Auspice Broad Commodity Excess Return Index (ABCERI)

November Auspice Managed Futures Index Commentary

October Auspice Diversified Program Commentary

October Auspice Broad Commodity Index Commentary

October Auspice Managed Futures Index Commentary

September Auspice Diversified Program Commentary

September Auspice Broad Commodity Index Commentary

September Auspice Managed Futures Index Commentary

August Auspice Broad Commodity Index Commentary

August Auspice Managed Futures Index Commentary

August Auspice Diversified Program Commentary

July Auspice Diversified Commentary

July Auspice Broad Commodity Index Commentary

Auspice Broad Commodity Excess Return Index (ABCERI)

Market Review

After commodities generally moved lower in the first half of 2013, July provided a correction higher in a number of markets. Commodities were generally stronger on the month led by Energy and Metals while Ags continued to be weak. However, even within sectors, remaining agile and tactical was important as individual markets like Natural Gas (lower) and Cotton (higher) bucked their sector trends. While the index softened slightly on the month, it continues to show the ability to protect the downside. Tactical position shifts are made based on individual component merit as opposed to sector generalities which continues to lead to better performance over tradition long commodity index approaches.

Index Review

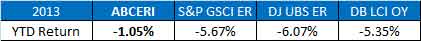

The ABCERI lost 0.11% in July to be off only 1.42% in 2013 despite significant commodity pressure. The index continues to outperform (see table below) most of the comparable indices on the year. The strategy continues to hold 3 components or 25% of the possible basket.

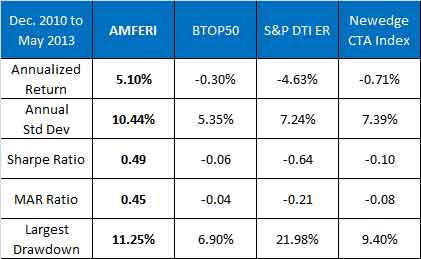

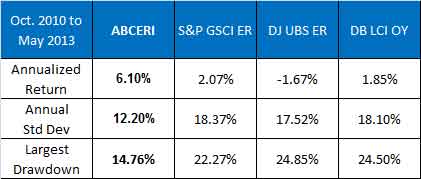

Since the start of publication in 2010 and calculation by the NYSE, the index has outperformed its peers significantly in absolute return and risk adjusted measures. The following table highlights the strategies ability to capture the upside while limiting the downside.

The ABCERI does not attempt to simply track the broad commodity markets or predict their direction, but rather aims to capture upward price trends from those commodities that are making sustained moves higher while protecting capital on those that are making sustained moves lower.

Portfolio Recap:

In July, the ABCERI made gains in 1 of the 3 broad sectors. The strategy made gains in Energy which was offset by the loss in Ags. There are no Metals holdings at this time.

Energy

By avoiding corrections against short trend positions, the Energy sector managed to make gains in July.

The energy markets continued to correct against the established trends with a sharp and quick move higher in Crude Oil, Heating Oil and Gasoline. Natural Gas started the month higher as well before reversing sharply at month end to make new period lows. While the index does not have a weight in Gasoline or Heating Oil, the Crude move was substantial enough to change the trend and the index went long early in the month for a solid gain. Similarly but in the opposite direction, the Natural Gas market broke down at month end which resulted in an exit to be flat.

Metals

The index remains without a long weight in Metals although the component markets rallied in July. The rally was led by Gold with Silver and Copper showing much less conviction. No positions weight changes at this time.

Agriculture

The Ag sector was negative in July as overall Grains weakness pulled Soybeans lower. The index remains without positions in Corn, Wheat and Sugar all of which trended lower. The long position in Cotton provided gains and partially offset the correction in Soybeans.

Outlook

It is not the stated goal of Auspice, nor the ABCERI to predict future market direction, but rather participate in up-trends while minimizing risk during downtrends. It is the continued goal of the ABCERI index strategy to minimize the downside with low volatility and drawdown and remain a store of value until upside opportunity presents itself.

