the Natural Gas market is close to a shift but not quite there yet. Natural Gas has $1-$2 potential from here both up and down.

ADDITIONAL REFERENCES

- A recent article in Advisors Edge dispels some of the myths regarding Managed Futures.

- For those interested, Michael Covel, a leading author specializing in Managed Futures and trend following, interviewed Tim Pickering on his background and the unique aspects that make Auspice a Next Generation CTA. Listen to the podcast through iTunes.

- Additionally, for those interested in more ideas about investing in alternatives, please check out www.amfmblog.com.

For those with specific interest in this sector, please contact Auspice regarding the Auspice Energy Program.

Metals: After a challenging 6 months, Metals were the star of the portfolio. Gains were made from both long Palladium and short Copper. We remain on the sidelines in Gold at this time.

Grains: Grains were negative on the month on the back of a long position in Soybeans and a brief long position in Corn. Both positions were exited as the market collapsed at month end while the Wheat short already in place partially offset this shift in exposure. Grains are an example of a sector with disparate trends and positions that often highlight transition. Keep a close eye here.

Soft Commodities: The Softs sector was positive on the month from existing and new positions. The short Coffee trade moved lower while we added new long positions in OJ and Cotton. Lumber has been a tough market to trade but we have taken a position on strength. The Softs sector is another example of a sector with disparate risks and unique opportunities.

Currencies: After a choppy few months, the currencies sector was profitable on existing positions and some new trades. While the US Dollar continued higher vis-à-vis currencies, some individual markets have shown renewed trend. We have added a short in the Swiss Franc while adding a new long position in the Aussie dollar. We continue to be short the Japanese Yen and British Pound. Of note the Aussie Dollar, with its often associated commodity tilt, was quite strong and beyond that of the Canadian dollar.

Interest Rates: We continue to hold a modest amount of risk in rates via long positions in US 5 and 10 year Notes. The sector was slightly off on the month primarily on the late month entry in 5 years.

Equities: After reducing risk and crystallizing gains in this very profitable sector over the last 6 months, the sector continues to perform. While we cut the weakest of the markets in the Hang Seng in February, we have added Nasdaq during early March. We will highlight intra month changes in risk if and as it arises and continue to adjust to best capture this opportunity.

*Returns represent the performance of the Auspice Managed Futures LP Series 1.

Futures trading is speculative and is not suitable for all customers. Past results is not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offense to claim otherwise.

February 2013 Auspice Diversified Program Commentary

Download the Commentary here.

The Auspice Diversified Program was down 2.23% in February.

While the last couple months provided good opportunity, February was challenging and a time to play defense. During February, we cut risk in all long equity positions and exited some markets entirely. While we are still long, this is to say that we believe the probability of keeping our equity gains is diminishing and reducing our risk and crystallizing some of the gains is prudent.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

We also exited long positions in some commodities and currencies. Commodities were notably weak on the month making up over 75% of the loss. However, it should be noted that by being agile and protecting capital, the strategy outperformed long commodity indices, many of which were down 4-6% (Ex GSCI down 4.39%). We are optimistic commodities may provide opportune trends in the near future and corrections like this are a normal part of our strategy. In the meantime, we focus on risk management and the overriding goal of capital preservation.

While we don’t know the direction of the traditional equity and fixed income markets, what investors need is an insurance policy that will pay off at times when the inevitable pullbacks occur. In our opinion, Auspice Diversified Program is better than insurance in that it also has a good chance of making money when you need it most and at least not losing much, at other times. Overall, your total portfolio has less risk and more chance of making money over the long term by adding a non correlated investment. You wouldn't drive a car without insurance and you shouldn't invest without it either.

For those interested in an updated copy of an analysis of the drawdown and recovery periods for Auspice Diversified, please contact Auspice. A quick synopsis can be obtained here (right), which highlights the environment and the opportunity. The current environment is an opportune time to be adding to this type of an investment.

Interesting Trades:

The Auspice Diversified Program was profitable in 1 of the 7 sectors traded and flat in 1 other. Although, the strongest market was Equity indices, we reduced risk and crystallized some of the gains as the risk/reward of staying in this trade has shifted. After a strong start to the year, commodities and commodity related currencies also lost momentum in February.

- Risk reduction in all long equity index positions including S&P, Russell 2000, Nikkei, CAC 40 Paris and exited Hang Seng completely crystallizing this uptrend gain.

- Profitably exited long position in Aussie dollar.

- Reduced risk in other currencies including Swiss Franc and Euro.

The 5 year statistics (Mar 08 - Feb 13) are: +0.96% annualized return with 11.05% volatility. The worst drawdown for the period is 20.96% with an average Margin to Equity ratio of 6.21%. It should be noted that during this 5 year period, Auspice Diversified remains ahead of the benchmark industry index. The Newedge CTA index is +0.88% annualized over the same period.

Most global equity markets remain down to small positive (-2% to +3% annualized range) with 35-50% more volatility and deeper drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile versus traditional investments due to stringent risk management and downside protection.

