Auspice Investor Education

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances. Some of the contents on this web page were published prior to March 1st, 2023, when The Auspice Diversified Trust and the Auspice One Fund Trust (collectively, the Funds) were offered via offering memorandum only and the Funds were not reporting issuers. The expenses of the Funds would have been higher during such prior period had the Funds been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Funds to permit the disclosure of the prior performance data for the Funds for the time period prior to it becoming a reporting issuer.

Auspice Educational Research and White Papers

THE TECHNOLOGY BOOM TO FURTHER FEED THE COMMODITY CYCLE

(May 2024) - Auspice Research Article Featured in the Commodity Insights Digest (CID)

The commodity intensity of EVs has been well documented – what is lesser known is the corresponding energy and commodity intensity of Artificial Intelligence (AI), driven by the demand for data centres and computer chips.

Major multinational brands including the investment arm of the IKEA group are following automakers in securing their supply chains, particularly in raw materials and energy. We expect the recent Technology and AI boom to have a similar, albeit larger impact as Big Tech looks to secure supply given significant energy and raw commodity requirements.

Big Tech may be the next big commodity buyer – at a time when supply is increasingly tight, and prices are already on the rise.

Read more here.

MANAGED FUTURES AND TREND FOLLOWING CTAS - TEN REASONS TO INVEST

(February 2024) - Auspice Brochure

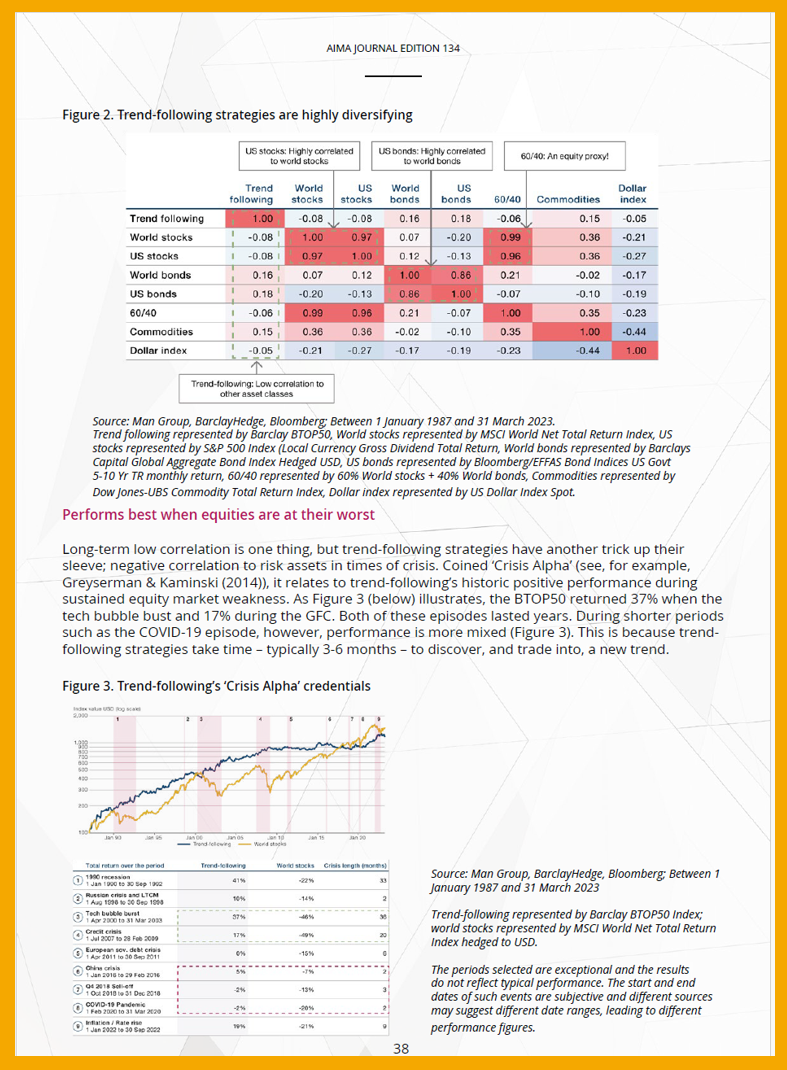

Explore why pensions allocate 5-10% to Trend Following CTAs, how they’ve delivered positive returns during market downturns (Crisis-Alpha), and their historical out-performance of equities and bonds. This brochure highlights why it pays to be a Trend Follower.