The long side of the index is represented by 3 of the 12 components and has 2 of the 3 broad sectors represented. With careful selection, the strategy has been able to take advantage of those commodities moving higher while avoiding excessive losses in the markets moving lower and remain a store of value despite significant sector weakness.We believe that the long term outlook for commodities has not changed and remains promising and the overall trend is up. However, given the path is not a straight line, a tactical and risk management oriented approach will be most effective. The price movements so far in 2013 are important reminders of the agility required for long term success and the best risk adjusted result. As such, strategies linked to the Auspice Broad Commodity Index, which have the benefit of disciplined risk adjusted participation, may continue to outperform the traditional (long only) commodity peer groups with better upside, lower downside and reduced volatility.

Strategy and Index

The Auspice Broad Commodity Index aims to capture upward trends in the commodity markets while minimizing risk during downtrends. The index, which is considered to be a “third generation commodity index”, considers both risk and reward. The index uses a quantitative methodology to track either long or flat positions in a diversified portfolio of 12 commodity futures which cover the Energy, Metal, and Agricultural sectors.

Auspice Indices utilize dynamic risk management to produce superior risk adjusted performance in a variety of market environments. By dynamically managing the volatility of each commodity, Auspice ensures that no one commodity dominates the index thus maximizing the benefits of commodity diversification. Enhanced contract roll optimization further increases performance. On a risk adjusted basis, the Auspice Broad Commodity Total Return Index significantly outperforms its global peers.

The Broad Commodity index is available in Total and Excess Return versions. The cash return for the total return index will be calculated daily using the 3-month CDOR (Canadian Dealer Offered Rate). The CDOR is the average rate for Canadian bankers' acceptances for specific terms-to-maturity (one year or less), determined daily from a survey on bid-side rates provided by the principal market-makers, including the major Canadian banks.

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk.

Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US. Auspice’s core expertise is managing risk and designing and executing systematic trading strategies.

Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.

July Auspice Managed Futures Index Commentary

June Auspice Diversified Program Commentary

Download the commentary here.

The Auspice Diversified Program gained 0.66% in June despite significant market turbulence and correction.

Traditional markets followed up a volatile May with a correction in June hitting commodity based equity markets the hardest. Most fixed income markets continued to reverse sharply lower in June, a move that started early May.

Commodities were generally lower:

- Metals were again most opportune with gains made on the short side.

- Grains were also lower.

- Energies were mixed with Natural gas lower on the month and petroleum based slightly higher.

- Softs were soft.

- Currencies were volatile reversing directions a number of times with general weakness in the US Dollar Index.

It’s good to be short! Months like June highlight why we are direction agnostic and willing to participate in trends regardless of common opinion. With the equity markets at very least stalling and beginning to come off following the correction in Fixed Income and commodity, we are reminded that opportunity can come from being short as it did to end 2008. This is the time to consider adding or increasing CTA exposure if you are looking to protect traditional asset weightings or take an opportune and tactical view.

Sectors and Trades:

- Profitable in 3 of the 7 sectors traded. Gains were led by Metals, followed by Grains and Energy largely from the short side.

- The most challenging sectors were Currency and Equity Indices.

- The open equity risk continued to shift to commodity during June.

- We have cut Equity risk in half.

- Largest portfolio gains came from Gold and Copper from short side. Short Wheat, Natural Gas, and Coffee were also large contributors.

- Very profitable short in Japanese Yen was crystallized.

Key Points Regarding our Positions

Energies:

- Petroleum based energies were slightly positive led by Crude. We are on the sidelines currently.

- Natural Gas was weak and a new short was entered early in the month and quite profitable on the month.

- Sector was positive based on the Natural Gas trade.

Metals:

- Strongest sector with opportunities in Gold and Copper on the short side,

- Added new short in Palladium late in the month,We have resized the risk in this sector, crystallizing some of the short gains made.

Grains:

- Grains made gains on the back of the short in Wheat we have held since February.

- Long Soybeans corrected lower but still remains the strongest of the grains. Remain on sidelines in Corn which corrected sharply lower at month end.

Soft Commodities:

- Cotton continued to behave in an erratic manner rallying to start the month and giving it all back by the end, We tried a long position but exited quickly as the trend lacked persistence. Lumber was similarly whippy in the opposite order and we remain flat.

- Continued gains from short Coffee while long Orange Juice did not provide the breakfast blend it did in May. We are still long OJ and monitoring trend closely.