The close parity in returns of the equity markets and Auspice strategy represents an excellent entry point historically, and the team at Auspice is investing at this time.

Key Points Regarding our Positions

Energies: The sector was not profitable led by aggressive corrections lower in Gasoline and Heating Oil. Crude had been on the sidelines but we entered a short position during the month which offset and participated in some of the move down. We remain short Natural Gas but this did not provide much help during the month. This continued choppy behavior is challenging, and the sector is long overdue for trending behavior.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy. The program went live on March 2nd, 2012.

Metals: Metals were universally weak in February. While we remain long Palladium and flat Gold, we have added a new short in Copper. This sector has been choppy and we are testing for direction and opportunity either way.

ADDITIONAL REFERENCES

- A recent article in Advisors Edge dispels some of the myths regarding Managed Futures.

- For those interested, Michael Covel, a leading author specializing in Managed Futures and trend following, interviewed Tim Pickering on his background and the unique aspects that make Auspice a Next Generation CTA. Listen to the podcast through iTunes.

- Additionally, for those interested in more ideas about investing in alternatives, please check out www.amfmblog.com.

Grains: Grains were negative on the month and a couple positions were changed. While still holding a long position in the stronger Soybeans market, we have exited Corn to be flat and entered a new short in Wheat. By our definition, with the exception of Wheat, the Grains remain in long-term up trend.

Soft Commodities: The Softs sector was negative on the month. We re-entered a short in Coffee for a gain while exited a re-entry in Lumber from the long side for a loss. This position was quickly stopped out as it eroded alongside commodities in general. Cotton was the strongest in the sector, and we are close to a newlong position.

Currencies: The Currencies sector largely reversed aggressively lower vis-à-vis the US Dollar but we managed to exit our long Aussie dollar position profitably. We also exited long positions in Swiss Franc and the Euro while holding short in Japanese Yen. We have added a new short in the British Pound. We remain on the sidelines in the Canadian Dollar which was also weak alongside its commodity currency counterparts. We have taken a new long position in the US Dollar Index in the wake of this transition to US strength.

Interest Rates: After January’s big shift in Interest Rates, where we exited all long positions and completely crystallize the multi-year gains made in this sector, we have added new long positions in 5 and 10 year Notes. This sector was flat on the month.

Equity Indices: Risk was reduced in the long equity markets which have been very profitable over the last 4 months. During February we reduced long positions in the S&P, Russell 2000, Nikkei, CAC 40 Paris and exited Hang Seng completely. We have remained flat the Nasdaq since October 9th, 2012. This market has not moved higher with the other global equity benchmarks. Equity sector was profitable in February.

While we do not aim to call tops in markets, we believe in selling assets where we believe the probability of keeping our gains is diminishing. As with any disciplined asset allocation strategy, we move to sell overvalued assets when the risk is out-sized. In this case, equities fall in this category and reducing our risk and crystallizing some of the gains is prudent.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

Most global equity markets remain down to small positive (-2% to +3% annualized range) with 35-50% more volatility and deeper drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile versus traditional investments due to stringent risk management and downside protection.

The close parity in returns of the equity markets and Auspice strategy represents an excellent entry point historically, and the team at Auspice is investing at this time.

January Commentary & Performance

Download the Commentary here.

The Auspice Diversified Program was up 0.40% in January.

January continued to provide opportunity in a number of sectors and not just in the obvious Equity market as participants appear to be comfortable that the “Fiscal Cliff” has been averted. While we are not sure about that thesis, we are happy to follow the trends that can be generated by policy. Moreover, it is important to point out that policy and central bank intervention does not always cause the choppiness that we have experienced over the past few years. Historically, trend can be inspired by these “decisions” and if agile enough, captured which remains the goal at Auspice. During the month, this theme was illustrated as we crystallized positions in both Interest Rates futures and Lumber.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

For those interested in a copy of an analysis of the drawdown and recovery periods for Auspice Diversified, please contact Auspice. A quick synopsis can be obtained here (right), which highlights the environment and the opportunity. The current environment is an opportune time to be adding to this type of an investment.

The Auspice Diversified Program was profitable in 3 of the 7 sectors traded. The strongest market was Equity indices as equities shot up in January closely followed by Energies and to a small degree Grains.

Interesting Trades:

- Crystallized long US 10 year Notes held since March 2011 at 10x risk.

- Crystallized long Lumber trade held since October 2012 at over 3x risk.

- New long in Heating Oil while exited short in Crude Oil on Energy strength outside of Natural Gas.

- Continued gains from short Japanese Yen while being long the Nikkei stock index.

- Exited long in Gold and entered a new long in Palladium.

- New long in Corn.