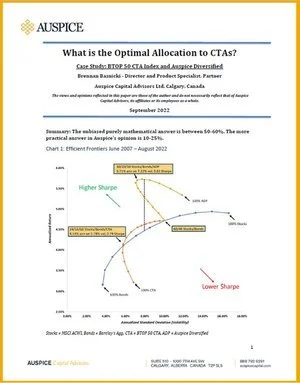

WHAT IS THE OPTIMAL CTA ALLOCATION?

(September 2022) - Auspice Case Study: BTOP 50 and Auspice Diversified

Increasingly the question of “how much to allocate” to trend-following CTAs has been posed to Auspice. This 2-page case study looks at the math and portfolio benefits.

COMMODITY INVESTING IN THE AGE OF ESG AND INFLATION

(November 2021) - Auspice White Paper

Whether for broad diversification or in response to increasing inflation risks, commodity futures may be the the most practical and effective solution for responsible investors looking for commodity exposure. This white paper considers commodity futures within ESG frameworks.

Auspice Educational Blog Posts

GOLD AND TIPS - NOT INFLATION HEDGES

(January 2025)

If a new wave of inflation pressure is on the horizon, what will prove to be an effective hedge? Looking back at the last five years, we can dispel some myths, and this may provide clarity particularly around the role of Gold and TIPS. As inflation occurred, the worst of the options was TIPS. Over the 5-year period, including inflation and disinflation, TIPS was the worst performer. As inflation occurred, the 2nd worst performer was Gold. Gold has since performed well during the period of disinflation. Read more.

RETURN STACKING “PORTABLE ALPHA” AND THE AUSPICE ONE FUND

(December 2024)

After listening to our institutional and retail investors, Canada’s original and only pioneering 81-102 approved “return stacking / portable alpha” solution, the Auspice One Fund is evolving to serve you better. Instead of overlaying a value-tilted balanced mandate, we are simplifying - for every dollar invested, you get $1 of the long-standing protective CTA/managed futures fund, Auspice Diversified, and $1 of the S&P500. Two for one. As a “Liquid Alt” with daily liquidity. The fee is the same: you only pay for long-term performance net of the monthly fee: management fee or performance, not both. Read more.

THE AI DRIVEN COMMODITY BOOM HAS BEGUN

(September 2024)

In an April 7th Special to the Financial Post “Will The Tech Boom Feed the Commodity Cycle?” Auspice Founder and CIO Tim Pickering described how the link between Big Tech and Commodities is strong and growing stronger (see full article in the April August Blog, here). Notably, Big Tech may be the next big commodity buyer – at a time when supply is increasingly tight and prices are already on the rise. In September we saw what we believe to be the beginning of this long-term driver affect commodity markets. Read More.

THE TECH BOOM TO FURTHER FEED THE COMMODITY CYCLE (FULL ARTICLE)

(May 2024)

This month's Auspice Blog is the full research article, previously summarized and featured in the April 7th, 2024 Financial Post (here), the March 2024 Auspice Blog (here), and an upcoming publication in the summer edition of the Commodity Insights Digest, a publication of Bayes Business School - City, University of London (U.K.). Read more.

NOT A WORLD WAR, BUT A WORLD AT WAR

(February 2024)

The number of wars and global conflicts are at the highest levels since WWII. For people under 80 - a large majority of the world's population - we have never lived in a world with so many different conflicts between countries and amongst non state groups such as terrorists’ cells and drugs cartels.