Currencies:

- Currencies continue to be a tough trade with sharp moves up and down within the month across most major markets.

- We exited the very profitable short Japanese Yen trade early in the month before the whippiness ensued. The trade returned approximately 7 times capital risked.

- After exiting long positions in both commodity currencies (Aussie and Canadian dollar) in May, we have flipped these to short.

- Exited recent new shorts in Euro, Pound and Swiss Franc.

- Exited recent new long the US Dollar index.

Rates:

- We are currently on the sidelines in all rates after exiting long positions.

Equity Indices:

- We gave back gains in long equity indices as the market started to correct globally in various amounts. This crystallized some profitable positions.

- After exiting the Nikkei May 31, we also exited the Nasdaq and the Hang Seng.

- We continue to hold the strongest of the markets in S&P, Russell and CAC 40.

- Exposure to long equity has been cut by 50% in the last month.

June Auspice Managed Futures Index Commentary

Auspice Managed Futures Excess Return Index (AMFERI)

Market Review

The AMFERI has closed the first half of 2013 with a very strong performance gaining 3.09% in June. While much of the global market focus has been on the outperforming Equity sector, the strategy has tactically found opportunity both short and long and across a diverse basket of assets., both commodity and financial. After years of strong gains in Interest Rates (long price, short yield), this sector has gone through transition and has only recently provided opportunity to participate in new trends. While much of the monthly gains have come from being short, the tactical and agile approach employed is proving itself in absolute return and risk management. The strategy is adapting to the market condition and opportunity in an agnostic fashion that continues to provide non-correlated results, specifically when they are needed most.

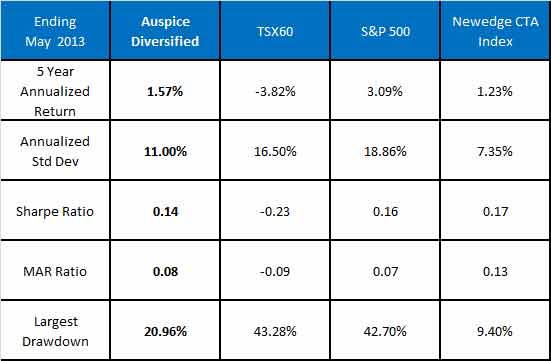

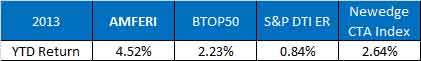

As seen in the next table, the performance of AMFERI versus both investable and non-investable managed futures indices has been good. Since the launch of the index in December 2010, AMFERI continues outperform on both an absolute and risk-adjusted basis.

While it is impossible to predict the future, it is important to note that the strong performance by the AMFERI in the first half of 2013 and specifically as the traditional markets correct, is a feature that benefits all portfolios. For it is not just non-correlation, but added performance when you need it most that helps reduce the depth and length of inevitable setbacks in any portfolio.

For those interested in a copy of an analysis of the drawdown and recovery periods for AMFERI, please contact Auspice. See synopsis to the below.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

lease contact us at info@auspicecapital.com for the complete analysis.

Index Review

The AMFERI was up 6.01% in Q2 to be up 7.75% in 2013, outperforming a number of investable and non-investable CTA indices.(Highlighted in the table below) As a single strategy CTA index, this strategy provides the benefits of traditional CTA through trend following and agility along with the benefits of transparency and third party publishing, monitoring and benchmarking. The strategy now underlies ETFs, 40 act mutual funds and managed accounts providing a low cost means of allocating to Managed Futures without sacrificing performance.

Portfolio Recap:

In June the index was up in 4 of the 5 sectors. Gains were made primarily from short positions in both commodities and financial markets. The strongest sector was again Metals. The top performing components within the index were shorts in Gold and Silver complimented by shorts in Wheat, Corn and a long exposure in Cotton. The most challenging sector was Energy. The index is currently positioned short in 9 of 12 commodity markets. The index has further tilted short in the financial markets with 7 of the 9 components holding a short weight. Currencies remain positioned short versus the USD.