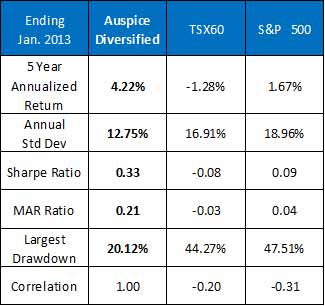

The 5 year statistics (Feb 08 - Jan 13) are: +4.22% annualized return with 12.75% volatility. The worst drawdown for the period is 20.12% with an average Margin to Equity ratio of 6.27%. It should be noted that during this 5 year period, Auspice Diversified remains ahead of the benchmark industry index. The Newedge CTA index is +1.81% annualized over the same period.

The global equity markets remain down to small positive (-5% to +2% annualized range) over this same period with 20-35% more volatility and deeper drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile vs. traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: The sector was profitable led by long positions in Gasoline and new long in Heating Oil. We exited our short in Crude Oil to be flat. Crude and Natural Gas remains laggards in this sector but are ones to watch very closely. Energy is long overdue for trending behavior.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy. The program went live on March 2nd, 2012.

Metals: Metals have continued to be choppy with Gold and Copper lacking trend for some time. We remain out of Copper and exited Gold in January. However, after similar choppy action, Palladium was added and moved sharply higher during the month. Always one to be aware of, this market can provide explosive trends that we have been successful in capturing in the past.

ADDITIONAL REFERENCES

- A recent article in Advisors Edge dispels some of the myths regarding Managed Futures.

- For those interested, Michael Covel, a leading author specializing in Managed Futures and trend following, interviewed Tim Pickering on his background and the unique aspects that make Auspice a Next Generation CTA. Listento the podcast through iTunes.

- Additionally, for those interested in more ideas about investing in alternatives, please check out www.amfmblog.com.

Grains: Grains eked out a small gain after getting beat up since last summer, While Wheat continued this path much of the month, Soybeans and Corn are stronger at month end. We have added a new long position in Corn. By our definition, with the exception of Wheat, the Grains remain in up trend.

Soft Commodities: The Softs sector was negative on the month primarily on profits taken in long term successful trades. We exited the Coffee short for a small gain, and exited the long Lumber position for a solid win. Cotton has continued to show strength and has potential in the short term for a long trade while OJ remains choppy and uninspired.

Currencies: The Currencies sector had some great gains but was offset by losses as we changed direction in certain markets. Gains were led by trades we hold short in Japanese Yen and long Aussie dollar. However, we exited the long positions in British Pound, Canadian Dollar, and Swiss Franc. The Euro was added late in the month as this market shows strength and was immediately profitable. We remain on the sidelines in US Dollar index.

Interest Rates: Big shift in Interest Rates as we exited both US 30 years Bonds and 10 year Notes. The 10 year is one of the best trades in recent years returning 10 times the capital risked, We are not holding any rate positions at this time.

Equity Indices: The star of the month was the Equity sector which has been profitable the last 3 months. The sector moved higher led by continued gains domestically in the S&P and Russell in addition to the Japanese Nikkei index, CAC 40 and Hang Seng. After the first of the month, the Nasdaq did not follow the same trajectory.

As mentioned on the opening statement, we are happy to jump on these Equity trends whether we believe in them or not. However, most critical is the ability to crystallize the gains and capture the trends as change.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

December Commentary & Performance

Download the Commentary here.

The Auspice Diversified Program was up 0.81% in December.

After a period of pullback in the portfolio since June, the Diversified program has started to find opportunity once again. There have been a number of factors we can guess may have caused the “risk on” and “risk off” market behavior in 2012: speculation re China’s growth, the US election, the so called “Fiscal Cliff”, and many others. While each of these things may have contributed to choppy market action, there have been gains made and trends captured. Financial markets have been opportune this quarter and perhaps show a sign that markets are starting to normalize. Now that the “Fiscal Cliff” is behind us, we anticipate the disparate asset classes that provide the unique opportunity in managed futures (and trend following in general) will yet again show their diversification benefits. After a particularly challenging September to November, the commodity portion of the portfolio brought more opportunity in December,

As mentioned last month, we would also like to point out that Auspice is currently buying into the strategy at the corporate/manager level. We believe this is a very opportune time for investment similar to what we experienced in mid 2007. Our investment is thus increasing from our previous commitment as we take advantage of the current opportunity.

Many market participants also agree that the timing is favourable. Assets have grown at Auspice and in a recent article regarding institutional investors (check out our blog post here), it was highlighted that:

- "Year on year, more investors are adding CTAs to their portfolios of alternative asset funds in order to tap into this diversified liquid source of alpha.

- “….more assets have gone to CTAs than any other hedge fund strategies since 2008.”

For those interested in a copy of an analysis of the drawdown and recovery periods for Auspice Diversified, please contact Auspice. A quick synopsis can be obtained here (below), which highlights the environment and the opportunity. The current environment is an opportune time to be adding to this type of an investment.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

The Auspice Diversified Program was profitable in 4 of the 7 sectors traded. Gains were made in 2 of the financial markets, Currencies and Equity Indices as well as 2 of the Commodity sectors: Energies and Softs.