You might think the world is always violent, wars and conflicts are always happening somewhere. This moment can’t be any special. That would be wrong. Read more.

2023 WAS TOUGH. WHATS CHANGED? IN SHORT, NOTHING.

(January 2024)

Following 3 years of strong returns for CTAs, 2023 was a challenging environment for both passive commodity and active CTA/Managed Futures strategies (“CTAs”). Indeed, while a far cry from the drawdowns stocks and bonds experienced in 2022 , all four commodity / CTA benchmark indices finished slightly lower in 2023. Read More.

RETURN STACKING – WHAT, WHY, WHERE, AND HOW

(JULY 2022)

What exactly is return stacking, why should you consider it, where does it fit within a portfolio, and how has it performed in the recent environment? Read More.

(August 2023)

The world has changed since 2020. Quantitative Easing (“QE”) is over, interest rates are no longer pegged at zero, and inflation has normalized closer to the long-term average 3.5% (US CPI) since 1948. How does one construct a portfolio that can deliver in this environment?

This month we provide a glimpse into the asset class allocation of some of the largest pensions and endowments. Read more.

OUR BIGGEST ANNOUNCEMENT IN 16+ YEARS.

(February 2023)

Auspice Diversified Trust (ADT) and the Auspice One Fund Trust (AOFT) are now available to all Canadian investors as National Instrument 81-102 (“NI 81-102”) alternative mutual funds “liquid alternatives” (no longer available to institutional and accredited investors only), now public mutual funds with daily liquidity. Read more.

Third Party CTA Educational Resources

(February 2023)

LGT: The Case for Managed Futures in a World of Seismic Shifts

Third Party Commodity Research

Other Notable Educational Resources

Auspice Commonly Used Financial Terminology

Commodity Trading Advisors (CTAs) are professional investment managers, similar to portfolio managers in mutual funds, who seek to profit from movements in the global financial, commodity and currency markets by investing in exchange traded futures, options, and OTC forward contracts.

CPI - The Consumer Price Index (CPI) is a measure of the average change overtime in the prices paid by urban consumers for a market basket of consumer goods and services.

Value at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day.

The Margin to Equity ratio represents the amount of trading capital that is being held as margin at any particular time. For example, if a CTA fund with $100 million AUM executes trades requiring $25 million in margin, the margin-to-equity ratio is 25%.

Standard deviation is a measure of how much an investment's returns can vary from its average return. It is a measure of volatility and, in turn, risk. Annualized standard deviation is a way to see the approximate standard deviation over an annual basis.

The Sharpe ratio measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns.

The MAR Ratio is the annualized return divided by the largest drawdown.

Skew is the degree to which returns are asymmetric around the mean. Why does skew matter? If portfolio returns are right, or positively, skewed, it implies numerous small negative returns and a few large positive returns. If portfolio returns are left, or negatively, skewed, it implies numerous small positive returns and few large negative returns.

Worst Drawdown measures the maximum fall in the value of the investment, as given by the difference between the value of the lowest trough and that of the highest peak before the trough.

Alpha is a measure of the active return on an investment, the performance of that investment compared with a suitable market index. An alpha of 1% means the investment's return on investment over a selected period of time was 1% better than the market during that same period

Crisis alpha means that an investment strategy generates positive return in periods of high financial stress. For example, if a manager is short the market when it crashes, that manager will generate positive returns when other investors lose money.

Long known as “portable alpha” and “overlays”, return stacking is a strategy that has been practiced by institutional investors for decades. At its core, return stacking generally is the combination of strategies, often an “alpha” and a “beta” strategy, into a single portfolio or fund. One of these components, the alpha or the beta, is generally attained through cash efficient derivatives. Given futures require only a small percentage of capital versus the gross notional exposure, capital can be used to create multiple exposures. As such, leverage is employed, but generally (and importantly) in a risk reducing manner.