Energy

The energy markets corrected against the established trends in Crude and Heating Oil while Gasoline was slightly lower in the direction of trend for a small gain. There were no position changes in Energy as the petroleum weights remain short (Gasoline, Heating Oil and Crude Oil while long Natural Gas). Natural Gas moved sharply lower on the month against the long position. Energy was the most challenging of the sectors for the Index.

Metals

Metals was the strongest performing sector as the index remains short and again benefitted from across the board weakness. The strategy is short weights in Gold, Silver and Copper.

Agriculture

Ags were also large contributors to the strategy gains in June. While the long position in Soybeans was a modest drag, Grains, Wheat and Corn continue to benefit from the trend lower . Meanwhile, a small gain from the long term price deterioration in Sugar and a gain from Cotton also helped the performance from the long side.

Interest Rates

Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times, common during transition in trends while often at the short term expense of return. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed. The components have moved back to be tilted short to take advantage of higher interest rates (short bonds) in 2 of the 3 markets as the momentum shifted to lower bond prices. The index switched to short both US 5 year Notes and 30 year long bonds while currently remaining long 10 year Notes.

Currencies

Currencies were modestly profitable despite a choppy and challenging month. Currencies reversed direction a number of times versus the US Dollar and the index benefited from the robust trend filter which avoided trading in and out of the chop. We are holding the same positions: short Aussie dollar in addition to existing shorts in Yen, Canadian dollar, British Pound. The index remains long US Dollar Index and the Euro.

Outlook

The AMFERI has made gains in 2013 alongside the equity market despite the specific lack of equity exposure in the portfolio. In fact there is a negative correlation to the markets despite both being positive on the year. As the equity markets have begun to correct in June, the AMFERI has had a very strong performance with approximately half the volatility of the Equity sector year to date. Consider the non-correlated performance of the index as one looks for opportunities to reduce portfolio risk given the traditional markets have performed well in the last couple of years.

Strategy and Index

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available as either a total return index (includes a collateral return) or as an excess return index (no collateral return).

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk. Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US.

Auspice’s core expertise is managing risk and designing and executing systematic trading strategies. Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.

June Auspice Broad Commodity Index Commentary

Auspice Broad Commodity Excess Return Index (ABCERI)

Market Review

Commodities continued to move lower to finish the first half of 2013 with only a few exceptions. While the index softened slightly on the month, it continues to show the ability to protect the downside and wait for an opportunity to capture gains when markets move in a sustained trend higher. Tactical position shifts are made based on individual component merit as opposed to sector generalities which continues to lead to better performance over tradition long commodity index approaches.

Index Review

The ABCERI lost 0.27% in June to be off only 1.32% in 2013 despite significant continued commodity pressure. The monthly loss was far less than the peer group and the index continues to outperform (see table below). The strategy had no position changes during the month, and continues to hold 3 components or 25% of the possible basket.

Since the start of publication in 2010 and calculation by the NYSE, the index has outperformed its peers significantly in absolute return and risk adjusted measures. The following table highlights the strategies ability to capture the upside while limiting the downside.

The ABCERI does not attempt to simply track the broad commodity markets or predict their direction, but rather aims to capture upward price trends from those commodities that are making sustained moves higher while protecting capital on those that are making sustained moves lower.

Independent Report

As outlined in a report published by ETF Securities (UK) entitled Global Commodity ETP Quarterly, the Auspice Broad Commodity index remains at the top of the global broad commodity index peer group with both the highest return and lowest volatility. Copies of the report can be obtained by contacting Auspice.

Portfolio Recap:

In June the ABCERI made gains in 1 of the 3 broad sectors. The strategy remains positioned long in Cotton for a gain in Ags sector while holding long positions in Natural Gas and Soybeans.

Energy

There were no position changes in energy as the petroleum weights remain flat (Gasoline, Heating Oil and Crude Oil) while long Natural Gas. Natural Gas moved sharply lower on the month against the position for a small negative sector performance.

The Energy sector remains choppy with an overall negative bias to trend in the petroleum components.

Metals

The index remains without a long weight in Metals as the sector experienced weakness across the board in June. The metals sector was the weakest of the commodity sectors.

Agriculture

The Ag sector was positive despite overall weakness. The index remains without positions in Corn, Wheat and Sugar all of which trended lower. The long position in Cotton provided strong gains and offset the correction in Soybeans which was lower.