Interesting Trades:

- Generally holding profitable trades into end of month.

- Natural Gas short benefited the portfolio significantly.

- The long Lumber position has continued to benefit the portfolio.

- Gains from short Japanese Yen while being long the Nikkei stock index.

- Gains in short Coffee.

The 5 year statistics (Jan 08 - Dec 12) are: +5.27% annualized return with 12.95% volatility. The worst drawdown for the period is 20.12% with an average Margin to Equity ratio of 6.3%. It should be noted that during this 5 year period, Auspice Diversified remains ahead of the benchmark industry index. The Newedge CTA index is +1.82% annualized over the same period.

The global equity markets remain flat to down (0 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile versus traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: The sector was profitable while Energy rallied into month end after initial weakness and choppy action. Natural Gas was an island to provide gains as our short paid off. At month end we remained short Crude and flat Heating Oil but took a long position in Gasoline mid month. Sector to be watched closely.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners of New York. The program went live on March 2nd, 2012.

Metals: Metals struggled in December as the sector weakened early before a late year partial recovery. At month end, we were on the sidelines in Copper and Palladium while holding Gold. Palladium is stronger than the other markets and was added on the first day of the new year from the long side.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Grains: Grains were the most challenging in December and produced a loss. After trying Wheat from the long side in November, we covered quickly, a good thing as this market collapsed in December, The same story presented itself in Soybeans in December where we added a long position only to stop out. The long position in Corn was also covered and we are holding no Grain length at month end.

Soft Commodities: The Softs sector had a great month after a challenging period recently led by the long position in Lumber and short in Coffee. We have reduced some of the risk in Lumber near month end crystallizing some of this gain. Cotton continued to be strong against a short entered at the start of the November and we have exited. We are on the sidelines in OJ which is acting very choppy at the moment.

Currencies: The Currencies sector was profitable led by the short taken in Japanese Yen last month. We added a long position in the British Pound early in the month which was profitable as the market appears excited about the new Bank of England Governor in Canada’s Mark Carney as mentioned last month. Swiss Franc was also added from the long side and profitable. We remain long the Aussie and Canadian dollar positions. We have exited our short Euro position and are on the sidelines in the US Dollar Index.

Interest Rates: The Interest Rates sector was not profitable in December on the back of existing long positions in 5 and 10 year US Notes as well as 30 year US Bonds. Of particular note we have exited the 5 years in December and the 30 years in the first days of 2013 to only hold the 10 years.

Equity Indices: Lastly, we were again profitable in the Equity sector led by an explosive breakout higher in the Japanese Nikkei index. At the end of November it looked like this sector was faltering, however we are happy to eat humble pie and jump back on as the opportunity presented itself. During December we added (from long side) and were profitable in Nikkei and Hang Seng. We continue to hold long positions in the French CAC 40, the Russell 2000, all of which were profitable

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

November Commentary & Performance

Download the commentary here.

The Auspice Diversified Program was down 2.38% in November.

While experiencing a loss on the portfolio, the gains made came from a part of the market that has been challenged for some time. The volatility in the market and flipping between “risk on” and “risk off” has been centred in the financial sectors for some time now. Gains in the portfolio from trends came precisely from these sectors – Interest Rates, Currencies, and Equity Indices. It has been since early 2011 that these 3 sectors lined up to all provide trend opportunity by our definition.

The commodity portion of the portfolio remained challenging to capture trends with markets generally dropping in the first half before partially recovering later in month.

Of special note, we would also like to point out that Auspice is currently buying into the strategy at the corporate/manager level. We believe this is a very opportune time for investment similar to what we experienced in mid 2007. Our investment is thus increasing from our previous commitment as we take advantage of the current drawdown opportunity.

For those interested in more commentary on timing in the CTA/managed futures sector, we would highlight a couple posts on our blog. The first is entitled “The opportunity in CTA/Managed Futures drawdowns” which is a great article that revisits a classic analysis by a legendary trend trader, Tom Basso.

As an extension to that research, For those interested in a copy of an analysis of the drawdown and recovery periods for Auspice Diversified, please contact Auspice. A quick synopsis can be obtained here (top text), which highlights the environment and the opportunity. The current environment is an opportune time to be adding to this type of an investment.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

The Auspice Diversified Program was profitable in 3 of the 7 sectors traded. Gains were made in the 3 financial markets, Interest Rates, Currencies, and Equity Indices. The 4 Commodity sectors had net losses led by weakness in the Grains and Softs.

Interesting Trades:

- Exited a profitable short trade in Copper that was entered in October.

- The long Lumber position has continued to benefit the portfolio.

- Covered a long Wheat position that was only on for a few days. The wheat market remains very tight and range bound.

The 5 year statistics (Dec 07 - Nov 12) are: +5.58% annualized return with 12.98% volatility. The worst drawdown for the period is 20.12% with an average Margin to Equity ratio of 6.3%. It should be noted that during this 5 year period, Auspice Diversified remains ahead of the benchmark industry index. The benchmark Newedge CTA index is +2.00% annualized over the same period.