Outlook

It is not the stated goal of Auspice, nor the ABCERI to predict future market direction, but rather participate in up-trends while minimizing risk during downtrends. It is the continued goal of the ABCERI index strategy to minimize the downside with low volatility and drawdown and remain a store of value until upside opportunity presents itself.

The long side of the index is represented by 3 of the 12 components and has 2 of the 3 broad sectors represented. With careful selection, the strategy has been able to take advantage of those commodities moving higher while avoiding excessive losses in the markets moving lower and remain a store of value despite significant sector weakness.

We believe that the long term outlook for commodities has not changed and remains promising and the overall trend is up. However, given the path is not a straight line, a tactical and risk management oriented approach will be most effective. The price movements so far in 2013 are important reminders of the agility required for long term success and the best risk adjusted result. As such, strategies linked to the Auspice Broad Commodity Index, which have the benefit of disciplined risk adjusted participation, may continue to outperform the traditional (long only) commodity peer groups with better upside, lower downside and reduced volatility.

Strategy and Index

The Auspice Broad Commodity Index aims to capture upward trends in the commodity markets while minimizing risk during downtrends. The index, which is considered to be a “third generation commodity index”, considers both risk and reward. The index uses a quantitative methodology to track either long or flat positions in a diversified portfolio of 12 commodity futures which cover the Energy, Metal, and Agricultural sectors.

Auspice Indices utilize dynamic risk management to produce superior risk adjusted performance in a variety of market environments. By dynamically managing the volatility of each commodity, Auspice ensures that no one commodity dominates the index thus maximizing the benefits of commodity diversification. Enhanced contract roll optimization further increases performance. On a risk adjusted basis, the Auspice Broad Commodity Total Return Index significantly outperforms its global peers.

The Broad Commodity index is available in Total and Excess Return versions. The cash return for the total return index will be calculated daily using the 3-month CDOR (Canadian Dealer Offered Rate). The CDOR is the average rate for Canadian bankers' acceptances for specific terms-to-maturity (one year or less), determined daily from a survey on bid-side rates provided by the principal market-makers, including the major Canadian banks.

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk.

Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US. Auspice’s core expertise is managing risk and designing and executing systematic trading strategies.

Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.

May Auspice Diversified Program Commentary

Download the commentary here.

May Commentary & Performance

The Auspice Diversified Program was off 0.90% in May after gaining 0.99% in April.

- Traditional markets continued to be volatile in May while holding onto gains.

- Fixed income reversed sharply lower.

- Commodities were generally lower:

- Metals were most opportune with gains made on the short side.

- Grains had moves in both directions.

- Energies were lower on the month including Natural gas.

- Softs were mixed with strong moves in either direction.

- Currencies weakened vis-à-vis the US Dollar.

Broadly we are finding trends in both commodities and financial markets and from both long and short positions across the portfolio. While commodities are tilted short, the opportunity comes from capturing trends in both directions and shifting in an agile and agnostic fashion. Commodities remain a significant core allocation within our risk budget which differentiates Auspice from many other global CTA strategies.

Please take a look on our website at a new resource from the CME. The recent report called “Portfolio Diversification Opportunities”.

Sectors and Trades:

- Profitable in 3 of the 7 sectors traded.

- Gains were led by Grains and Metals in addition to Equity Indices.

- Most challenging sectors were Interest Rates and Softs.

- The open equity risk is shifted to commodity at month end.

- Largest portfolio gain in Gold from short side. Short Wheat and Long Soybeans was also a large contributor.

- Nikkei equity index exited at May 31.

Key Points Regarding our Positions

Energies:

- All Energies were lower on the month.

- We exited a recent short in Crude early in the month to be flat all components.

- Very choppy and range bound sector.

Metals:

- Sector continues to perform very well.

- Short taken in Gold in April was top performer in the portfolio.

- Short Copper despite a move higher

Grains:

- Top performing sector.

- Short Wheat and newly added long Soybeans provided the gains.

- On sidelines in Corn which was modestly higher.

Soft Commodities:

- After providing opportunity, we exited the long Cotton position as this market weakened significantly.

- Continued gains from short Coffee and long Orange Juice (a coincidental pairing!) did not offset Cotton loss.

Currencies:

- Small loss as most currencies traded lower vis-à-vis the US dollar and we made a number of position changes.

- Best trend was again from the short Japanese Yen (lower).

- Exited long positions in both commodity currencies (Aussie and Canadian dollar).

- New shorts in Euro, Pound and Swiss Franc.

- New long the US Dollar index.

Interest Rates:

- Exited all rate positions during month as markets fell.

- Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times which is common during transition in trends. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed.

Equity Indices:

- Equity indices were profitable as we are long.

- Nikkei exited on May 31 at over 9x capital to risk taken as many markets corrected aggressively in the last week and volatility and risk expanded.

- We are still on this train after reducing risk in February, adding in March, held positions in April.

May Auspice Managed Futures Index Commentary

Auspice Managed Futures Excess Return Index (AMFERI)

Market Review

The AMFERI has continued a profitable run in 2013 with a gain of 0.55% in May. This comes despite the market focus on the equity sector which is not part of this single strategy index. While global equity continued its charge higher, interest rates reversed and bond futures fell hard on the month. However, opportunity continued to be found in Metals and Energies as these markets softened. Lastly, the move to USD currency was significant recently and this has been captured within the trend following approach employed in the Auspice index. The portfolio composition and agility is a central feature of the strategy and a number of changes occurred during the month to adapt to ever changing risks and opportunities as highlighted below.

Core allocation: It is important to recognize the value of the managed futures sector is to provide long term absolute return, asset diversification and non-correlation. Given the overall market environment has been very good, especially the performance of the traditional equity and fixed income sectors in the last couple years, managed futures remains an excellent addition to diversify an investment portfolio. The AMFERI is a low cost and transparent ways to get this important exposure

As seen in the next table, the performance of AMFERI versus both investable and non-investable managed futures indices has been good. Since the launch of the index in December 2010, AMFERI continues outperform on both an absolute and risk-adjusted basis.

After a period of challenge for many managed futures strategies, the index is off to a strong start in 2013 making back a significant part of the recent modest drawdown. Pullbacks happen within all strategies; however with managed futures such drawdowns can be an opportune time for investors. Investors should consider the drawdown history of their preferred strategy and gain expectations for potential payoff on recovery and extension.

For those interested in a copy of an analysis of the drawdown and recovery periods for AMFERI, please contact Auspice. See synopsis below.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

Please contact us at info@auspicecapital.com for the complete analysis.

Index Review

The AMFERI was up 0.55% in May and is up 4.52% in 2013, outperforming a number of investable and non-investable CTA indices highlighted in the table below. As a single strategy CTA index, this strategy provides the benefits of traditional CTA through trend following and agility along with the benefits of transparency and third party publishing, monitoring and benchmarking.

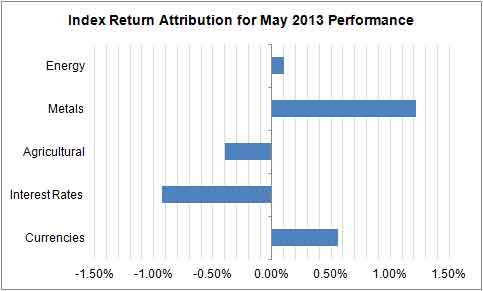

Portfolio Recap:

In May the index was up in 3 of the 5 sectors. The strongest sector was again Metals. The top performing components within the index were shorts in Gold and Silver complimented by Wheat, Soybeans and Sugar. Gains were made with both long and short positions and both in commodities and financial markets. The most challenging sector was Interest Rates as bonds corrected sharply lower. The index is currently positioned short in 9 of 12 commodity markets reducing one short position. The index is now tilted short in the financial markets with 6 of the 9 components holding a short weight. Within Financials, Currencies are now positioned short versus the USD adding a new short in May. Interest rate components are mixed with a move to short in 2 of the 3 markets as the price trends lower.

Energy

There were no position changes in energy as the petroleum weights remain short (Gasoline, Heating Oil and Crude Oil while long Natural Gas. While Natural Gas moved lower on the month against the position, the rest of the sector was off adding value to the sector for a net gain.

The Energy sector remains choppy with an overall negative bias to trend in the petroleum components.