The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile versus traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: Energy was choppy largely trading sideways. We remain short Crude, flat Heating Oil and Gasoline. Natural Gas provided a wild ride extending weakness started in mid October before rallying mid month only to sell off at month end. Unfortunately, this caused us to enter a new short in gas and exit before re-entering at month end. As such we leave the month with a short tilt in energy.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners of New York. The program went live on March 2nd, 2012.

Metals: Metals were mixed with Gold sideways but Copper and Palladium sharply higher. While we remain long Gold, the Copper short was covered into this strength for a small gain. We remain on the sidelines in Palladium. As mentioned last month, we felt a move was overdue and this should be an opportune sector soon.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Grains: Grains started the month off weak led by Soybeans. We covered our Soybeans position for a small gain and hold the long Corn position. Wheat was entered long and quickly exited as the sector weakness was developing.

Soft Commodities: The Softs sector was challenging with markets moving sharply with an upwards bias. Lumber was sharply higher and we are long. Cotton was also strong against a new short entered at the start of the month. We are holding at the moment. OJ was also strong and we covered our short. Coffee on the other hand was weak where we are short for a solid portfolio gain.

Currencies: Solid gains made in currencies with only one portfolio change on the month. We remain long the strongest markets in Aussie and Canadian dollar positions. We are short the Euro and have added a new short in the Yen. We are on the sidelines in the Swiss Franc Dollar Index, and British Pound. Perhaps the new Bank of England Governor (Mark Carney of the Bank of Canada) will be able to inject some life into the Pound.

Interest Rates: The Interest Rates sector was profitable in November on the back of existing and new long positions. We have now added 5 year Notes and 30 year Bonds to our long standing position in US 10 years, held since early 2011.

Equity Indices: Lastly, we were also profitable the Equity sector where the market traded lower following the US election before gaining back some ground at month end. After noting last month we were holding one of the strongest markets in the Hang Seng, we have now taken profits. The Hang Seng adds to our flat positions in the Nasdaq and the Nikkei. We continue to hold long positions in the French CAC 40, the Russell 2000, and the S&P 500 with significantly reduced exposure since the summer. While the sector has not eroded completely, the stronger markets have softened significantly in the last 2 months. It appears additional upside momentum has been lost and we are happy to crystallize gains in this sector.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

October Commentary & Performance

Download the commentary here.

October continued to be a challenging environment for trend following strategies. While the common reasons for this are obvious: a lack of pervasive trends or moves against established trends, we are experiencing other interesting market behavior. The volatility in the market has been very choppy flipping between “risk on” and “risk off” environments as opposed to volatile and headed in a particular direction. Moreover, we are experiencing high correlation between the diverse asset classes.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

All of these things have combined recently to cause a challenging environment for the strategy but here is the key thing: this is not uncommon. This has happened historically many times. We most recently experienced this environment in 2006 into late 2007. In this case we were in a similar situation where the equity market had been strong, peaking in October 2007. Performance was a challenge in almost all sectors covered leading to a performance low in the summer of 2007 (August specifically). Out of that period, the strategy gained significantly: 60% from August 2007 to February 2009 while the equity markets moved lower: TSX60 down 38.2% and the S&P dropped 50%. While we do not imply that things will unfold exactly the same, the set-up is very similar, right down to the US election and the equity markets strength beginning to wobble.

For those interested in a copy of an analysis of the drawdown and recovery periods for Auspice Diversified, please contact Auspice. A quick synopsis can be obtained here, which highlights the environment and the opportunity. This is the exact environment to be holding or adding to this type of an investment.

The Auspice Diversified Program was not profitable in any of the 7 sectors traded. The last time this occurred was in July 2007 right before the strategy began a rally up to March 2009.

Interesting Trades:

- Exited a profitable short trade in Cotton that was entered in February.

- Crystallized gains in Gasoline as the rally showed signs of softening.

- Exited a long position in the Nasdaq equity index.

- Covered a Lumber short that was only on for a few days. This was a great move as the lumber market has moved substantially higher and we are now long.

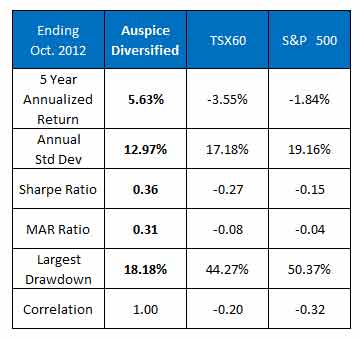

The 5 year statistics (Nov 07 - Oct 12) are: +5.63% annualized return with 12.97% volatility. The worst drawdown for the period is 18.18% with an average Margin to Equity ratio of 6.3%. The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile vs. traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: As was the case last month, with the exception of Natural Gas, Energies were weak dominated by Crude and Heating Oil. While Heating Oil mustered up a rally in the first part of the month, it followed Crude and Gasoline lower in the last half. We are still short Crude and flat Heat. Natural Gas was sideways and we remain on the sidelines at the moment. Keep a close watch here as we are seeing signs of upside potential. Lastly, we covered the long trade in Gasoline initiated in July for a gain.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners. The program went live on March 2nd.