Metals

The Metals sector remains short and again benefitted from the significant weakness in Gold and Silver. While the strategy is short Copper which moved higher, this was offset by the gains made. Metals were the most significant attribution to the portfolio gains in May.

Agriculture

With the exception of Cotton, the Ags did very well in May. Led by a short in Wheat, the reversal and new long position in Soybeans were profitable. While Corn rallied modestly against its short, Sugar continued its long term deterioration and the short benefitted. The bulk of the sector loss came from long Cotton which moved significantly lower and will be one to watch closely.

Interest Rates

Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times, common during transition in trends while often at the short term expense of return. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed. The components have moved back to be tilted short to take advantage of higher interest rates (short bonds) in 2 of the 3 markets as the momentum shifted to lower bond prices. The index switched to short both US 5 year Notes and 30 year long bonds while currently remaining long 10 year Notes.

Currencies

Currencies were profitable in May as most trended lower against the US Dollar. The index has shifted to short the Aussie dollar in addition to existing shorts in Yen, Canadian dollar, British Pound. The index remains long US Dollar Index and the Euro.

Outlook

The AMFERI is making gains in 2013 alongside the equity market despite the specific lack of equity exposure in the portfolio. In fact there is a negative correlation to the markets despite both being positive on the year. Consider this fact as one looks for opportunities to reduce portfolio risk given the traditional markets have performed well in the last couple of years.

While the broad equity market ended higher in May, the ability to generate returns outside of this sole sector should be recognized and considered. While we don’t have crystal ball, consider ways to protect the portfolio as cracks start to appear in traditional asset classes and alternatives. Managed Futures and the AMFERI are a transparent and cost effective way to add non-correlation and portfolio protection, while still having absolute return from tactical exposures as we saw in May through our shorts in Metals, Energies and Currencies.

Strategy and Index

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available as either a total return index (includes a collateral return) or as an excess return index (no collateral return).

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk. Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US.

Auspice’s core expertise is managing risk and designing and executing systematic trading strategies. Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.

There were no position changes in energy as the petroleum weights remain short (Gasoline, Heating Oil and Crude Oil while long Natural Gas. While Natural Gas moved lower on the month against the position, the rest of the sector was off adding value to the sector for a net gain.

The Energy sector remains choppy with an overall negative bias to trend in the petroleum components.

Metals

The Metals sector remains short and again benefitted from the significant weakness in Gold and Silver. While the strategy is short Copper which moved higher, this was offset by the gains made. Metals were the most significant attribution to the portfolio gains in May.

Agriculture

With the exception of Cotton, the Ags did very well in May. Led by a short in Wheat, the reversal and new long position in Soybeans were profitable. While Corn rallied modestly against its short, Sugar continued its long term deterioration and the short benefitted. The bulk of the sector loss came from long Cotton which moved significantly lower and will be one to watch closely.

Interest Rates

Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times, common during transition in trends while often at the short term expense of return. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed. The components have moved back to be tilted short to take advantage of higher interest rates (short bonds) in 2 of the 3 markets as the momentum shifted to lower bond prices. The index switched to short both US 5 year Notes and 30 year long bonds while currently remaining long 10 year Notes.

Currencies

Currencies were profitable in May as most trended lower against the US Dollar. The index has shifted to short the Aussie dollar in addition to existing shorts in Yen, Canadian dollar, British Pound. The index remains long US Dollar Index and the Euro.

Outlook

The AMFERI is making gains in 2013 alongside the equity market despite the specific lack of equity exposure in the portfolio. In fact there is a negative correlation to the markets despite both being positive on the year. Consider this fact as one looks for opportunities to reduce portfolio risk given the traditional markets have performed well in the last couple of years.

While the broad equity market ended higher in May, the ability to generate returns outside of this sole sector should be recognized and considered. While we don’t have crystal ball, consider ways to protect the portfolio as cracks start to appear in traditional asset classes and alternatives. Managed Futures and the AMFERI are a transparent and cost effective way to add non-correlation and portfolio protection, while still having absolute return from tactical exposures as we saw in May through our shorts in Metals, Energies and Currencies.

Strategy and Index

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available as either a total return index (includes a collateral return) or as an excess return index (no collateral return).

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk. Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US.