Metals: Metals were universally weak. While we remained on the sidelines in Palladium, we re-entered a short in Copper. This market has been trading a tight range, drifting lower since early 2011. We think a sharper move is overdue. We continue to hold Gold and despite the pullback in October, it looks strong overall.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Grains: Grains were weak across the board in October and we did not make any position changes. We are holding the same long positions in the strongest part of the Grains sector: Corn and Soybeans. Wheat continues to consolidate since July and we remain flat.

Soft Commodities: The Softs sector was active as we repositioned responding to trend validation. As mentioned above, we covered a brief short in Lumber and went long near month end. This will be one to watch alongside the US storm rebuilding efforts. We crystallized a profitable Cotton short and added new shorts in both OJ and Coffee.

Currencies: This sector continues to be challenging highlighting the risk on risk off environment. We remain long the strongest markets in Aussie and Canadian dollar positions but exited a short lived long British Pound position. We continue to be short the Euro but covered the short in the US Dollar Index. We remain on the sidelines in the Yen and Swiss Franc although both a have a slight upwards bias at this time.

Interest Rates: While only producing a small loss on the month, the Interest Rates sector was weaker (higher rates). This is a sector that has been very profitable from the long side for a number of years and we have crystallized most of the gains. We are only holding US 10years, unchanged from September.

Equity Indices: Lastly, we made some changes in the Equity index sector. While most of the global sector was weak, we managed to own one of the stronger markets in Hong Kong’s Hang Seng added early in the month. While we continue to hold long positions in the French CAC 40, the Russell 2000, and the S&P 500, we have begun to reduce risk elsewhere. We have exited the Nasdaq and we are also flat the Nikkei at month end. It appears some of the upside momentum has been lost and we are monitoring this closely.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

September Commentary & Performance

Download the commentary here.

The Auspice Diversified Program was down 3.64% in September.

September was a challenging month with strong moves against the established trends. The month was in contrast to the shift that started Q3 that reduced the defensive stance (shorts) and added long positions in many sectors including Energy, Grains, Metals, and Equity Indices.

While we experienced a number of positive trades, these were outweighed by the “risk off” stance that occurred quickly in Grains, Rates and Energies. Most of the trends and positions in these sectors remain intact. The commodity side of the market remains strong overall as indicated by the global long commodity indices that recently showed strength.

The Auspice Diversified Program was profitable in only 1 of the 7 sectors traded with a gain from Metals. The Equities and Softs sectors were near flat. The most challenging sectors were Energies, Interest Rates, Currencies and Grains.

Interesting Trades:

- Reduced long Interest rates exposure – exited US 30 year bonds locking in gains.

- Exited short Copper trade profitably locking in gains.

- Added exposure to Equity Indices as they remain strong.

- Commodity currencies are strong while Euro and USD are weak.

- Gold leads commodities higher and has broken out to the upside. We are long.

- Exited Natural Gas short, added Crude short and continue to hold Gasoline long as energy has been volatile.

The 5 year statistics (Oct 07 - Sep 12) are: +6.96% annualized return with 13.05% volatility. The worst drawdown for the period is 16.68% with an average Margin to Equity ratio of 6.4%. The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile vs. traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: With the exception of Natural Gas, Energies were weak dominated by Crude and Heating Oil. We have added a new short to Crude but remain long the strongest part of the sector with Gasoline. The recent new short in Natural Gas has been covered and is now flat. Natural gas is going through transition and should be monitored very closely for opportunity and risk.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners. The program went live on March 2nd.

Metals: The Metals sector was profitable with some interesting position gains and changes. The long Gold position that we added in August made great gains during the month. The Gold trade offset losses in a new long position in Palladium that was short lived. Palladium started to fall sharply along with many commodities at mid month and we covered quickly. Lastly, we covered our long standing short in Copper to lock in a gain. At month end, Gold is the only long position within the Metals sector.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Grains: We are holding the same long positions in the strongest part of the Grains sector: Corn and Soybeans. While both of these markets sold off during the month, we are holding the positions as the long term trend remains intact. Wheat remains the laggard and we are flat at this time.

Soft Commodities: As within August, with the exception of Coffee, the Softs markets followed the rest of commodity market – this time it was lower. While we remain short Cotton, we added a short in Lumber near month end. The Coffee market that was shorted in August was covered. We are on the sidelines with OJ at month end. The sector was near flat in September.

Currencies: We have added to the long Aussie and Canadian dollar positions with a British Pound position. We tried the Japanese Yen from the long side but there was little follow through and we reduced the risk. We continue to be short the Euro and added a short in the US Dollar Index. Swiss Franc remains flat. Despite the commodity weakness during the month, it appears that “commodity currencies” are in favor.

Interest Rates: Rates were choppy again as they were in August and we have further reduced the long side risk. We exited US 30 year bonds to only hold a position in US 10 year Notes. This is a big shift from the long exposure that we have profitably held in this sector for the last couple years.

Equity Indices: We continued to add to the long side of the Equity index market in September adding a position in the French CAC 40. This adds to the Russell 2000, S&P 500 and Nasdaq positions already held. The Asian markets remain weaker and we remain flat the Nikkei. We briefly put on a short position in the Hong Kong Hang Seng, but covered quickly as this market showed strength after the first week of the month. At the moment, the Equity sector remains strong in general.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

August Commentary & Performance

Download the commentary here.

The Auspice Diversified Program was down 0.70% in August.

August was highlighted by uptrends in the commodity markets. While we were positioned to take advantage of some of these uptrends in Energy and Grains, further uptrend saw changes to the portfolio in the Metal, Softs and Equity Indices sectors. As such, while the portfolio was positioned defensively at the end of Q2 (tilted short), we have continued a shift to the long side which was started in July. The uptrends triggered position changes in commodities (Metals, Softs, Energies and Equity Indices) where we have reduced shorts or added new long positions.

The Auspice Diversified Program was profitable in 4 of the 7 sectors traded with largest gains from Energies, Grains and Metals and a small gain from Equities during the month. Concentrated losses in Softs, Interest Rates and Currencies slightly offset these gains for a small loss.

Interesting Trades: Two of the strongest markets during the month were Gasoline and Soybeans. Additionally, while not a massively profitable trade, a short exit in Palladium highlights our ability to be agile in the face of a trend reversal. In this case, we exited the short prior to an extended and sharp upside move. Lastly, we have re-entered Natural Gas short and added a new long in Gold.

The 5 year statistics (Sep 07 - Aug 12) are: +8.99% annualized return with 13.11% volatility. The worst drawdown for the period is 13.93% with an average Margin to Equity ratio of 6.4%. The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile from traditional investments due to stringent risk management and downside protection.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Key Points Regarding our Positions

Energies: After covering shorts in many Energy markets in July, the market continued to show strength. While we remain on the sidelines in Crude and Heating Oil, Gasoline soared making most of the sector gains from the long side. After exiting Natural Gas in July, we have re-entered from the short side on late month weakness.

For those with specific interest in this sector alone, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners. The program went live on March 2nd.

Metals: The Metals sector was marginally profitable with some notable position changes. First, we added a new long position in Gold as this market is picking up momentum. We also exited the short in Palladium prior to the aggressive rally that occurred mid month. Lastly, while Copper was profitable from the short side in July, the price rallied against the trend in August. We remain short Copper despite the recent rally. This sector is no longer tilted short and will be one to watch for further upside.

Grains: Grains also provided reward in August where we are holding the same positions where we remain on the sidelines in Wheat, but are long Corn and Soybeans.

Soft Commodities: With the exception of Coffee, the Softs markets followed the rest of commodity rally higher. While we remain short Cotton, we added a short in the Coffee market on its individual weakness. We are on the sidelines in Lumber and OJ at month end. This sector was not profitable in August.

Currencies: Currencies were very challenging in August as many markets reversed sharply. We exited our long positions in Japanese Yen and the US Dollar index as well as a short in the Swiss Franc. We have added a Canadian dollar position to the long Aussie dollar position. We remain short the Euro and remain on the sidelines in the British Pound.

Interest Rates: Rates were challenging in August as they sold off aggressively in the first half of the month only to reverse and head higher in the latter part. We covered some of our long positions defensively in the short end of the curve (US 2 and 5 year Notes) mid month. We remained long 30 year Bonds and US 10 year Notes (since early 2011) and re-entered 5 years at month end.

Equity Indices: After starting to tilt the Equity portion of the portfolio long in July, we have furthered that position slightly in August resulting in a small gain in the sector. We added the Nasdaq index late in the month while covering our short in the Nikkei. This adds to the existing long positions in Russell 2000 and S&P. We remain on the sidelines in Hong Kong’s Hang Seng and the French CAC 40.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

July Commentary & Performance

Download the commentary here.

The Auspice Diversified Program was up 1.17% in July.*

Hail Natural Gas!

July is one of those months that is often a dichotomy. While we are trying to relax, enjoy some summer holidays, our families/ kids etc, the markets are often very challenging. However, this year July provided some great opportunities as the markets normalized and calculated risk was rewarded.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some o fthe mysths regarding managed futures.

- Listen to a podcast interview with Michael Covel, a leading author specializing in Managed Futures and trend following, and Tim Pickering. Tim discusses his background and the unique aspects that make Auspice a Next Generation CTA.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

The traditional equity markets followed the strength in June with somewhat muted gains in July while commodities bounced back aggressively. While the strategy ended June positioned defensively (tilted short), protecting from downside in many commodities and equities, we have started to shift the other way. We have reduced shorts, crystallized some significant gains (see Interesting Trades below), and added new long positions in a number of sectors including Energy, Grains, Soft Commodities, and to a lesser extent in Equity Indices.