Auspice’s core expertise is managing risk and designing and executing systematic trading strategies. Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.

May Auspice Broad Commodity Index Commentary

Auspice Broad Commodity Excess Return Index (ABCERI)

Market Review

Commodities continued lower in May with only a few exceptions. While slightly lower on the month the index continues to show the ability to protect the downside and wait for an opportunity to capture gains when markets move in a sustained trend higher. Tactical position shifts are made based on individual component merit as opposed to sector generalities which continues to lead to better performance over tradition long commodity index approaches.

Index Review

The ABCERI lost 0.55% in May to be off only 1.05% in 2013 despite significant continued commodity pressure. The monthly loss was far less than the peer group and the index continues to outperform (see table below). The strategy had a single position change during the month, now holding 3 components or 25% of the possible basket long at this time.

Since the start of publication in 2010 and calculation by the NYSE, the index has outperformed its peers significantly in absolute return and risk adjusted measures. The following table highlights the strategies ability to capture the upside while limiting the downside.

The ABCERI does not attempt to simply track the broad commodity markets or predict their direction, but rather aims to capture upward price trends from those commodities that are making sustained moves higher while protecting capital on those that are making sustained moves lower.

Portfolio Recap:

In May the ABCERI did not make gains in any of the 3 broad sectors. The strategy remains positioned long in Cotton and Natural Gas and added a new long position in Soybeans during the month.

Energy

There were no position changes in energy as the petroleum weights remain flat (Gasoline, Heating Oil and Crude Oil) while long Natural Gas. Natural Gas moved lower on the month against the position for a small negative sector performance.

The Energy sector remains choppy with an overall negative bias to trend in the petroleum components.

Metals

The index remains without a long weight in Metals as much of the sector was lower in May. The sector sell-off was led by Gold and Silver while Copper was modestly higher on the month.

Agriculture

The bulk of the Ag sector loss came from long Cotton which moved significantly lower and will be one to watch closely. A new long position in Soybeans was added and profitable. While Corn rallied modestly, Sugar continued its long term deterioration and without a weighting along with Wheat and Corn.

Outlook

It is not the stated goal of Auspice, nor the ABCERI to predict future market direction, but rather participate in up-trends while minimizing risk during downtrends. It is the continued goal of the ABCERI index strategy to minimize the downside with low volatility and drawdown and remain a store of value until upside opportunity presents itself.

The long side of the index is represented by 3 of the 12 components and has 2 of the 3 broad sectors represented. With careful selection, the strategy has been able to take advantage of those commodities moving higher while avoiding excessive losses in the markets moving lower and remain a store of value.

We believe that the long term outlook for commodities remains promising and the overall trend is up. However, given the path is not a straight line, a tactical and risk management oriented approach will be most effective. The price movements so far in 2013 are important reminders of the agility required for long term success and the best risk adjusted result. As such, strategies linked to the Auspice Broad Commodity Index, which have the benefit of disciplined risk adjusted participation, may continue to outperform the traditional (long only) commodity peer groups with better upside, lower downside and reduced volatility.

Strategy and Index

The Auspice Broad Commodity Index aims to capture upward trends in the commodity markets while minimizing risk during downtrends. The index, which is considered to be a “third generation commodity index”, considers both risk and reward. The index uses a quantitative methodology to track either long or flat positions in a diversified portfolio of 12 commodity futures which cover the Energy, Metal, and Agricultural sectors.

Auspice Indices utilize dynamic risk management to produce superior risk adjusted performance in a variety of market environments. By dynamically managing the volatility of each commodity, Auspice ensures that no one commodity dominates the index thus maximizing the benefits of commodity diversification. Enhanced contract roll optimization further increases performance. On a risk adjusted basis, the Auspice Broad Commodity Total Return Index significantly outperforms its global peers.

The Broad Commodity index is available in Total and Excess Return versions. The cash return for the total return index will be calculated daily using the 3-month CDOR (Canadian Dealer Offered Rate). The CDOR is the average rate for Canadian bankers' acceptances for specific terms-to-maturity (one year or less), determined daily from a survey on bid-side rates provided by the principal market-makers, including the major Canadian banks.

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk.

Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US. Auspice’s core expertise is managing risk and designing and executing systematic trading strategies.

Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.