As mentioned last month, if you consider the market still at risk and/or are looking for non-correlated diversification from commodity agility, this may be an entry point to consider. We have been shifting our stance from long to short and back again while controlling downside risk and capturing significant trends along the way.

Monthly commentary:

The Auspice Diversified Program was profitable in 4 of the 7 sectors traded with solid gains from Interest Rates, Currencies and Grains and small gains from Metals during the month.

Interesting Trades: We exited two very profitable short trades of note. First, we exited a long standing short in Natural Gas crystallizing remaining gains. We also exited a short trade in Coffee capturing the bulk of a recent move down that started in February.

The 5 year statistics (Aug 07 - Jul 12) are: +8.47% annualized return with 13.20% volatility. The worst drawdown for the period is 13.93% with an average Margin to Equity ratio of 6.4%. The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile from traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: The move higher in Energies started late in June which included Natural Gas and caused us to lighten up significantly on the short side of Energy. We covered our positions in Crude, Natural Gas and Heating Oil and added a new long position in Gasoline. While by no means a long term trend yet, it is a significant shift from the trend lower experienced since February. While this sector wasn’t profitable in July overall, the shift from short to neutral and long while moving to flat natural gas is notable.

Natural Gas was exited capturing approximately 9.5 times the dollar risk taken in August 2008. The position closes one of the longest trades we have taken in our careers. If you would have told us 10 years ago that it would be in natural gas and from the short side, we wouldn’t have believed it! However, this trade really highlights the non-fundamental trend following approach we take works in volatile markets like natural gas.

For those with specific interest in this sector alone, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners. The program went live on March 1st.

Metals: The Metals sector was marginally profitable holding the same positions. Most of the gain came from the short in Copper. In general the Metals sector has been consolidating the last two months and is one to watch for direction soon. This sector remains tilted short at this time.

Grains: Grains provided the bulk of sector gains during the month. While we remain on the sidelines in Wheat, we added a long Corn position to compliment Soybeans. Both were very profitable in July. This sector is now tilted long.

Soft Commodities: We came into the month short all the Softs and have covered all but Cotton. Lumber and OJ were covered into strength for small losses while Coffee was covered returning over 2 times risk taken. Softs were not profitable in July.

Currencies: While Currencies have bore the brunt of various interventions and policy shifts in the last year, July provided a welcome opportunity. Gains were made long the US Dollar Index and Aussie dollar while adding a new long position in Japanese Yen. We remain short the Euro and re-entered a short in Swiss Franc. All were profitable in July. We are on the sidelines in British Pound, and Canadian Dollar.

Interest Rates: Rates were positive in July. We have re-entered long positions in US 2 and 5 year Notes and remain long 30 year Bonds and US 10 year Notes (since early 2011).

Equity Indices: While we left June with some markets short and some long - net neutral, July inspired some changes. First, we covered our short in the CAC 40 and replaced it with a new short in Japan’s Nikkei. While we remain on the sidelines in Hong Kong’s Hang Seng and the Nasdaq, we have added new long positions in the S&P 500 and Russell 2000 markets. As such, we have tilted slightly long with a small loss on repositioning in July.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.

June Commentary & Performance

Download the commentary here.

The Auspice Diversified Program was down 6.29% in June.

"Good Vol, Bad Vol, Interventions, CTAs fall"

At Auspice we are always very up front that like every investment strategy, there are less ideal periods for our particular strategy. While many commonly suggest that CTAs have trouble in periods without trend, we recognize that this is a challenge for most strategies and not a very good explanation. Like in June, periods of choppy volatility, central bank interventions, and sharp reversals are difficult times for most CTA strategies. In these times, we need to control the drawdown but not avoid taking calculated risk. We do not apologize for periods of sideways performance and modest pullbacks which are a reality and trade-off in producing non-correlated performance.

In June, many markets that had been falling reversed and moved higher in an abrupt fashion. The strategy is currently positioned defensively (tilted short), protecting from downside in many commodities and equities. Since equity markets moved lower starting in March/April and continued sharply lower in May, the diversification benefits of Managed Futures added value and a measure of reassurance in an otherwise volatile environment. While a negative individual month does not feel good, it needs to be taken in the context of the overall portfolio. If you consider the market still at risk and/or are looking for non-correlated diversification, this may be an entry point to consider.

For those interested, Michael Covel, a leading author specializing in Managed Futures and trend following, interviewed Tim Pickering on his background and the unique aspects that make Auspice a Next Generation CTA. Listen to the podcast through iTunes.

Monthly commentary:

Most commodity markets rallied right near month end against short positions we hold in many sectors. The Auspice Diversified Program was profitable in only 1 of the 7 sectors traded with small gains from Metals during the month.